Should you keep Health Insurance through your employer or switch to Medicare?

When it comes to healthcare coverage, there are many different options available, from health insurance plans provided by your employer to government-funded programs like Medicare. For those who are eligible for both, deciding whether to keep health insurance through your employer or switch to Medicare can be a complex decision. Each option has its advantages and disadvantages, and the best choice will depend on your individual situation and needs.

In this blog post, we’ll explore the key factors to consider when deciding whether to keep your employer-based health insurance or switch to Medicare. We’ll take a closer look at factors such as cost, benefits, network, and eligibility requirements to help you make an informed decision. By the end of this post, you should have a better understanding of the pros and cons of each option and be better equipped to make the right choice for your healthcare coverage.

Deciding whether to keep health insurance through your employer or switch to Medicare depends on your individual situation and needs. Here are some factors to consider:

-

Age: If you are under 65 years old, you may not be eligible for Medicare unless you have a qualifying disability. In this case, you would need to rely on health insurance provided by your employer or purchase health insurance on your own.

-

Employer size: If your employer has 20 or more employees, they are required to offer you the option to continue your health insurance coverage through COBRA when you leave your job. COBRA allows you to keep your employer-based health insurance for up to 18 months after you leave your job. However, COBRA can be expensive since you will be responsible for paying the full premium, including the portion that your employer previously paid.

-

Cost: Compare the cost of your employer’s health insurance plan with the cost of Medicare. Medicare has monthly premiums, deductibles, and co-pays, but they may be less expensive than what you are currently paying through your employer.

-

Benefits: Compare the benefits of your employer’s health insurance plan with Medicare. Medicare offers comprehensive coverage, including hospitalization, doctor visits, and prescription drug coverage. However, some employer plans may offer additional benefits, such as vision and dental coverage.

-

Network: Check if your doctors and healthcare providers are in the network of your employer’s health insurance plan or Medicare. If you have established relationships with certain doctors, you may want to consider if they are in the network of the plan you choose.

In summary, it’s essential to weigh the pros and cons of both options to determine which one is the best fit for you. It may also be helpful to consult with a licensed insurance agent to discuss your options further.

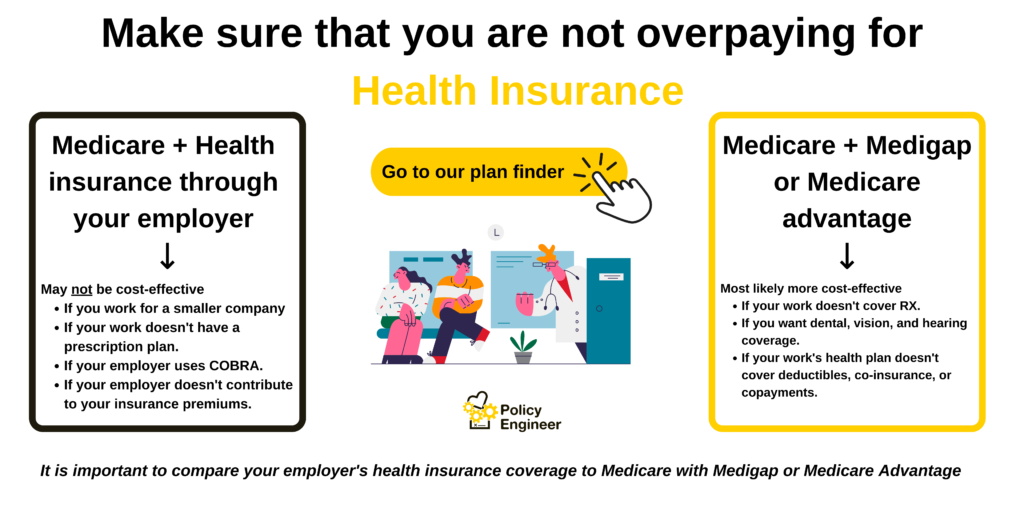

How to review the costs of your Employer Coverage to Medicare

To compare the costs of your employer coverage with Medicare, conducting research can be helpful. Doing so can avoid late penalties for signing up for Medicare too late and determine your most cost-effective plan. You can use our Medicare plan finder to get an overview of different plans, their costs, and coverage and ensure you’re not paying too much for health insurance if you choose to keep your employer’s coverage. Additionally, one of our licensed insurance agents can assist you in determining the better option for your situation.

If you work for a large company with over 20 employees and have employer-sponsored group health insurance, you can combine Medicare with your employer’s coverage. Usually, your employer insurance will be primary, and Medicare will be secondary. Medicare Part A doesn’t have a premium if you’ve worked for at least ten years, and your out-of-pocket costs could be lower than your employer’s plan. Therefore, most people who are still working enroll in Medicare Part A.

However, you will likely have to pay a premium for Medicare Part B, so some people wait until they retire and their employer’s coverage ends to enroll in Part B. In this case, you’ll need a creditable coverage letter from your employer to avoid late penalties when you enroll in Part B or Part D.

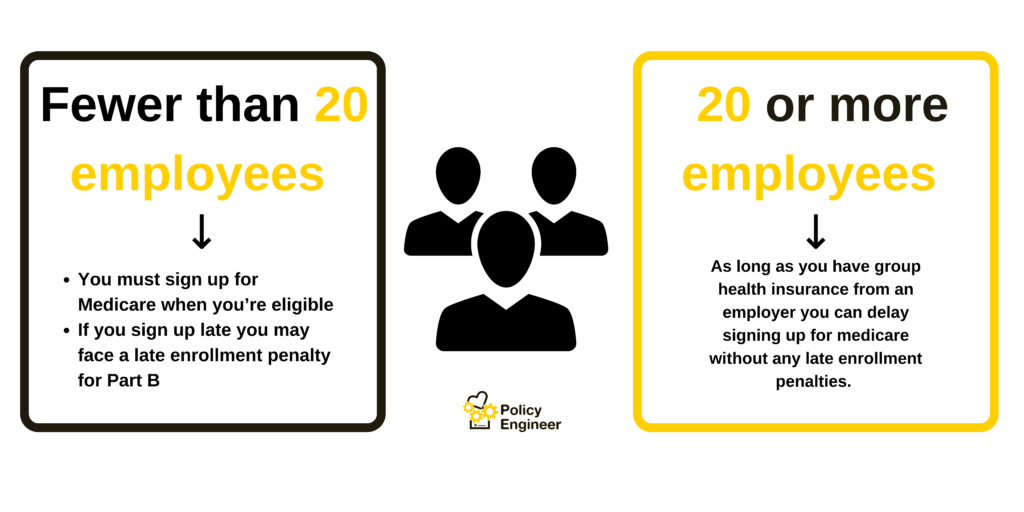

One of the first things to check is how many employees your employer has.

This will determine whether you have to sign up when you turn 65 or if you can delay signing up.

This will determine whether you have to sign up when you turn 65 or if you can delay signing up.

Medicare rules for employers with more than 20 employees

A: If you work for a large company and your employer has Group Health Insurance.

You can combine Medicare with your employer’s insurance; Medicare can coordinate benefits with your employer’s coverage. In most cases, Medicare will be your secondary insurance, and your employer insurance will be your primary insurance. Your employer’s group plan will pay first, and Medicare will pay second. Remember that Medicare Part A doesn’t come with a premium if you worked for at least ten years and that your deductible or other costs could be lower. Because of this, most people who are still working will sign up for Medicare Part A

This is different for part B since you will most likely have to pay a premium for part B. For this reason, some people wait to sign up for part B until their employer’s group plan ends when they retire. If you choose to do this, you will receive a creditable cover letter that you must show when applying for Medicare Part B or D to avoid late penalties.

B: If you work for a large company and your employer has COBRA.

With COBRA, Medicare coordinates the opposite way; if you have COBRA coverage, Medicare pays first, and COBRA pays second. It is essential to review your employer’s coverage and compare it to Medicare to determine if you’re paying more than necessary. Also, once you turn 65, you must enroll in Medicare Parts A and B to avoid late enrollment penalties.

You can also drop your Employer’s Health Insurance and go on Medicare.

If you’re working for a large company, delaying enrollment in Medicare could cost you more in the long run. Sometimes, dropping your employer’s health insurance and enrolling in Medicare may be more cost-effective. Adding a Medigap policy to your Medicare coverage could also be a wise choice to lower your out-of-pocket costs for deductibles and co-pays.

Alternatively, a Medicare Advantage Plan is another option that combines Medicare Parts A, B, and D with extra benefits such as dental, hearing, and vision coverage. Many people are unaware that they could end up paying more for their health insurance through their employer than if they switched to Medicare with a Medigap or Advantage plan. Therefore, comparing each option’s costs and benefits is essential to determine the most cost-effective option.

Click here to go to our plan finder to find out what you would be paying for a Medicare plan with the same coverage as your Employer’s Health insurance plan.

Medicare rules for employers with less than 20 employees

If you work for a company with fewer than 20 employees, you must enroll in Medicare Parts A and B. While this may seem like an additional cost, Medicare is your primary insurance, and your employer’s group insurance is secondary. This means Medicare will pay first, and your employer’s insurance will pay second. In some situations, you might be able to delay your part D enrollment if your group insurance has RX benefits. Having group insurance through your employer might not be worth depending on your medical needs. Sometimes even having Medicare + Medigap insurance may be cheaper than your group insurance altogether.

Review plans to determine if staying with your Employers insurance is worth it or if a Medicare plan with Medigap or an Advantage plan would be cost-effective. Remember that Medicare also has monthly premiums, deductibles, and co-pays, but they may be less expensive than what you currently pay through your employer. It’s important to remember that the cost of health insurance can vary widely depending on factors such as your age, location, and health status. Another factor to consider is the benefits offered by each option. Medicare offers comprehensive coverage, including hospitalization, doctor visits, and prescription drug coverage. However, some employer plans may provide additional benefits, such as vision and dental coverage. Be sure to review each option’s benefits to determine which offers the coverage you need. Also, check if your doctors and healthcare providers are in the network of your employer’s health insurance plan or Medicare. If you have established relationships with certain doctors, you may want to consider if they are in the network of the plan you choose. It’s important to note that some Medicare plans, such as Medicare Advantage plans, may have more restrictive provider networks than employer-based plans.

What is a co-pay?

What is a co-pay?

A co-pay is a dollar amount (fixed) paid by employees when they use medical services. This could be a doctor visit with a $45 co-pay or an ER visit with a $300 co-pay.

What is Coinsurance?

An employee pays Coinsurance for medical services after she’s met her deductible. This is a percentage of the total cost—for example, a $200 doctor visit with a 10% coinsurance. After the employee has met the deductible, the employee would have to pay $20, and the insurance company would have to pay the remaining $120.

A licensed Insurance Agent can walk through all of this and determine if you should stay with your current employer coverage or if switching to another plan would be more effective. Click here to schedule a meeting with one of our Licensed Insurance agents.