Self Insure

Insurance Policy

VA Benefits

Government Aid

What is the average cost of care without insurance?

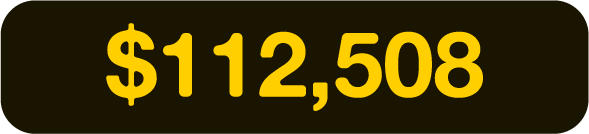

Nursing Home w/

Private Room

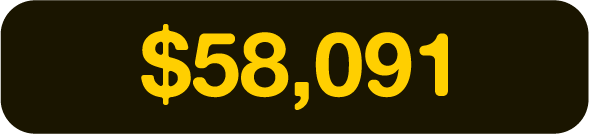

Assisted Living

Facility

Home Health

Care

Not everyone needs insurance, but no one should go without a plan.

Long Term Care planning is crucial to ensuring a stable lifestyle for you and your loved ones as you age. Your planning should give you peace of mind, along with the freedoms of being cared for where you feel most comfortable, by the caregivers of your choice, and without compromising your loved ones’ lifestyle.

Ask yourself

Where do you want to be cared for?

at home or at a facility

Who do you want to care for you?

family or professionals

Who do you want to pay for your care?

you, insurance or your family

Try Not To Make This Retirement Planning Mistake

Long-term care is often overlooked and the costs are underestimated in retirement planning. On top of that long-term care, expenses are growing every year. The possibility of needing help taking care of yourself later in life is probably hard to imagine and most likely not on your priority list. If you forget to add this to your planning you might run out of your retirement savings before you know it.