Three income sources for those with qualifying disabilities.

State Disability

Social Security SSI

Insurance Policy

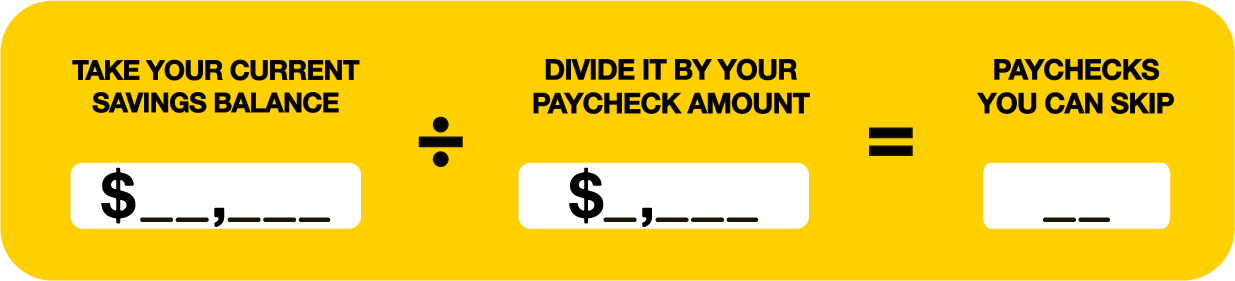

The average American paycheck, after taxes, is

The average American spends

The median savings account in America is

What Is Disability Insurance?

If you experience an injury or illness that prevents you from working, disability insurance can provide you with financial security. This type of insurance pays out a predetermined amount of money, based on your income and the policy limits you set when you purchased it.

When it comes to disability insurance, there are two primary types to consider: Short Term Disability Insurance and Long Term Disability Insurance. It’s crucial to evaluate policies and match them with individual circumstances to make the best choice of coverage.

Flip The Tiles

What’s the average length of a disability?

More than one in four of today’s 20-year-olds can expect to be out of work for at least a year because of a disabling condition before they reach the full retirement age of 67.

Don’t follow the herd.

At least 51 million working adults in the United States are without disability insurance other than the basic coverage available through Social Security.

Three months go by in the blink of an eye.

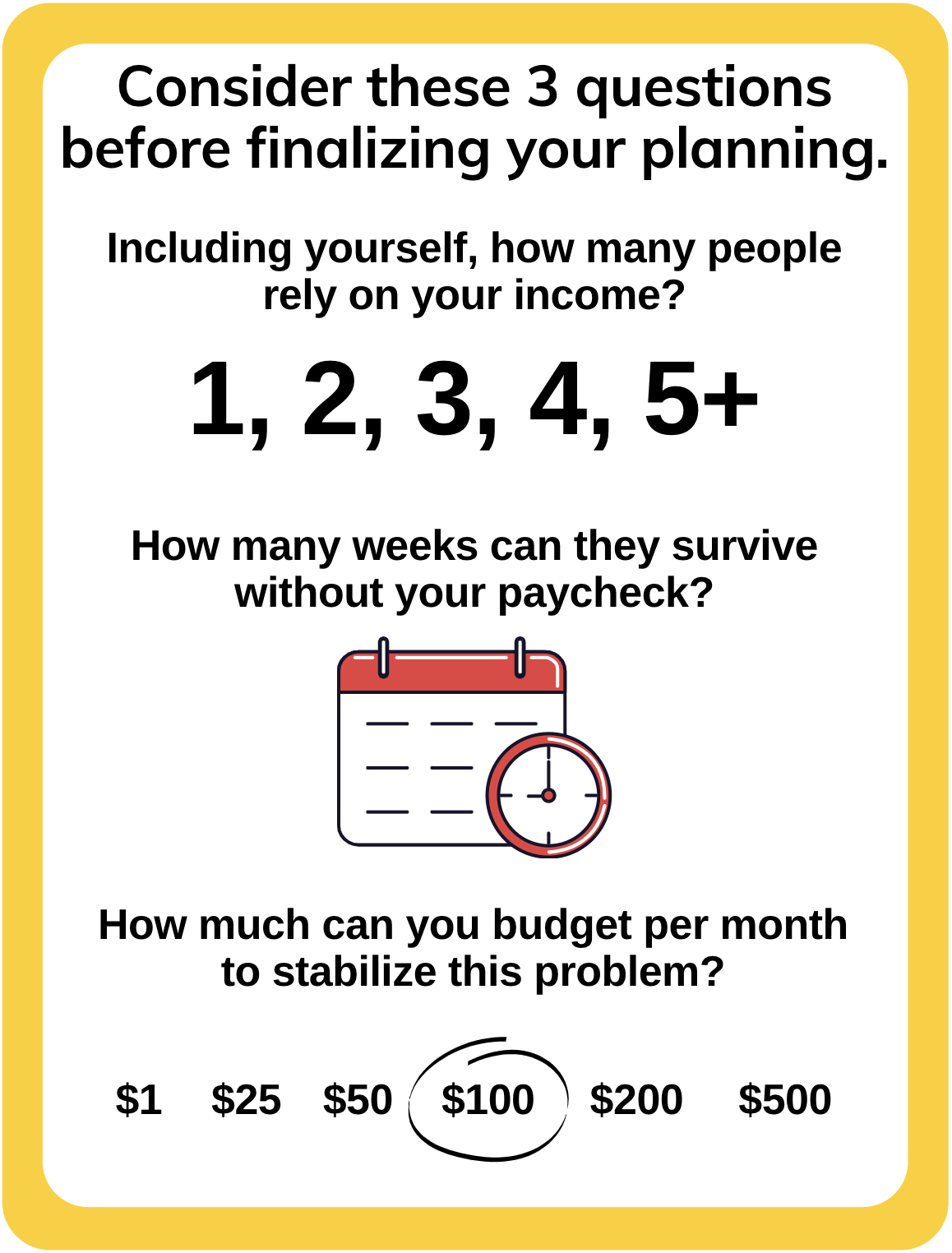

Only 48 percent of American adults indicate they have enough savings to cover three months of living expenses if they’re not earning any income.

Don’t get caught with empty pockets.

Almost half of the American adults indicate they can’t pay an unexpected $400 bill without taking out a loan or selling something to do so.

Protect your paycheck; make sure you are covered.

Imagine not being able to work for a couple of months. How will you pay for essential costs such as; rent, mortgage, car loans, or groceries. Do you have an emergency fund or insurance in place?