Is a Medicare Advantage or Medicare Supplement plan better for you?

Not sure which Medicare plan to pick? Both options have their advantages and disadvantages, so it’s essential to understand the differences and assess which plan aligns better with your healthcare needs and financial situation. We are here for you to try to make this process easier for you. This blog will explain the difference between a Medicare Advantage plan and a Medicare Supplement plan.

Medicare Overview Before diving into the comparison, let’s briefly review what Medicare is. Medicare is a health insurance program the federal government provides for people aged 65 or older, individuals with specific disabilities, and people of any age with End-Stage Renal Disease. Medicare is composed of four parts:

Original Medicare

- Part A (Hospital Insurance): Covers inpatient hospital care, skilled nursing facility care, hospice care, and some home healthcare services.

- Part B (Medical Insurance): Covers outpatient medical services, such as doctor visits, preventive services, and durable medical equipment.

Original Medicare (Part A & B) doesn’t cover the following: Long Term Care, most dental care, eye exams related to prescribing glasses, dentures, cosmetic surgery, acupuncture, hearing aids and exams for fitting them, and routine foot care.

Additional Plans

- Part D (Prescription Drug Coverage): Offers prescription drug coverage to help with medication costs.

- Part C (Medicare Advantage): Medicare Advantage plans are offered by private insurance companies and provide an alternative way to receive Medicare benefits, often including Parts A, B, and D, and sometimes additional benefits like dental and vision coverage.

- Medigap: pays for the gaps original Medicare doesn’t cover

You have two options to replace or enhance your Original Medicare Coverage.

- First, add a Medicare Supplement (or Medigap) insurance plan to your Original Medicare coverage.

- The second option is a Medicare Advantage plan, another way to get Original Medicare benefits.

These plans differ in costs, benefits, and how they work. In short: Medicare Supplement Insurance (Medigap) is a health insurance policy that can cover several healthcare expenses that Original Medicare doesn’t cover. A Medicare Advantage drug (MAPD, Part C) plan combines Parts A and B and can include Part D.

Option 1. Medicare Supplement plan (Medigap)

Medicare Supplement Plan (Medigap): A Medicare Supplement plan, commonly called Medigap, is designed to fill the gaps in coverage left by Original Medicare (Parts A and B). Original Medicare typically covers about 80% of healthcare expenses, leaving beneficiaries responsible for the remaining 20%. Medigap plans help cover these out-of-pocket costs, such as deductibles, copayments, and coinsurance.

Key Features of a Medicare Supplement Plan:

-

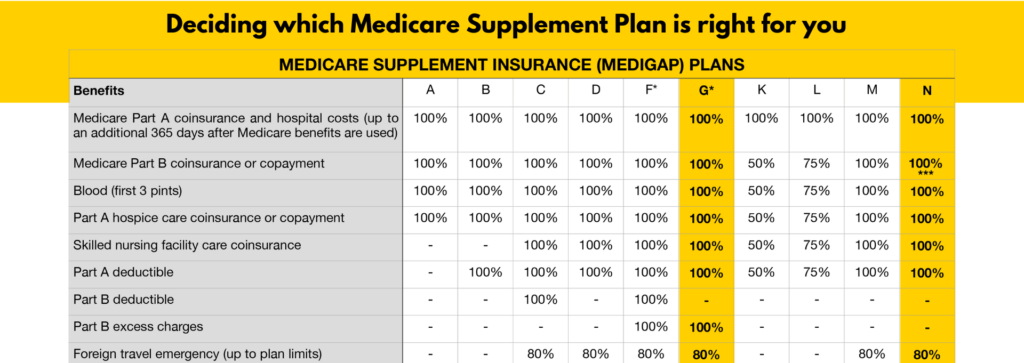

Standardized Plans: Medigap policies are standardized and labeled with letters (A, B, C, D, F, G, K, L, M, and N) in most states. Each lettered plan offers the same benefits, regardless of the insurance company selling it.

-

Wide Choice of Providers: With a Medigap plan, you can visit any healthcare provider in the U.S. that accepts Medicare, giving you broader access to healthcare services.

-

Separate Prescription Drug Coverage: Medigap plans do not include prescription drug coverage. You need to enroll in a separate Part D plan to obtain drug coverage.

-

Guaranteed Issue Right: During your Medigap Open Enrollment Period (OEP), which starts on the first day of the month you turn 65 and lasts for six months, insurance companies cannot deny you coverage or charge higher premiums based on your health status.

-

No Network Restrictions: Medigap plans do not have network restrictions, allowing you to seek care from any Medicare-approved provider nationwide.

The Gaps Medicare Supplement Insurance (Medigap) can fill:

- deductibles,

- copays

- coinsurance

Which Medicare Supplement Plan fits you best?

A Medicare supplement plan does not cover the following:

Prescription Drugs: Drug coverage will need to be bought separately through a Prescription Drug Plan, or other creditable coverage

Other things you should know about a Medicare Supplement Policy:

1. The supplement coverage covers one person; your spouse would have to buy a separate policy.

2. You can buy it from any private insurance company licensed in your state to sell.

3. The insurance company can’t cancel your policy if you pay the premium.

4. Supplement policies sold after January 1, 2006, aren’t allowed to include prescription drug coverage.

5. It’s illegal for anyone to sell you a Medicare Supplement policy if you have a Medicare Advantage Plan, except if you are switching back to Original Medicare.

6. Since January 2020, Medicare supplement plans sold to people new to Medicare can’t cover the Part B deductible anymore. If you qualified for Medicare before January 1, 2020, but are not yet enrolled, you might be able to purchase one of the Part B deductible plans (Plan C or F). Were you covered by Plan C or F (or the Plan F high deductible version) before January 1, 2020? Then you can keep your plan (medicare.gov).

The insurance plans listed below are not part of a Medicare supplement plan:

- Medicare Advantage Plans (such as HMO, PPO, or Private Fee-for-Service Plans)

- Long-term care policies

- Medicare Prescription Drug Plans

- Medicaid

- Employer or union plans

- Tricare

- Veterans’ benefits

- Indian Health Service, Tribal + Urban Indian Health plans

When is the right time to purchase a Medigap policy?

Your Medicare Supplement Open Enrollment Period (OEP) is the best time to buy a Medigap policy. Most likely, you will get better prices and more choices among policies. OEP starts on the first day of the month, on which you are at least 65. You will have six months to buy a Medicare Supplement insurance plan. Another advantage of purchasing a Medigap during OEP is that you will get a guaranteed issue right. A guaranteed issue right means that companies can’t deny your Medicare Supplement insurance plan application because of pre-existing health conditions or disabilities.

It’s essential to understand your Medigap Open Enrollment Period, so check when your open enrollment period is.

Click here to schedule a virtual or in-person appointment if you have questions about your Medigap Enrollment.

You can still apply after your open enrollment period, but you could be rejected or charged more if you have health problems.

*Some states have additional Open Enrollment Periods, including those under 65 who qualify.

How can you review Medigap costs best?

Since each insurance company can set its prices, the cost of Medigap policies can vary widely. This means: that there can be significant differences in the premiums for the same coverage. As you shop for a Medigap policy, reviewing the same type and checking the pricing they have used is essential. Luckily you can review different Medicare insurance companies on our website, so you get competitive prices and never overpay for the same insurance.

What will be covered if you travel with a Medigap Policy?

Some Medigap policies offer emergency health care services for when you are outside of the U.S.

- Standard Medigap Plans C, D, F, G, M, and N can cover foreign travel emergency healthcare when you travel outside the U.S.

- Plans E, H, I, and J are no longer available. However, if you bought one before June 1, 2010, you might be able to keep it. These plans cover foreign travel and emergency health care when you travel outside the U.S.

- Medigap Plan C, D, E, F, G, H, I, J, M, or N; Cover foreign travel emergency care in the first 60 days of your trip

- Pays 80% of the billed charges for some medically necessary emergency care outside the U.S. after you meet the $250 deductible for the year.

Medigap Foreign travel emergency coverage has a lifetime limit of $50,000.

What are the Medicare Supplement Insurance Pros & Cons?

PROS

- Medigap will help fill some gaps that Original Medicare doesn’t cover.

- You will have access to providers nationwide who accept Medicare.

- Most Medigap plans will help pay the Part A deductible.

- You can get a supplemental plan that covers Part A and Part B coinsurance.

- There are plans with no copayments.

- With Plan F, you don’t have to worry about out-of-pocket expenses.

- Standardized – 10 plans have the same coverage, no matter which company.

- A Medicare Supplement company cannot cancel your policy for using the policy too much. Your policy will renew automatically every year.

You can change your Medigap plan or company at any time you want. - You have 30 days to drop the coverage and receive your premium back when your policy is approved.

Cons

- Medigap plans do not cover prescription drugs.

- If it is more expensive, your rate most likely increases

- You have to have Part A and Part B.

- Do not cover routine dental, vision, or hearing care.

- After your Guarantee issue ends, getting approved might be tricky if you have certain health conditions.

Option 2. Medicare Advantage Prescription Drug Plan

A Medicare Advantage plan, also known as Part C, is an alternative to Original Medicare that private insurance companies offer. These plans combine the benefits of Parts A and B, often include Part D prescription drug coverage, and may provide additional benefits like dental, vision, hearing, and fitness services.

Key Features of a Medicare Advantage Plan:

-

Bundled Coverage: Medicare Advantage plans to consolidate Medicare Parts A, B, and D into a single plan, offering comprehensive coverage for medical services and prescription drugs.

-

Additional Benefits: Some Medicare Advantage plans go beyond Original Medicare by offering other benefits, such as dental, vision, hearing, and gym memberships.

-

Network-Based: Medicare Advantage plans typically have network restrictions, requiring beneficiaries to use specific providers or healthcare facilities to receive full coverage.

-

Premiums and Cost-Sharing: Medicare Advantage plans may have lower monthly premiums than Medigap plans, but they often involve cost-sharing through copayments and coinsurance for medical services.

-

Annual Changes: Medicare Advantage plans can change their benefits and cost structures yearly, so reviewing plan updates during the Annual Election Period (AEP) is essential.

An overview of the different types of Medicare Advantage plans

- HMO (Health Maintenance Organization):

- PPO (Preferred Provider Organization)

- PFFS (Private Fee-for-Service)

- SNP (Special Needs Plan)

- HMO-POS (Health Maintenance Organization Point-of-Service)

- MSA (Medical Savings Account).

When should you enroll in Medicare Advantage?

- During your seven-month Initial Enrollment Period for Part D.

- Annual Election Period (AEP): October 15 to December 7.

- Special Election Period (SEP) during other times of the year so you can change your Medicare Advantage coverage.

Shop for Part C plans with Medicare’s plan finder tool on our website to review Part C plans available in your area.

What are the Medicare Advantage Insurance Pros & Cons?

PROS

- The out-of-pocket maximum is $7,550 a year (2020)

- Many plans cost low to no cost a month

- Can include drug coverage

- Many plans may consist of vision, hearing, and dental

- Gym discounts

CONS

- You can only change your policy during Open Enrollment

- Smaller network, so there is no nationwide coverage

- Many plans require referrals to see a specialist

- Plans are not standardized

- Medicare Advantage can change its benefits every year

3. Main Differences between Medicare Supplement (Medigap) and Medicare Advantage plan:

Comparison: Medicare Supplement vs. Medicare Advantage Plans Now that we’ve outlined the main features of each plan type, let’s compare the two:

-

Coverage and Costs: Medicare Supplement plans offer standardized coverage that helps fill gaps in Original Medicare, providing predictable out-of-pocket costs. In contrast, Medicare Advantage plans bundle coverage and can vary significantly in costs and benefits from one plan to another.

-

Provider Choice: Medigap plans allow beneficiaries to see any Medicare-approved provider nationwide without network restrictions, while Medicare Advantage plans often require using network providers for full coverage.

-

Prescription Drug Coverage: Medicare Supplement plans do not include prescription drug coverage, so beneficiaries need to enroll in a separate Part D plan. Conversely, Medicare Advantage plans usually incorporate prescription drug coverage, streamlining the process.

-

Additional Benefits: Medicare Advantage plans often offer extra benefits like dental, vision, hearing, and fitness services, which are not provided by Medigap plans.

-

Cost Considerations: Medigap plans typically have higher monthly premiums but lower cost-sharing (e.g., copayments and coinsurance) than Medicare Advantage plans. Medicare Advantage plans may have lower premiums but involve higher cost-sharing for medical services.

-

Open Enrollment Periods: Medigap plans have a one-time guaranteed issue right during the six-month Medigap Open Enrollment Period, which ensures acceptance regardless of pre-existing conditions. Medicare Advantage plans have specific enrollment periods, including the Annual Election Period (AEP), during which beneficiaries can change their coverage.

Which Plan is Better for You?

The answer to whether a Medicare Supplement plan or a Medicare Advantage plan is better for you depends on your individual healthcare needs, preferences, and budget. Consider the following factors when making your decision:

-

Desired Provider Flexibility: A Medicare Supplement plan might be more suitable if you prefer the freedom to see any Medicare-approved provider without network restrictions.

-

Predictable Costs: A Medigap plan could be a better fit if you value predictability in your healthcare expenses and are willing to pay higher premiums for lower out-of-pocket costs.

-

Additional Benefits: If you require other benefits like dental, vision, or hearing coverage, and you are comfortable with using network providers, a Medicare Advantage plan might be more attractive.

-

Prescription Drug Coverage: If you already take prescription medications, a Medicare Advantage plan with integrated Part D coverage might simplify your healthcare needs.

-

Budget Considerations: Evaluate your budget and compare the monthly premiums, copayments, coinsurance, and deductibles of both plan types to determine which aligns better with your financial situation.

-

Health Status: Your health status and anticipated healthcare needs can influence your decision. The guaranteed issue right during the Medigap Open Enrollment Period might be crucial if you have pre-existing conditions.

A Medicare Supplement Insurance (Medigap) policy is health insurance that can help pay some healthcare costs that Original Medicare doesn’t cover. Medigap helps you pay for deductibles, coinsurance, and other out-of-pocket expenses. Medicare Advantage drug (MAPD, Part C) plan combines Parts A and B and can include Part D; coverage plans may include hearing, dental, vision, and many other services.

Choosing between a Medicare Supplement plan and a Medicare Advantage plan is a significant decision that can impact your healthcare coverage and costs. It’s essential to conduct thorough research, compare plans offered in your area, and consider your healthcare needs and preferences before selecting. Additionally, you may benefit from discussing your options with a licensed insurance agent specializing in Medicare to receive personalized guidance and recommendations. Remember that your healthcare needs may change over time, so it’s crucial to review your coverage regularly and make adjustments to ensure you have the most appropriate plan for your situation.