Last Updated on January 11, 2025 by policyengineer

The Amazing Power of Compound Interest: How Time Helps You Save Money Easily

What is Compound Interest?

Think of compound interest like a snowball rolling down a hill. As it rolls, it picks up more snow, getting bigger and bigger. With compound interest, your money works the same way. Not only does it earn interest on the money you put in, but it also earns interest on the interest it’s already earned. This means your savings can grow faster and faster over time.

Let’s See It in Action!

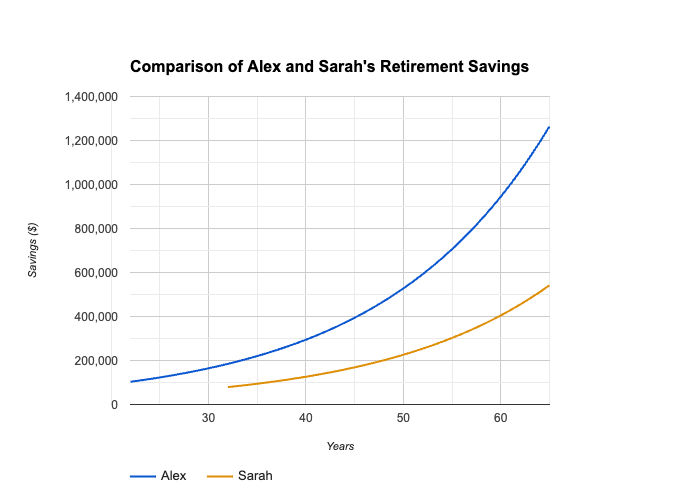

-

Alex’s Contributions and Savings:

- Total years of saving: 65 – 22 = 43 years

- Total contributions: $200/month * 12 months/year * 43 years = $103,200

- Using a compound interest calculator with a 6% annual interest rate, Alex’s savings at age 65 amount to approximately $

$1,057,292

.

-

Sarah’s Contributions and Savings:

- Total years of saving: 65 – 32 = 33 years

- Total contributions: $200/month * 12 months/year * 33 years = $2

- Using the same compound interest rate of 6%, Sarah’s savings at age 65 would be approximately

-

$407,474

Alex’s savings at retirement amount to approximately $1,057,2924 while Sarah’s savings would be approximately $407,474

This illustrates a more substantial difference in only 10 years of saving, emphasizing the significant impact of starting early on retirement savings even with a relatively modest monthly contribution.

Tips to Make Your Money Grow Even Faster:

- Start early: The earlier you save, the more time your money has to grow. Even if you can only save a little bit, every bit helps!

- Increase your savings: Try to save more as you earn more money. Even adding a little extra each month can make a big difference over time.

- Use retirement accounts: Retirement accounts like IRAs or 401(k)s can boost your savings. They often offer tax benefits, so you can keep more of your money.

- Consider permanent life insurance and annuities. These financial products often use compound interest to grow savings over time while providing additional benefits such as a death benefit or guaranteed income stream.

- Be patient. Building wealth takes time and patience. Stick to your savings plan, even when progress seems slow.

No matter your age or income, it’s never too late to start saving. The sooner you begin, the more time your money has to grow. So, don’t wait—start saving today and watch your money grow effortlessly over time. Remember, with compound interest on your side, even small savings can turn into big wealth down the road.

Retirement Timing Considerations

5 Years Before Retirement:

- Evaluate your current financial position.

- Assess your anticipated retirement expenses.

- Fine-tune your investment strategy for the short term.

10 Years Before Retirement:

- Increase contributions to retirement accounts.

- Reassess risk tolerance and adjust investments accordingly.

- Explore healthcare options and costs.

20 Years Before Retirement:

- Focus on long-term investment strategies.

- Update your retirement goals and expectations.

- Consider tax-efficient retirement savings strategies.

40 Years Before Retirement:

- Establish a comprehensive financial plan.

- Maximize contributions to retirement accounts.

- Explore early retirement possibilities.

Personalizing Your Plan:

This journey should be customized to your individual circumstances. Take the time to:

- Assess your risk tolerance: Are you comfortable with market fluctuations, or do you prioritize stability?

- Define your financial goals: How much do you need to live comfortably in retirement?

- Consider your health circumstances: Do you have any existing health conditions or family history that might impact healthcare costs?

Resources for the Road Ahead:

Numerous resources can help you build your personalized retirement plan:

- Financial planning tools: Manage your budget, investments, and debts.

- Government websites: Access information on Social Security, Medicare, and other benefits.

- Financial advisors: Seek professional guidance tailored to your unique situation.

Frequently Asked Questions

-

Q: How does compound interest work in retirement savings? A: Compound interest is the interest earned not only on the initial investment but also on the accumulated interest over time. This means that your savings grow exponentially, with the potential for significant growth over long periods, especially when compounded over years or decades.

-

Q: What if I can’t afford to invest a lot of money early on? A: The key is consistency rather than the amount. Even small, regular contributions can make a significant difference over time due to the compounding effect. Starting early allows you to take advantage of this compounding and build wealth gradually over time.

-

Q: How can I start investing early if I’m young and just starting my career? A: Consider starting with a retirement account such as a 401(k) or IRA, if available. Automate your contributions so that a portion of your paycheck goes directly into your retirement savings. Additionally, educate yourself about investment options and seek guidance from financial advisors if needed. You may also explore options like permanent life insurance and annuities, which offer benefits such as a death benefit or guaranteed income stream, while also utilizing compound interest to grow your savings over time.

-

Q: Is it ever too late to start investing for retirement? A: While starting early offers the greatest advantage, it’s never too late to begin investing for retirement. Every year of saving and investing counts, so it’s important to start as soon as possible, regardless of your age. The key is to be consistent and committed to your long-term financial goals.

-

Q: What are the risks of not investing early for retirement? A: Delaying investing for retirement can result in missed opportunities for wealth accumulation. Without the advantage of time and compound interest, you may need to save a much larger portion of your income later in life to achieve your retirement goals. Additionally, you may have to rely more heavily on alternative sources of income in retirement, such as Social Security.

The information provided is for general informational purposes only and should not be considered professional tax or financial advice.

Start Planning With Our FREE Financial Freedom Navigation Tool: MyBlocks

- Financial Goal Setting

- Retirement Income Forecasting

- Budget & Expense Analysis

- And more!

Start with these featured Tools👇