Everything you need to know about IULs!

Indexed Universal Life Insurance (IUL) is a type of policy that combines life coverage with interest-earning opportunities. This guide will explain IUL in simple terms, including its features, benefits, and strategies.

1. What Are IULs?

Indexed Universal Life Insurance (IUL) is a form of permanent life insurance that offers both a death benefit and a cash value component linked to a market index like the S&P 500. Unlike traditional life insurance, IUL allows policyholders to participate in market gains without risking principal loss, thanks to built-in floor values typically set at 0%.

What Are The Key Features Of IULs

2. Using an IUL for Retirement Income:

IULs are increasingly recognized for their role in retirement planning. The ability to grow cash value on a tax-deferred basis, coupled with flexible tax-free withdrawals and loans, makes IUL a robust component of retirement strategies.

Strategies for Maximizing Retirement Income with IUL:

- Overfunding: Paying premiums above the minimum can significantly increase cash value, providing more capital for retirement income.

- Policy Loans and Withdrawals: Tax-free withdrawals or loans from the cash value can supplement retirement income without affecting Social Security or Medicare benefits.

3. Using an IUL for Kids’ Benefit:

An IUL can also be structured to benefit children, serving as a dual-purpose financial tool providing both a death benefit and a living benefit for funding educational expenses or other major life events.

Benefits for Children:

- Educational Funding: Withdrawals can cover college tuition or private schooling costs.

- Financial Head Start: Cash values can provide seed funds for future business ventures or home purchases.

Example of how an IUL can work

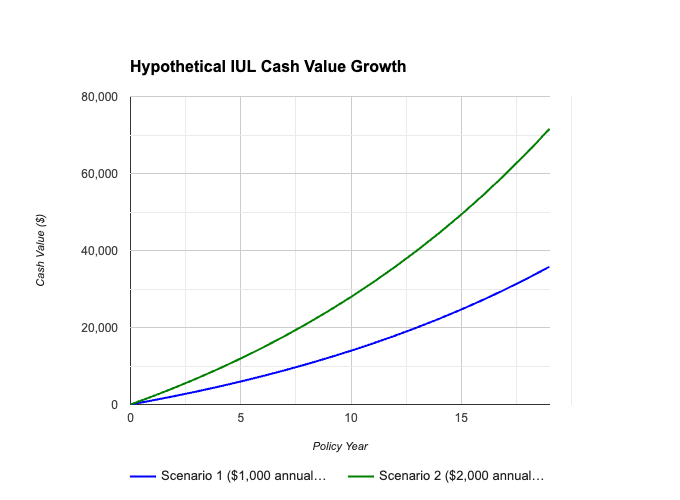

Hypothetical IUL Cash Value Growth: Understanding the Impact of Premiums

The graph below depicts how an IUL’s cash value can potentially grow based on different premium payment amounts. It’s important to remember that this is a hypothetical scenario, and actual growth will depend on various factors like market performance, fees, and interest rate crediting.

Assumptions:

- Starting cash value: $0

- Policy term: 20 years

- Floor rate: 0% (guaranteed minimum interest rate)

- Market index performance (hypothetical): 6% average annual growth

Scenarios:

- Scenario 1 (Blue Line): $1,000 annual premium

- Scenario 2 (Green Line): $2,000 annual premium

As you can see from the graph, the scenario with a higher annual premium (Scenario 2 – green line) results in a more significant cash value accumulation over time due to the power of compounding interest. The additional premium amount in Scenario 2 earns interest not only on the initial contribution but also on the accumulated value in previous years.

- Scenario 1 (Blue Line): Around $35,785.59

- Scenario 2 (Green Line): Around $71,571.18

This is a simplified example. Actual IUL policies may have additional fees that can affect cash value growth. The market index performance is hypothetical. Real-world market performance can fluctuate, impacting cash value growth. The graph doesn’t show potential withdrawals, which can also affect cash value.

Tips for Choosing an IUL Policy:

Shop Around and Compare: Obtain quotes from multiple insurance companies to compare features, fees, and interest rate crediting options.

Consider Your Financial Needs: Evaluate your long-term goals and choose a policy with features that align with your financial objectives.

Understand the Fees: Be aware of all associated fees, including surrender charges, administrative costs, and mortality expenses.

Choose a Reputable Insurer: Select a financially stable insurance company with a strong track record.

Seek Professional Advice: Consider consulting with a qualified financial advisor to determine if IUL is the right fit for your financial portfolio.

4. How do IULs compare with Other Life Insurance Options:

Understanding how IUL compares with other types of life insurance, such as whole life insurance or variable universal life insurance, can help you make an informed decision. While each option has its pros and cons, comparing them can provide insights into the advantages and disadvantages of IUL relative to other options.

| Feature | Indexed Universal Life (IUL) | Whole Life Insurance | Term Life Insurance |

|---|---|---|---|

| Death Benefit | Guaranteed payout to beneficiaries upon policyholder’s death. | Guaranteed payout to beneficiaries upon policyholder’s death. | Guaranteed payout to beneficiaries upon policyholder’s death within the specified term. |

| Cash Value | Yes, grows based on a market index with a floor rate (minimum guaranteed interest rate). | Yes, grows at a fixed or predetermined rate. | No cash value. |

| Premium Payments | Flexible, can be adjusted up or down. | Fixed premiums throughout the policy term. | Fixed premiums throughout the term, typically lower than whole life or IUL. |

| Tax Advantages | Cash value grows tax-deferred, tax-free withdrawals up to basis (total premiums paid). | Cash value grows tax-deferred, tax-free withdrawals up to basis. | No tax advantages. |

| Investment Potential | Potential for cash value growth based on market performance (with a floor rate). | Guaranteed, but typically lower growth than IUL. | No investment potential. |

| Suitability | Good for long-term wealth accumulation and life insurance needs, comfortable with market fluctuations. | Good for those seeking guaranteed cash value growth and predictable premiums. | Good for those prioritizing affordable coverage for a specific period (term). |

5. Are IULs for everyone?

-

Tax Implications of IUL:

Cash value growth within an IUL policy accumulates on a tax-deferred basis. This means you don’t pay taxes on any gains until you withdraw the money. If you take out loans from the policy, you generally don’t owe taxes on the loaned amount. However, it’s important to note that if withdrawals exceed your basis (total premiums paid), they may be taxed as ordinary income. It’s always wise to consult with a tax advisor for personalized guidance on your specific situation.

-

Suitability of IUL: IUL may not be suitable for everyone. It’s a complex financial instrument and often comes with higher fees than term life insurance. Consider your long-term financial goals, risk tolerance, and investment experience before deciding if IUL is right for you.

- Investment Horizon: If you need guaranteed growth or access to your money within a short period, IUL might not be the best option. It’s generally suitable for those with a long-term investment horizon (10+ years).

- Risk Tolerance: IUL involves market-based growth, so it’s essential to be comfortable with some level of risk.

- Financial Goals: Evaluate if IUL aligns with your financial goals. If you primarily need affordable life insurance coverage, term life might be a better choice.

-

Premium Payments: IUL policies offer flexibility in premium payments. However, to ensure your policy stays active and the cash value continues to grow, it’s crucial to maintain sufficient premium payments to cover insurance costs.

Should I consult with a financial advisor before getting IUL?

Consulting with a qualified financial advisor is highly recommended. They can help you assess your financial needs, risk tolerance, and goals to determine if IUL is the right fit for your financial portfolio.

Glossary of IUL and Life Insurance Terms:

- Death Benefit: The payout your beneficiaries receive upon your passing.

- Cash Value: The accumulated value within your policy that grows over time.

- Premium: The periodic payment you make to maintain your IUL policy.

- Floor Rate: A guaranteed minimum interest rate applied to your cash value, even if the market index experiences negative returns.

- Tax-Deferred Growth: Earnings within the policy accumulate without incurring taxes until withdrawn.

- Universal Life Insurance: A type of permanent life insurance offering both death benefit and cash value components.

- Term Life Insurance: A temporary life insurance policy that provides coverage for a specific period (term) at a lower premium cost.

6. Ready to shop and compare?

7. Where to start and how to open an IUL

1. Research and Educate Yourself:

- Understand IUL: Before diving in, thoroughly understand how IUL works, its benefits, drawbacks, and how it compares to other life insurance options (term life, whole life). This blog post you’ve created is a great resource!

- Research Insurance Companies: Look for reputable insurance companies with a good track record in the IUL market. Consider factors like financial strength, customer service ratings, and product offerings.

2. Identify Your Needs and Goals:

- Financial Goals: What are your long-term financial goals for the cash value? Is it for retirement income, educational expenses for children, or wealth accumulation?

- Coverage Needs: How much life insurance coverage do you need to protect your loved ones financially?

- Risk Tolerance: How comfortable are you with potential market fluctuations that can impact your cash value growth?

3. Get Quotes and Talk to Agents:

- Request Quotes: Once you’ve identified a few potential insurance companies, request quotes for IUL policies. The quotes should detail features like premiums, coverage amounts, fees, and potential cash value growth based on different scenarios.

- Consult with Licensed Insurance Agents: Speak with licensed insurance agents who specialize in IUL products. They can answer your questions, explain different policy options, and help you compare quotes.

4. Carefully Review Policy Details:

- Read the Fine Print: Before committing, thoroughly review the IUL policy contract. Understand all terms and conditions, including fees, surrender charges (fees for withdrawing money early), and exclusions.

- Ask Questions: Don’t hesitate to ask the insurance agent or financial advisor any questions you may have regarding the policy details.

5. Consider Consulting a Financial Advisor:

A qualified financial advisor with experience in IUL can provide valuable guidance. They can help you:

- Assess Your Needs: They can analyze your financial situation, goals, and risk tolerance to determine if IUL aligns with your overall financial plan.

- Compare Products: They can help you compare different IUL policies from various providers to find the one that best suits your needs.

- Make Informed Decisions: Their expertise can empower you to make informed decisions about your IUL purchase.

Important Reminders:

- Don’t Rush: Take your time to research, compare options, and ask questions before committing to an IUL policy.

- Focus on Your Needs: Choose an IUL policy that aligns with your specific financial goals and risk tolerance, not what someone else recommends.

- Get Everything in Writing: Ensure you receive a copy of the policy contract and any additional disclosures before signing.

8. Are There Any Potential Drawbacks and Considerations?

Underfunding an IUL: Understanding the Risks and Solutions

Indexed Universal Life (IUL) offers the potential for cash value growth alongside life insurance protection. However, there’s a potential pitfall – underfunding your IUL policy. Let’s explore what underfunding means, the risks it poses, and how to manage it effectively.

What is Underfunding an IUL?

Underfunding an IUL simply means not paying enough premium to adequately cover the policy’s costs. These costs include:

- Death benefit payout: The guaranteed amount paid to your beneficiaries upon your passing.

- Insurance costs: The expenses associated with providing the life insurance coverage.

- Policy fees: Administrative and other fees charged by the insurance company to maintain the policy.

When your premium payments fall short of covering these costs, your policy becomes underfunded.

Risks of Underfunding an IUL:

An underfunded IUL policy can lead to several negative consequences:

- Policy Lapse: If the cash value in your policy isn’t sufficient to cover ongoing costs, the policy may lapse. This means you lose your coverage and any accumulated cash value (minus surrender charges).

- Reduced Death Benefit: In some cases, the insurance company might use your cash value to pay for outstanding policy charges. This can reduce the death benefit payout your beneficiaries receive.

- Limited Cash Value Growth: Underfunding can restrict the potential for cash value growth in your IUL. The premiums are what fuel the cash value accumulation, so insufficient premiums can limit this growth.

How to Avoid Underfunding Your IUL:

Here are some strategies to prevent underfunding your IUL:

- Choose an Appropriate Premium: Work with a qualified financial advisor or insurance agent to determine the necessary premium amount to maintain your desired death benefit and achieve your cash value growth goals.

- Review Regularly: Periodically assess your financial situation and adjust your premium payments as needed. Life circumstances change, so your IUL strategy might need adjustments too.

- Consider a Flexible Premium Payment Option: Some IUL policies offer flexible premium options that allow you to increase or decrease your payments within certain limits. This flexibility can help you adapt to changing financial circumstances.

Warning Signs of Underfunding:

- Receiving Notices from the Insurance Company: If you start receiving notices about insufficient premium payments, it’s a red flag that your policy might be underfunded.

- Cash Value Not Growing as Expected: If your cash value isn’t growing as anticipated, it could be due to underfunding.

What to Do if Your IUL is Underfunded:

If you discover your IUL is underfunded, here are some options:

- Increase Premium Payments: Boosting your premium payments is the most straightforward way to address underfunding. However, make sure this increase aligns with your budget.

- Contribute a Lump Sum Payment: If financially feasible, consider making a lump-sum contribution to your cash value to get back on track.

- Work with Your Insurance Agent: Discuss your situation with your insurance agent. They might be able to offer solutions like premium payment holidays (temporary pause) or policy changes to help you catch up.

Remember: Early detection and action are key to managing underfunding. By being proactive, you can safeguard your IUL policy and ensure it continues to meet your long-term financial goals.

Regulatory and Legal Considerations

Staying informed about the regulatory environment surrounding IUL is vital. Recent legal or regulatory changes may affect your rights and obligations as a policyholder or impact the tax treatment of IUL policies. It’s also important to be aware of legal considerations, such as contractual terms or potential disputes with insurance companies, when purchasing or managing an IUL policy.

Risk Management Strategies

While we’ve discussed the risks associated with underfunding, there are additional strategies to mitigate other IUL risks, such as market fluctuations or changes in insurance company policies. Diversifying your investment allocations or regularly reviewing your policy’s performance can help manage these risks.

Please note that the information provided is for educational purposes only and should not be considered as financial or investment advice. Consult with a financial advisor or professional for personalized guidance regarding your specific situation.