Navigating the Choice Between Employer Insurance & Medicare

Making healthcare decisions can be daunting, especially as you approach eligibility for Medicare. One significant choice many individuals face is whether to stick with their employer’s health insurance or transition to a Medicare Plan. In this blog post, we’ll explore the key factors to consider when making this decision and offer guidance to help you navigate your options effectively.

1. Understanding Your Options:

Employer Health Insurance:

Employer-sponsored health insurance plans vary widely in terms of coverage, cost, and provider networks. Typically, these plans offer a range of benefits, including coverage for medical services, prescriptions, and preventive care. Understanding the specifics of your employer’s plan, such as the type (HMO, PPO, etc.), network limitations, and out-of-pocket costs, is crucial for making an informed decision.

Medicare Plans:

Medicare is a federal health insurance program primarily for individuals aged 65 and older, as well as some younger individuals with disabilities. It consists of several parts, including Part A (hospital insurance), Part B (medical insurance), Part C (Medicare Advantage), and Part D (prescription drug coverage). Each part offers different levels of coverage and comes with its own costs and considerations.

2. Weighing the Factors:

Price Comparison:

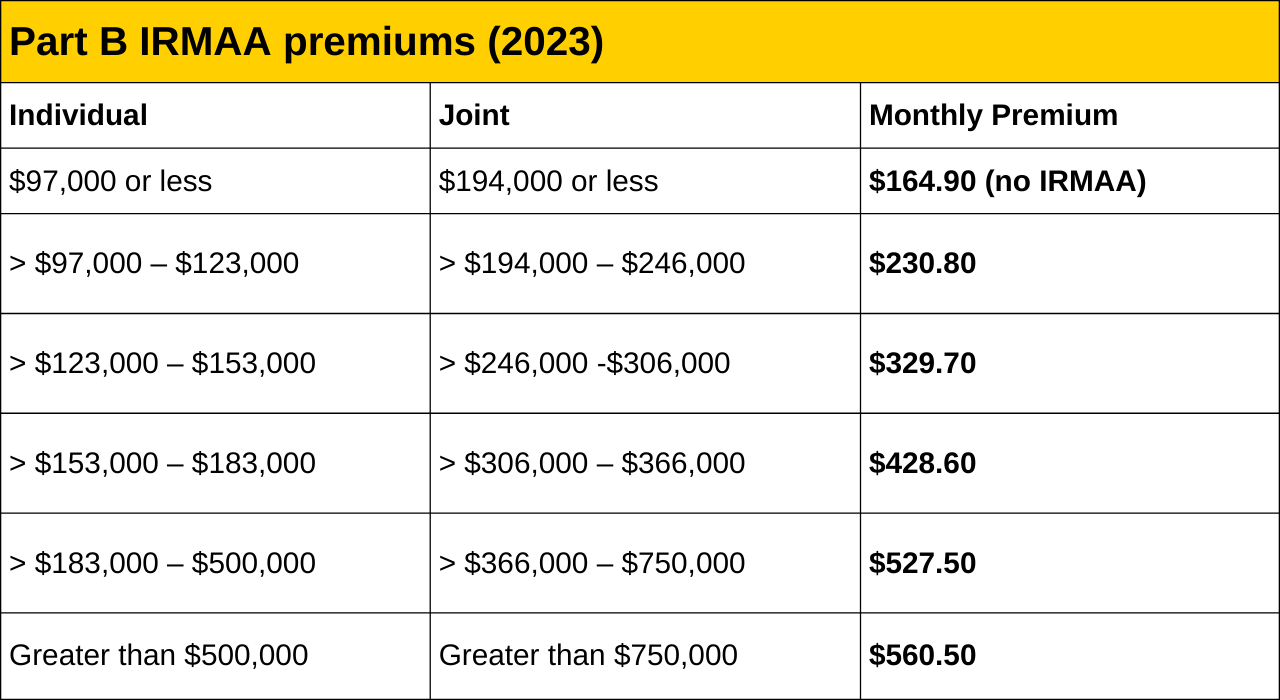

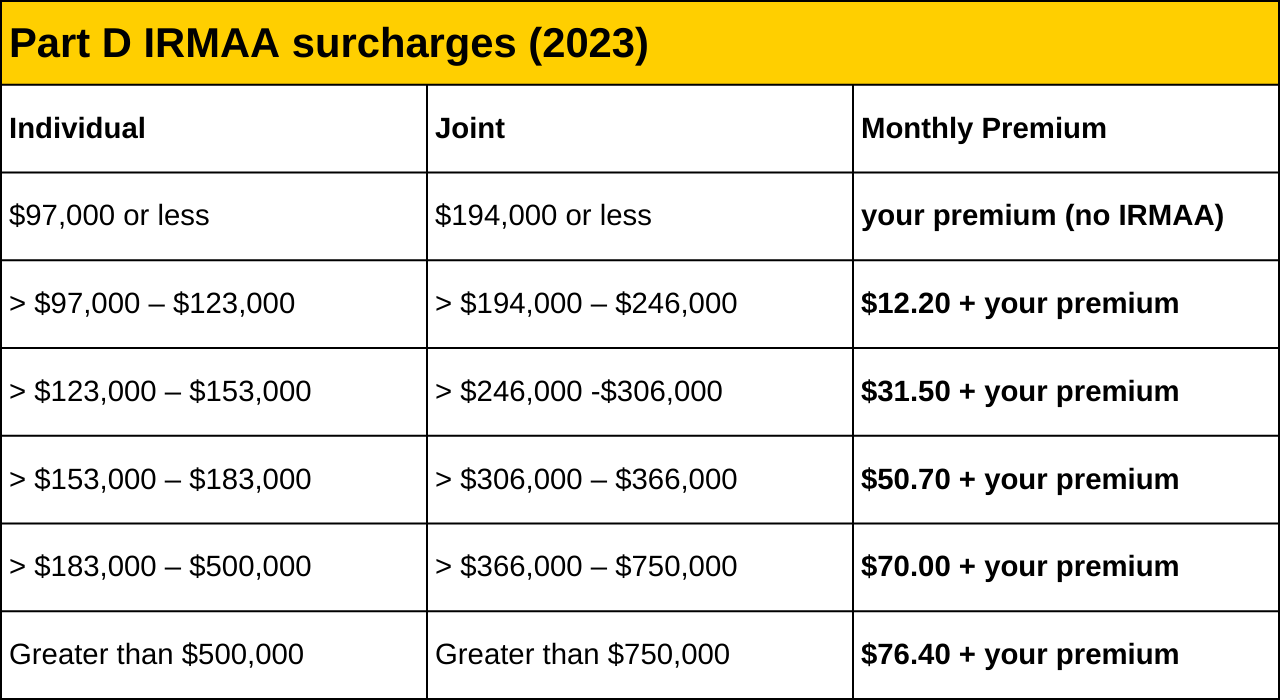

Comparing the costs of employer insurance versus Medicare involves evaluating premiums, deductibles, copayments, and out-of-pocket maximums. While employer plans may offer subsidies, Medicare premiums vary based on income and can include additional costs for prescription drug coverage and supplemental insurance (Medigap).

Coverage Scope:

Consider the breadth of coverage and provider flexibility offered by both employer insurance and Medicare. Employer plans may have network restrictions, whereas Medicare allows for greater choice in healthcare providers but may come with certain limitations depending on the type of plan selected.

Creditable Coverage:

Understanding whether your employer insurance provides “creditable coverage” is crucial for avoiding penalties when enrolling in Medicare. Employers are required to disclose this information, which determines whether your current coverage meets Medicare’s standards.

Employer Requirements:

Some employers may require retirees to enroll in Medicare Part B to maintain coverage. It’s essential to review your employer’s policies and consult with HR to understand any requirements that may impact your decision.

Special Considerations:

State-specific variations: Medicare plans and coverage options can vary depending on your state. It’s recommended to research your specific state’s Medicare landscape for more detailed information.

Medigap: Medigap plans help supplement Medicare coverage by filling in gaps like deductibles and copayments.

Employer Size: The size of your employer plays a crucial role in determining your healthcare options and coverage continuation after leaving your job. Employers with 20 or more employees are mandated by federal law to offer COBRA coverage to eligible employees. COBRA, which stands for Consolidated Omnibus Budget Reconciliation Act, allows you to continue your employer-based health insurance for a limited period, usually up to 18 months, after leaving your job or experiencing a qualifying event such as termination, reduction in hours, or other qualifying life events.

While COBRA provides a valuable safety net for maintaining health insurance coverage during transitional periods, it’s essential to be aware that COBRA can be expensive. As a COBRA participant, you are responsible for the entire premium, including the portion previously subsidized by your employer. This often results in significantly higher monthly premiums than what you were previously paying as an active employee. Therefore, individuals opting for COBRA coverage should carefully assess the financial implications and explore alternative coverage options, such as Medicare or individual health insurance plans, to ensure cost-effectiveness.

Medicare Coordination: For employees of large companies with 20 or more employees, another viable option is to coordinate Medicare with your employer’s coverage. Medicare, the federal health insurance program primarily for individuals aged 65 and older, typically serves as secondary insurance when combined with employer-sponsored health insurance. This means that your employer coverage remains primary, covering expenses first, while Medicare serves as secondary insurance, covering costs that your employer plan does not cover.

When considering Medicare coordination with employer coverage, it’s essential to evaluate the costs and benefits of Medicare Parts A and B compared to your employer coverage. Medicare Part A, which covers hospitalization, is often premium-free for individuals who have worked and paid Medicare taxes for a sufficient duration. However, Medicare Part B, which covers medical services and doctor visits, typically requires a monthly premium. By comparing the premiums, deductibles, copayments, and coverage limits of Medicare Parts A and B with your employer’s plan, you can determine the most cost-effective option that best meets your healthcare needs.

3. Making the Decision:

Assessing Your Healthcare Needs:

Take stock of your current healthcare needs and anticipate any future medical services or prescriptions you may require. Consider factors such as chronic conditions, prescription drug coverage, and preferred healthcare providers when evaluating your options.

Evaluating Financial Implications:

Evaluate the financial aspects of both employer insurance and Medicare, including premiums, out-of-pocket costs, and potential retirement savings. Factor in your budget, retirement income, and any available resources for covering healthcare expenses.

Consulting with HR or a Medicare Specialist:

Seek guidance from your HR department to understand the details of your employer’s insurance plan and any implications for Medicare enrollment. Additionally, consider consulting with a Medicare specialist who can provide personalized advice based on your individual circumstances.

Review your Medicare Plan

↓

Frequently Asked Questions About Medicare

1. What factors should I consider when deciding between employer insurance and Medicare? When making this decision, it’s essential to consider factors such as your age, employer size, coverage scope, costs (including premiums, deductibles, and copayments), benefits, provider network, and any specific requirements or coordination rules set by your employer or Medicare.

2. How does COBRA coverage work, and is it a cost-effective option? COBRA coverage allows eligible individuals to continue their employer-based health insurance for a limited period after leaving their job or experiencing a qualifying life event. While COBRA provides continuity of coverage, it can be expensive as participants are responsible for the entire premium, including the portion previously subsidized by their employer. It’s essential to assess the financial implications and explore alternative coverage options, such as Medicare or individual health insurance plans, to ensure cost-effectiveness.

3. Can I coordinate Medicare with my employer’s coverage? Yes, individuals working for large companies with 20 or more employees can coordinate Medicare with their employer’s coverage. Medicare typically serves as secondary insurance, covering costs that your employer plan does not cover. It’s crucial to evaluate the costs and benefits of Medicare Parts A and B compared to your employer coverage to determine the most cost-effective option that best meets your healthcare needs.

4. What should I do if I’m approaching Medicare eligibility age and still employed? If you’re nearing Medicare eligibility age and still employed, it’s advisable to review your employer’s health insurance policies, consult with human resources or benefits administrators, and explore your Medicare options. Consider factors such as your healthcare needs, financial situation, and any specific requirements or coordination rules set by your employer or Medicare.

5. How can I make an informed decision about my healthcare coverage options? To make an informed decision, gather information about your employer’s health insurance plan, review Medicare options and eligibility criteria, compare costs and benefits, assess your healthcare needs and financial situation, consult with licensed insurance agents specializing in Medicare, and seek guidance from healthcare professionals.

6. What if my spouse covers me under their employer’s health insurance plan? If your spouse covers you under their employer’s health insurance plan, you may still have options regarding Medicare enrollment. The decision may depend on factors such as your spouse’s employer size, coverage scope, and coordination rules. It’s advisable to assess your healthcare needs, review your spouse’s employer coverage, and explore Medicare options to determine the most suitable healthcare coverage arrangement for your situation.