Last Updated on January 11, 2025 by policyengineer

Last Updated: January 11th, 2025

Avoiding the Most Common Medicare Mistakes

-

A Comprehensive Guide for First-Time Beneficiaries

Choosing a Medicare plan for the first time can be a complex and confusing process. With so many options and variables to consider, making mistakes can easily have significant financial and health consequences. These include not checking if your doctors are in-network and not ensuring that your prescriptions are covered, along with understanding co-pays. We’ll provide tips to help you make informed decisions and avoid these errors.

Understanding Medicare: An Overview

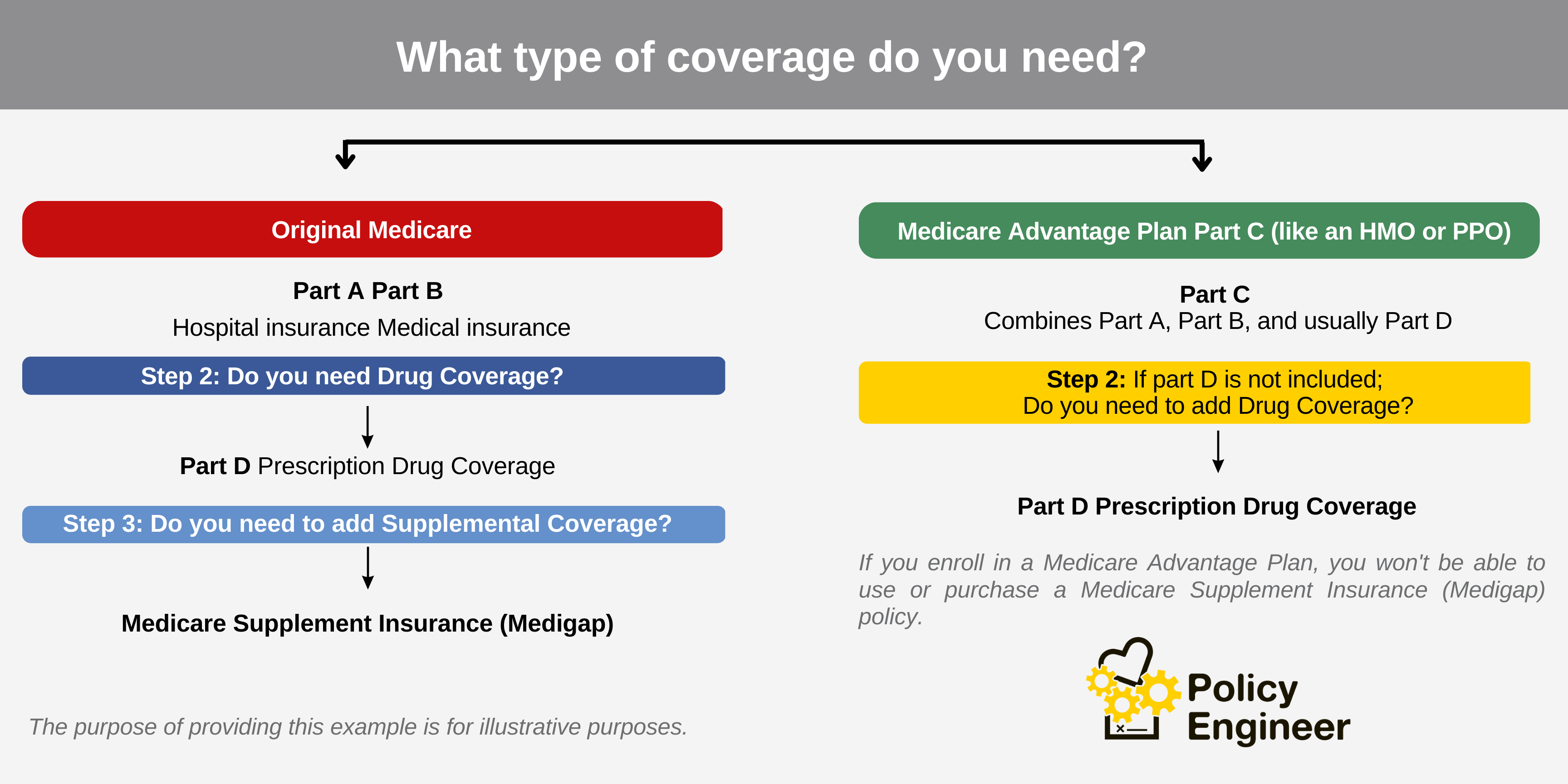

Medicare is a federal health insurance program primarily for individuals aged 65 and older, though it also covers some younger people with disabilities. It consists of several parts:

- Part A (Hospital Insurance): Covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

- Part B (Medical Insurance): Covers certain doctors’ services, outpatient care, medical supplies, and preventive services.

- Part C (Medicare Advantage): An alternative to Original Medicare that offers all Part A and B benefits and often includes Part D (prescription drug coverage) and additional benefits like dental and vision care.

- Part D (Prescription Drug Coverage): Provides coverage for prescription medications.

Each part of Medicare has its own rules and coverage options, and selecting the right plan requires careful consideration of your specific health needs and preferences.

Mistake #1: Not Confirming Doctors Are In-Network

One of the most common and impactful mistakes new Medicare beneficiaries make is failing to confirm that their doctors are in-network with their chosen plan. This includes your primary care physician and any specialists you see regularly. Medicare Advantage plans, in particular, often have specific networks of doctors and hospitals. Going out-of-network can result in significantly higher costs or even the denial of coverage for services.

Why Network Confirmation Is Crucial

Ensuring that your doctors are in-network is essential for several reasons:

- Cost Savings: In-network providers have agreed to accept the insurance plan’s payment terms, which typically results in lower out-of-pocket costs for you.

- Continuity of Care: Staying with your current doctors allows for uninterrupted care, which is particularly important for managing chronic conditions or ongoing treatments.

- Access to Specialists: Confirming that your specialists are in-network ensures that you can continue receiving the specialized care you need without additional financial burdens.

Tips for Confirming Doctor Networks

To avoid this mistake, follow these steps:

- Make a List of Your Doctors: Start by listing all your current healthcare providers, including primary care physicians, specialists, and any other practitioners you see regularly.

- Check Carrier Websites: Most insurance carriers have online tools that allow you to search for in-network doctors by name, location, and specialty. Use these tools to verify that your doctors are included in the network of any plan you are considering.

- Call Your Doctors: Contact your doctors’ offices directly to confirm that they accept the insurance plan you are considering. This step can help avoid any discrepancies or outdated information on carrier websites.

- Seek Assistance from a Licensed Agent: At Policy Engineer, Our agents can provide personalized assistance in verifying doctor networks and can offer additional insights based on their expertise.

Real Client Example: Importance of Doctor Network

Consider the case of Tom, a client who had a long-standing relationship with his primary care physician and several specialists. When he first enrolled in Medicare, he selected a Medicare Advantage plan without verifying whether his doctors were in-network. As a result, he faced higher costs for out-of-network visits and had to switch doctors for some of his care. This disruption was both stressful and costly. By switching to a plan that included his preferred doctors, Tom was able to continue his care without interruption and avoid unnecessary expenses.

Mistake #2: Not Confirming Prescription Coverage and Understanding Co-Pays

Another common mistake is not ensuring that all your medications are covered by your chosen plan and not understanding the associated co-pays. Each Medicare Part D plan and Medicare Advantage plan with prescription drug coverage has a formulary, which is a list of covered drugs. The cost of medications can vary significantly between plans, and not all plans cover all medications.

Why Prescription Coverage Confirmation Is Crucial

Ensuring that your prescriptions are covered is vital for several reasons:

- Cost Savings: Different plans have different formularies and co-pay structures. Confirming coverage and understanding co-pays can help you avoid high out-of-pocket costs.

- Access to Necessary Medications: Ensuring your medications are covered prevents interruptions in treatment and ensures you have access to the drugs you need.

- Preferred Pharmacies: Some plans offer lower co-pays at preferred pharmacies. Knowing which pharmacies are preferred can result in additional savings.

Tips for Confirming Prescription Coverage

To avoid this mistake, follow these steps:

- Prepare a Medication List: Start by making a comprehensive list of all the medications you take, including dosages and frequency.

- Use Our Medicare Plan Finder Tools: Policy Engineer has online tools that allow you to search for your medications and compare costs across different plans. Use these tools to ensure your medications are covered and to understand the co-pays.

- Review Plan Documents: Carefully review the plan’s formulary and drug tiers. Understanding which tier your medications fall into can give you a clearer picture of your potential costs.

- Check Preferred Pharmacies: Some plans have agreements with certain pharmacies to offer lower co-pays. Check if your preferred pharmacy is included in the plan’s network.

- Consult with a Licensed Agent: At Policy Engineer, our agents can provide personalized assistance in verifying medication coverage and can offer additional insights based on their expertise.

Real Client Example: Importance of Medication Coverage

Consider the case of Jane, a client who takes several medications for chronic conditions. When she first enrolled in Medicare, she chose a plan based on its low monthly premium without checking its formulary. She soon discovered that one of her essential medications was not covered, leading to out-of-pocket expenses that strained her budget. After consulting with us, Jane switched to a plan that covered all her medications, saving her hundreds of dollars annually.

Additional Tips to Avoid Common Medicare Mistakes

In addition to confirming doctor networks and prescription coverage, there are other steps you can take to ensure you choose the right Medicare plan for your needs:

- Understand Your Health Needs: Assess your current health status and anticipate future needs. Consider how often you visit doctors, the types of specialists you see, and any upcoming medical procedures.

- Compare Multiple Plans: Don’t settle for the first plan you come across. Compare multiple plans to find one that offers the best balance of coverage and cost.

- Utilize Free Resources: Take advantage of free resources available online. Visit policyengineer.com/medicare for our comprehensive Medicare 101 handbook. This resource covers the basics of Medicare, including parts A, B, C, and D, plan options, and common changes in the Medicare system.

- Attend Educational Events: Join our weekly live events to get a comprehensive overview of Medicare and the latest updates. These sessions provide an opportunity to ask questions and get real-time answers from our Medicare experts.

- Stay Informed About Changes: Medicare policies and plan details can change annually. Stay informed about any changes that might affect your coverage and costs.

How to Enroll in Part B of Medicare

Enrolling in Medicare Part B is a crucial step for most beneficiaries, and doing it right can save you time and hassle. The easiest way to enroll is online via the Social Security website (SSA.gov). At Policy Engineer, we provide step-by-step guidance on our site to help you through this process. Whether you’re enrolling for the first time or switching plans, our resources are designed to make the process as smooth as possible.

Takeaways and Tips for Making Informed Decisions

Here are some key takeaways and tips to help you avoid common Medicare mistakes and make informed decisions:

- Verify Doctor Networks: Always confirm that your primary care physician and specialists are in-network before enrolling in a plan. Use carrier websites, contact doctors directly, and seek help from Medicare advisors.

- Check Prescription Coverage: Ensure that all your medications are covered by the plan’s formulary and understand the co-pays. Use online tools and consult with Medicare advisors to compare plans and costs.

- Understand Plan Details: Carefully review plan documents and understand the coverage, costs, and network restrictions. Consider how the plan fits your current and future health needs.

- Utilize Preferred Pharmacies: Check if your preferred pharmacy is included in the plan’s network to take advantage of lower co-pays.

- Stay Informed and Seek Help: Medicare can be complex and confusing. Utilize free resources, attend educational events, and seek personalized assistance from Medicare advisors to stay informed and make confident decisions.

Conclusion

Navigating Medicare can be challenging, but with the right knowledge and resources, you can avoid common mistakes and choose a plan that best meets your needs. By confirming that your doctors are in-network and ensuring your prescriptions are covered with an understanding of the co-pays, you can save money and maintain continuity of care. Utilize the free resources from Policy Engineer to stay informed and make confident decisions about your Medicare coverage.

Remember, making the right choices about your Medicare plan can have a significant impact on your health and finances. Don’t hesitate to reach out for help and take advantage of the resources available to you. With careful planning and informed decisions, you can navigate Medicare with confidence and peace of mind.

Free Resources and How to Enroll in Medicare

Navigating Medicare can be complex, but there are resources available to help:

Free Resources

- Medicare 101 Handbook: Visit policyengineer.com/medicare for our comprehensive Medicare 101 handbook, covering all parts of Medicare, plan options, and common changes in the system.

- Weekly Live Events: Join our weekly live events to get a comprehensive overview of Medicare and the latest updates.

Medicare Part A Guide

Last Updated: January 11th, 2025