Understanding the Different Parts of Medicare

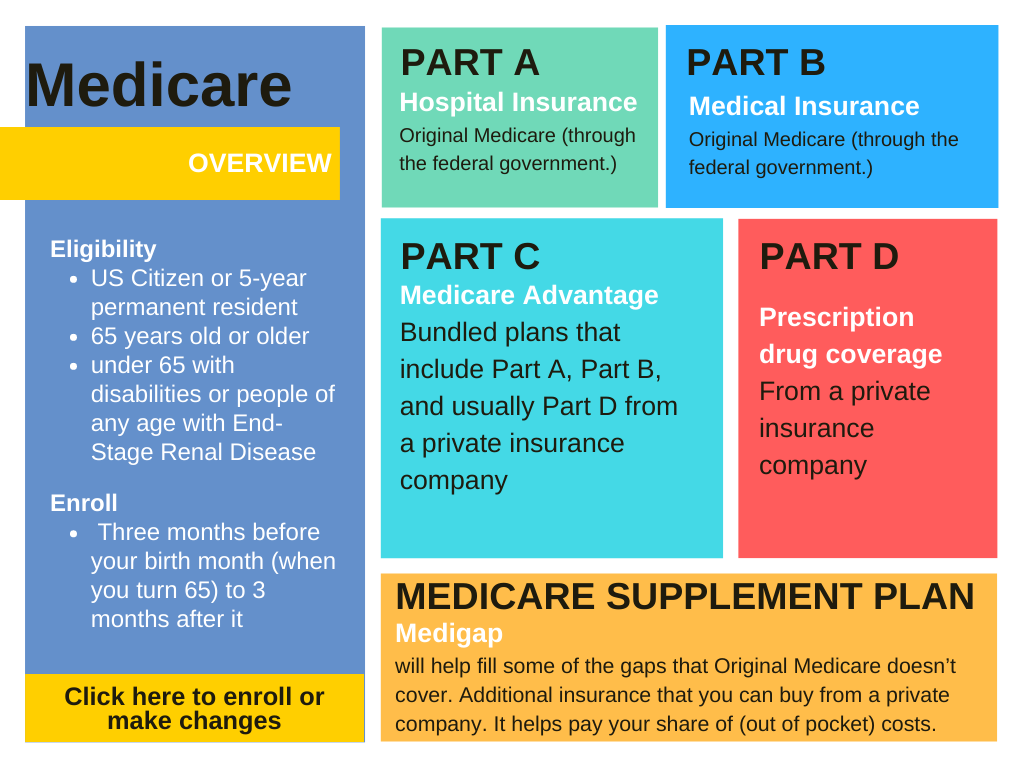

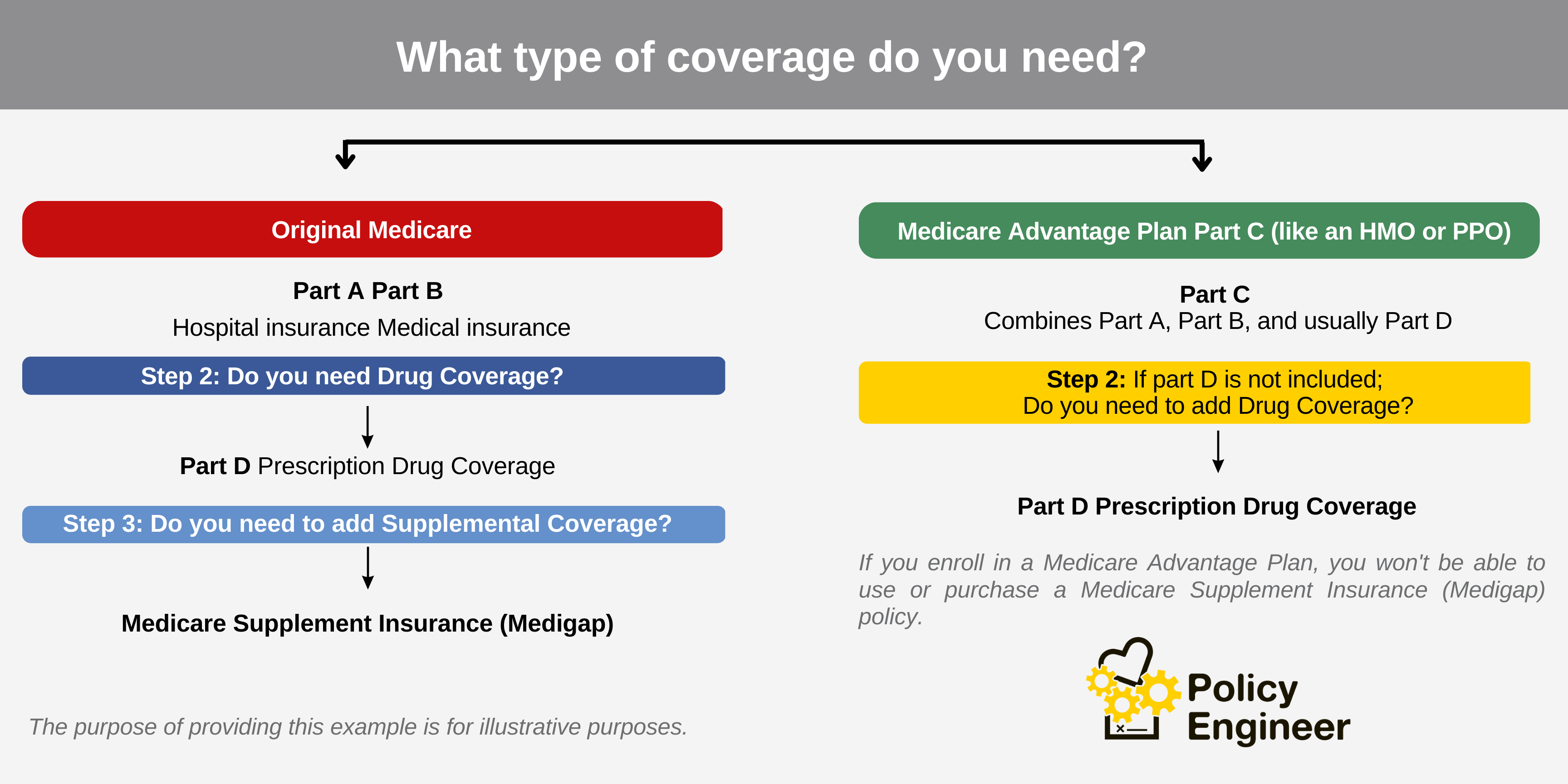

If you’re approaching 65 or need to modify your Medicare plan, this blog is for you. We’ll discuss the four parts of the Medicare & Medicare supplement plan to help you understand your options better. You can find the Medicare Chart and Flowchart below. It’s crucial to have a clear understanding of the available Medicare options so that you can make an informed decision when selecting your coverage.

What is Medicare?

Medicare is health insurance provided by the government for:

- People aged 65 and older: It helps cover medical expenses for seniors.

- People under 65 with disabilities: It assists those who are younger but have qualifying disabilities.

- People of any age with End-Stage Renal Disease (ESRD): It supports individuals with advanced kidney disease requiring dialysis or a transplant.

How does Medicare work?

Many people choose Original Medicare (Parts A and B), a traditional fee-for-service program. This means:

- Coverage: The government pays for healthcare services directly.

- Flexibility: You can go to any hospital in the USA that accepts Medicare.

Enrollment: If you’re already receiving Social Security benefits, you’ll be automatically enrolled in Medicare. For those not receiving Social Security, there’s a specific sign-up window:

- Timing: You can enroll three months before turning 65, during the birth month, and three months after.

- Importance of timely enrollment: Signing up during this window is crucial to avoid penalties for Parts B and D.

Penalties for Late Enrollment:

-

Part B Late Enrollment Penalty:

- Penalty: Your Part B premium may increase by 10% for every 12-month period you were eligible but didn’t enroll.

- Importance of timely enrollment: Enrolling late may result in higher monthly premiums.

-

Part D Late Enrollment Penalty:

- Penalty: For each month you delay enrolling in Medicare Part D (prescription drug coverage), you’ll pay a 1% late enrollment penalty.

- Importance of timely enrollment: Enrolling late may lead to increased costs for prescription drug coverage.

Key Takeaways:

- Medicare is health insurance for seniors, individuals with disabilities, and those with End-Stage Renal Disease.

- Original Medicare covers services provided by any hospital accepting Medicare.

- Timely enrollment is crucial to avoid penalties for Parts B and D.

- Social Security beneficiaries are automatically enrolled, but others must sign up during the designated window.

There are two routes you can take to get Medicare coverage. First, there is Original Medicare, which includes Part A and Part B. The Medicare Advantage Plan (Part C) is the second route to get Medicare. There are also add-ons; some people need additional coverage, like Medicare drug coverage (Part D) or Medicare Supplement Insurance (Medigap).

Medicare consists of four different parts; each Part of Medicare helps to cover specific services. Some are mandatory, and some are optional.

Four parts of Medicare coverage

Part A (Hospital Insurance)

- Original Medicare: Gives coverage for inpatient care in hospitals, skilled nursing facility care, hospice care, and home health care.

- Inpatient care in hospitals

- Skilled nursing facility care

- Hospice care

- Home health care

- Enrollment:

- Automatic enrollment for those applying for Medicare

- Part A Deductible (2024): $ 1,632

- When you apply for Medicare; you will be automatically enrolled,

- It covers in-home hospice care, but does not cover a stay in a hospice facility.

Fees

- In 2024, the deductible is $1,632

- A deductible applies if you’re hospitalized. If you stay longer than 60 days, you must pay a percentage of everyday expenses. You might need to pay a deductible each time if admitted to the hospital multiple times during the year. There is no copayment on days 0 to 60 of any inpatient stay. However, starting on day 61, you’ll have to pay $408 per day, and on day 91, you’ll pay $816 each day. This goes on until you hit your maximum lifetime of reserve days. You will get up to 60 of these days to use over your lifetime.

- Coinsurance costs might apply.

Part B (Medical Insurance)

- Coverage: Original Medicare; covers services from doctors and other healthcare providers.

- Services from doctors and healthcare providers

- Includes: doctor’s visits, medical equipment, outpatient care, outpatient procedures, purchase of blood, mammograms, cardiac rehabilitation, and cancer treatment

- Enrollment:

- Monthly premium applies

- Penalty for late enrollment without creditable coverage

- If you already have “creditable coverage” from another source, You’re not required to enroll in Part B. This creditable coverage could be through your employer or spouse’s employer.)

- You will have to pay the penalty if you enroll too late and don’t have creditable coverage (exceptions apply).

Fees

- Part B has a monthly premium. Some also pay a premium for Part A. The monthly cost in 2024 is $174.70

- You might have to pay an added surcharge if you have a higher income.

- There is also a Deductible. You’ll pay $240 for the year 2024.

- Most likely have to pay for 20% of the Medicare-approved cost of all covered services.

- If you are already getting Social Security, it might be deducted from your monthly payment.

How can you sign up for Original Medicare?

- You can sign up by visiting a Social Security office in your county, enrolling online by clicking here, or calling Social Security at 800-772-1213.

Does Original Medicare cover Long-term care?

Medicare doesn’t cover long-term care; 67% of people over 65 will need longer-term care at some point in their life. It would be best if you had a long-term care insurance policy to cover these costs. Medicare will only cover the fees for acute-care hospital services (patients transferred from intensive care or critical care unit). Click here to schedule a meeting with a licensed insurance agent to discuss your long-term care options.

Part D (Prescription drug coverage)

- Coverage:

- It helps cover the cost of prescription drugs (including many recommended shots or vaccines).

- Part D is optional and is usually included in any Medicare Advantage plan.

- These are stand-alone plans that only cover your medications.

You can join a Prescription drug coverage plan in addition to your Original Medicare. Or you can join a Medicare Advantage Plan with drug coverage. - If you have prescriptions or need a prescription later on and don’t have creditable coverage, this plan will be an excellent addition to your original Medicare; however, if you end up going without creditable drug coverage for 63+ days in a row after you’re first eligible. Then you most likely have to pay a late-enrollment fee if you enroll in a Medicare Prescription Drug Plan or Medicare Advantage Prescription Drug plan later.

- Private insurance companies offer this plan.

Fees

- Depending on your specific plan, there may be a yearly deductible before your plan starts covering the eligible drug costs. Part D plans could also have a co-pay.

- Medicare prescription drug plans do have a coverage gap. You could see this as a temporary limit on what the drug plan will cover until a certain amount has been reached.

- Many states have insurance options to close the coverage gap, but these may require paying an additional premium.

Enroll:

- During your seven-month Initial Enrollment Period for Part D.

- Annual Election Period (AEP) every year from October 15 to December 7.

Shop for Part D plans with Medicare’s plan finder tool on our website to review Part D plans available in your area

Part C Medicare Advantage “bundled” plans include Part A, Part B, and usually Part D

In short

- Coverage:

- Bundled plan including Parts A, B, and usually D

- Extra benefits like vision, dental, and fitness

- Enrollment:

- Offered by private insurance companies

- Additional premiums may apply

- This plan offers lower out-of-pocket costs and extra benefits such as vision care services.

- Offered through private insurance companies

- Provides Part A and Part B services covered by Original Medicare. Part C is required to cover every service that the original Medicare does.

- It may cover extra benefits such as; coverage for prescription drugs, Routine dental care including cleanings, x-rays, and dentures, Routine vision care including contacts and eyeglasses, Routine hearing care including hearing aids, Fitness benefits including exercise classes, and more.

- With these all-inclusive Medicare Advantage plans, you will cover all your health services in a single plan.

Fees

- You still have to pay for your Part B and Part A premiums if you have one.

- Some advantage plans have lower out-of-pocket costs than Original Medicare.

- Possibly you will have some network restrictions.

Your total costs for the Part C Advantage plan will depend on your chosen plan (compare different plans and carriers. - Medicare puts an out-of-pocket maximum for all Medicare Advantage part C plans; this was $7,550 in 2021

Shop for Part C plans with Medicare’s plan finder tool on our website to review Part C plans available in your area.

Medicare Supplement Insurance (Medigap):

In short

- Coverage:

- Fills gaps in Original Medicare coverage

- Enrollment:

- Can only be added to Original Medicare (Parts A and B)

-

- Enroll during the six-month open enrollment period for guaranteed acceptance:

-

- Your Medicare Supplement Open Enrollment Period (OEP) starts on the first day of the month you are at least 65, and you first have Medicare Part A and B.

- You have six months to buy a Medicare Supplement insurance plan, and you will have a guaranteed issue right? Companies cannot reject your application for a Medicare Supplement insurance plan based on pre-existing health conditions or disabilities.

- If you wait until after your open enrollment period, you can still apply anytime, but a plan could reject you or charge you more if you have any health problems.

Medicare Supplement Insurance, also called Medigap, will help fill some gaps that Original Medicare didn’t cover. You can get additional insurance from a private company, which helps pay your share of (out-of-pocket) costs in Original Medicare. Original Medicare generally covers 80% of your hospital and medical expenses. This will help pay your out-of-pocket costs in Original Medicare (like your 20% coinsurance, you have A percentage of the price you pay. In Part B, you generally pay 20% of the cost for each Medicare-covered service.

- There are ten standardized Medigap plans to choose from.

Medigap policies are standardized and are named by letters, A, B, C, D, F, G, K, L, M, and N in most states. - Each lettered plan’s benefits are the same, regardless of which insurance company sells them.

- You can review different insurance companies on our website to get the best price and never overpay for the same insurance.

- Only add a Medicare Supplement insurance plan if you have an original Medicare Part A and Part B plan.

- Combining a Medicare Supplement Insurance plan with a Medicare Advantage plan is impossible.

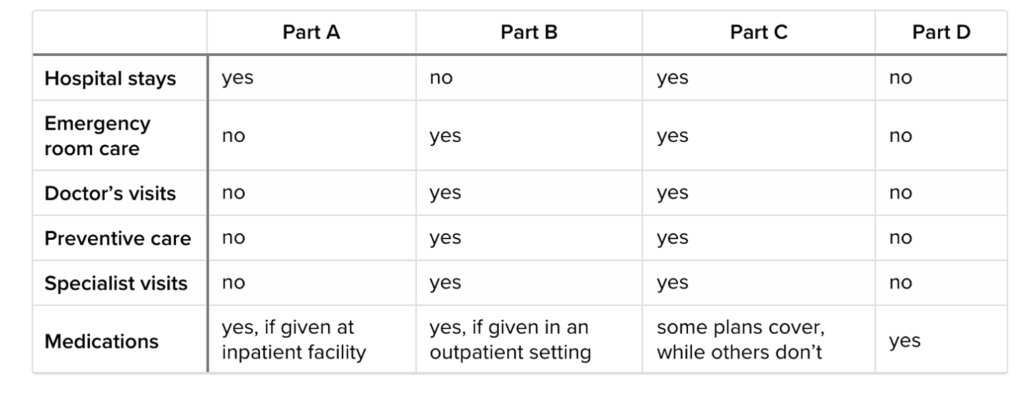

Summary of Medicare coverage:

Understanding your Medicare coverage choices is essential, and picking your coverage carefully. How you choose your benefits and who you get them from can affect your out-of-pocket costs and where you can get your care.

Important dates for Medicare enrollment:

Enrollment Information:

Original Medicare:

- Visit a Social Security office, enroll online, or call Social Security.

-

Part D (Prescription Drug Coverage):

- Initial Enrollment Period for Part D

- Annual Election Period (AEP) from October 15 to December 7

-

Medicare Advantage (Part C):

- Initial Enrollment Period for Part D

- Annual Election Period (AEP) from October 15 to December 7

-

Medicare Supplement Plan (Medigap):

- Open Enrollment Period (OEP) starts when you’re 65 and have Part A and B

- Six-month window for guaranteed acceptance

- Enrollment Periods

- General enrollment period (January 1–March 31). You could enroll in Medicare during this period if you didn’t enroll during your initial enrollment period.

- Medicare Advantage open enrollment (January 1–March 31). You can switch from one Medicare Advantage plan to another during this frame or return to the original Medicare. You can’t enroll in a Medicare Advantage plan if you already have Original Medicare.

- Part D enrollment/Medicare add-ons (April 1–June 30). If you don’t have Medicare Part A but are enrolled in Part B during the general enrollment period, you can sign up for a Part D prescription drug plan.

- Annual Enrollment Period (October 15 – December 7). You can switch from original Medicare (parts A and B) to Part C (Medicare Advantage) or from Part C back to original Medicare. You can also switch Part C plans or add, remove, or change a Part D plan.

- Special enrollment period. If you delayed Medicare enrollment for an eligible reason, you could later enroll during a special enrollment period. You have eight months from the end of your coverage or employment to sign up without penalty.