Your Social Security Benefits:

A Roadmap to Retirement Security

Imagine a comfortable retirement with a predictable income that helps you live your golden years to the fullest. Social Security plays a crucial role in making that dream a reality, but when to claim your benefits can significantly impact your financial well-being.

When to claim your Social Security benefits.

Imagine a comfortable retirement with a predictable income that helps you live your golden years to the fullest. Social Security plays a crucial role in making that dream a reality, but when to claim your benefits can significantly impact your financial well-being.

Understanding The Basics

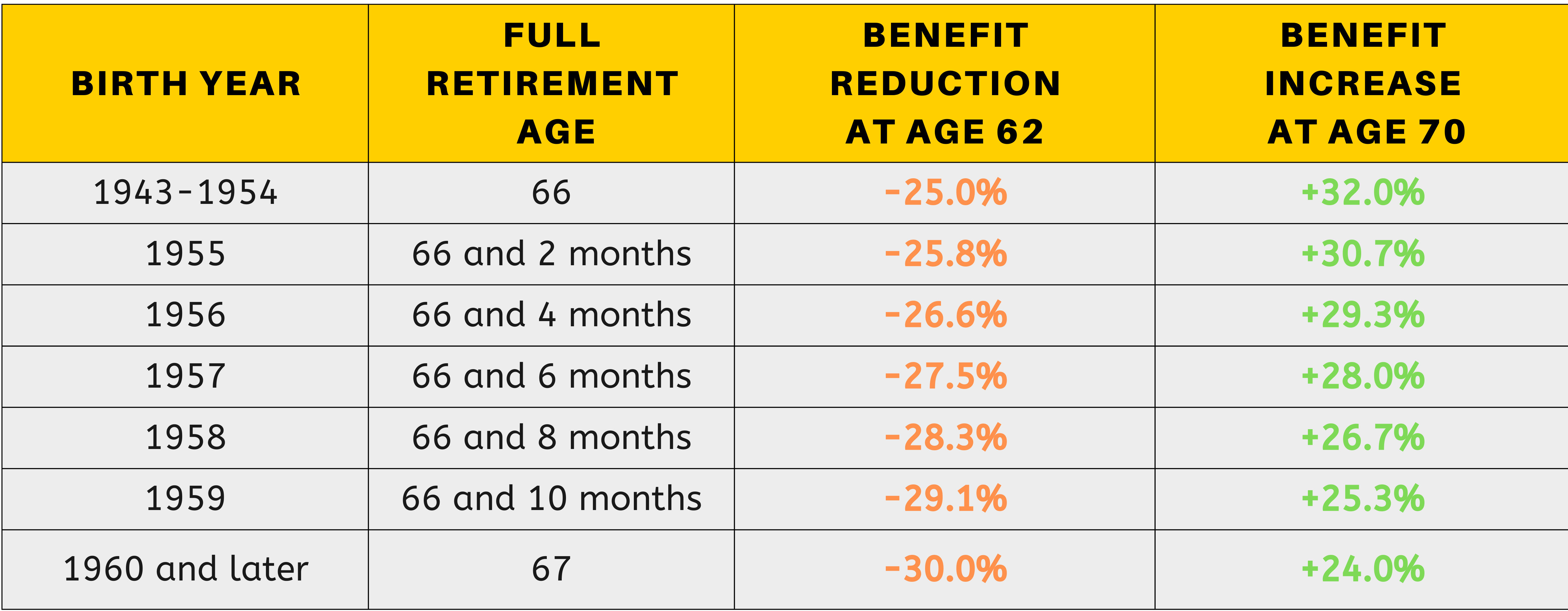

Before delving into the specifics of when to start receiving Social Security benefits, it’s essential to grasp some fundamental concepts. Your full retirement age (FRA) varies depending on your birth year. For instance, individuals born in 1956 have a full retirement age of 66 years and four months, while those born in 1960 or later have an FRA of 67 years.

This guide explores three common scenarios faced by retirees:

- Early Retirement: Can you enjoy freedom before full retirement age without sacrificing significant benefits?

- Working While Receiving Benefits: Balancing work and claiming benefits involves understanding income limits and potential adjustments.

- Delaying Benefits: Waiting can boost your monthly payout, but is it the right strategy for you?

Scenario A: Early Retirement & Claiming Benefits

Dreaming of an early escape from the daily grind? While you can start receiving benefits as early as age 62, remember:

- Reduced benefits: Each month claimed before FRA means a permanent reduction (6% per year, or 0.5% per month).

- Missed growth: Delaying benefits until age 70 can increase your payout by up to 8% per year after your FRA

Consider this:

- Can you afford a reduced income for life?

- Do you have other sources of income to bridge the gap?

Scenario B: Working While Receiving Benefits

Staying active while enjoying Social Security sounds ideal, but income limits apply:

- Below FRA: In 2024, earning over $22,320 means a $1 reduction in benefits for every $2 earned above the limit.

- At or above FRA: The limit rises to $59,520, with reductions of $1 for every $3 earned above it.

Remember:

- This only affects earnings from work, not other income sources.

- Once you reach full retirement age, income limits no longer apply.

Scenario C: Working & Delaying Benefits

This strategy can be highly rewarding:

- Increased benefits: Each month you delay claiming beyond FRA (up to age 70) means a higher monthly payout.

- Boosting your base: Current earnings can replace lower-earning years, leading to even higher benefits.

But keep in mind:

- You need continued health insurance (enroll in Medicare Part A & B three months before turning 65 if not receiving benefits).

- This strategy might not be suitable for everyone.

Making the Right Choice

There’s no magic formula. Carefully consider:

- Your financial needs: How much income do you need in retirement?

- Health status: Can you continue working, and for how long?

- Long-term goals: What lifestyle do you envision in retirement?

Consulting a licensed financial planner can provide personalized advice tailored to your unique situation. Remember, planning for a secure and fulfilling retirement starts with identifying your goals and making informed decisions.

Social Security Checklist

this checklist will help you assess your readiness for claiming Social Security benefits. By reflecting on your financial situation, health, and goals, you can make an informed decision about when to start receiving benefits.

Financial Readiness:

- □ Do you have a clear understanding of your full retirement age (FRA)?

- □ Have you estimated your monthly Social Security benefit amount at different claiming ages (e.g., 62, FRA, 70)?

- □ Do you have other sources of income besides Social Security (e.g., pensions, savings, investments)?

- □ Have you calculated your estimated monthly expenses in retirement?

- □ Do you have enough saved to cover potential healthcare costs in retirement?

Health and Work:

- □ Do you have health insurance coverage or plan to enroll in Medicare?

- □ Do you anticipate continuing to work after claiming Social Security benefits?

- □ Are you aware of the income limits that affect benefits while working?

- □ Do you have any health concerns that might impact your ability to work in retirement?

Goals and Preferences:

- □ What lifestyle do you envision in retirement?

- □ Do you prioritize early retirement or maximizing your monthly benefit amount?

- □ Are you comfortable receiving a reduced benefit if you claim early?

- □ Have you discussed your retirement plans with your spouse or other dependents?

Additional Resources:

- □ Visit the Social Security Administration website: https://www.ssa.gov/

- □ Schedule a consultation with a financial advisor specializing in retirement planning.

Estimate How Much You Will Need In The Future

-

Current Annual Expenses:

- Enter your current annual expenses. This should represent your present yearly spending.

-

Average Inflation Rate:

- Input the average inflation rate (in percentage) in the “Average Inflation Rate (%)” field. This reflects the expected annual increase in prices. The average inflation rate for the past 10 years is 2.65%.

- Input the average inflation rate (in percentage) in the “Average Inflation Rate (%)” field. This reflects the expected annual increase in prices. The average inflation rate for the past 10 years is 2.65%.

-

Years Into the Future:

- Specify the number of years into the future you want to plan for in the “Years Into the Future” field. This could be the duration until your retirement or any future financial goal.

-

Click “Calculate”:

- Hit the “Calculate” button to see the estimated future expenses and the corresponding savings needed.

-

Review Results:

- The calculator will display the estimated future expenses and the required savings to cover those expenses.

Result:

Your estimated future expenses will be $X.

You will need savings of $X to cover future expenses.

Retirement Timing Considerations

5 Years Before Retirement:

- Evaluate your current financial position.

- Assess your anticipated retirement expenses.

- Fine-tune your investment strategy for the short term.

10 Years Before Retirement:

- Increase contributions to retirement accounts.

- Reassess risk tolerance and adjust investments accordingly.

- Explore healthcare options and costs.

20 Years Before Retirement:

- Focus on long-term investment strategies.

- Update your retirement goals and expectations.

- Consider tax-efficient retirement savings strategies.

40 Years Before Retirement:

- Establish a comprehensive financial plan.

- Maximize contributions to retirement accounts.

- Explore early retirement possibilities.

Frequently Asked Questions

Claiming:

-

Q: I’m thinking of retiring early. What are the downsides of claiming benefits before my full retirement age?

-

A: You’ll receive a permanently reduced monthly benefit for each month you claim before reaching your full retirement age. The reduction can be significant, up to 30%!

-

Q: Should I wait until 70 to claim benefits even if I need the money now?

-

A: While delaying benefits until 70 gets you the highest monthly payout, it’s not always the best option. Consider your financial needs, health, and future income sources. Talk to a financial advisor for personalized advice.

-

Q: I’m still working. How do income limits affect my Social Security benefits?

-

A: If you’re below your full retirement age and earn over a certain amount from work, you might receive reduced benefits. The limit and reduction rate increase once you reach full retirement age.

Benefits:

-

Q: How much will I receive in Social Security benefits?

-

A: The amount depends on your work history and earnings. You can estimate your benefit online at the Social Security Administration website: https://www.ssa.gov/: https://www.ssa.gov/

-

Q: Will my Social Security benefits be taxed?

-

A: Depending on your total income, up to 50% of your benefits may be subject to federal income tax. Some states also tax Social Security benefits.

-

Q: I’m married. Can my spouse claim benefits based on my work history?

-

A: Yes, your spouse may be eligible for spousal benefits, even if they haven’t worked themselves. The amount depends on your earnings record and their age.

Other:

-

Q: My Social Security number was stolen. What should I do?

-

A: Report the theft immediately to the Social Security Administration and the Federal Trade Commission. Take steps to protect your identity and monitor your credit report.

-

Q: Where can I learn more about Social Security?

-

A: The Social Security Administration website offers a wealth of information: https://www.ssa.gov/. You can also contact your local Social Security office for assistance.