Medicare made easy

- Medicare: A Step-by-Step Guide

This blog is designed to help you understand Medicare and how it works. We’ll cover everything from eligibility to enrollment to benefits so that you can make informed decisions about your healthcare. Whether you’re just turning 65 or you’ve been on Medicare for years, we hope you’ll find this blog helpful.

What is Medicare?

Medicare is Health-insurance for people who are 65 years old or older. Or for people under 65 with disabilities or people of any age with End-Stage Renal Disease. Many people choose to receive their Parts A and B benefits through Original Medicare; this is a traditional fee-for-service program offered through the federal government. The health care services you receive will be paid directly by the government, and you can go to any hospital that takes Medicare anywhere in the USA. Sometimes having just original Medicare isn’t enough and will leave you with a significant amount of out-of-pocket costs.

1. Who is Eligible for Medicare?

- 65 years old or older

- Under 65 years old and have a disability

- Receiving Social Security Disability Insurance (SSDI) or Railroad Retirement Board (RRB) Disability Insurance (DI) benefits

- Have End-Stage Renal Disease (ESRD)

- US Citizen

2. What Are The Types Of Medicare?

Original Medicare & Private Insurance

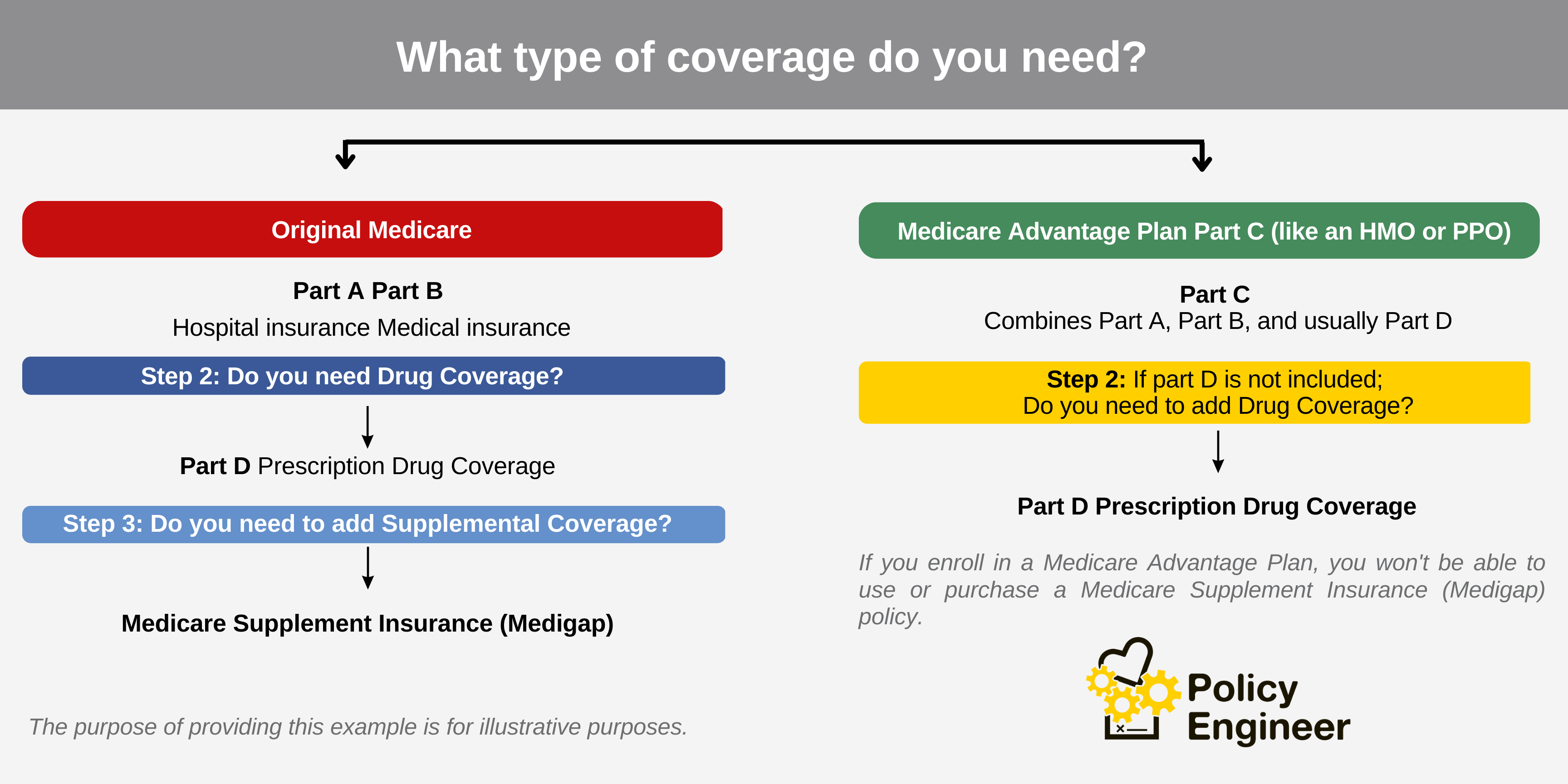

Once you know you are eligible for Medicare, you need to choose a plan.

There are two parts to Medicare: Part A and Part B this is often called Original Medicare.

- Part A Hospital Insurance covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care.

- Part B Medical Insurance covers certain doctors’ services, outpatient care, medical supplies, and preventive services.

There are also additional Medicare Plans offered by private insurance companies:

- Medicare Supplement

- Part C Medicare advantage

- Part D Prescription Drugs

What is a Medicare Supplement Plan (Medigap)?

Medigap is a type of private health insurance that can help you pay for the costs of Medicare that your Original Medicare does not cover. Medigap policies are standardized, so you can be sure that you are getting the same benefits no matter which company you choose.

There are 10 different Medigap plans available, each with its own set of benefits. The most common plans are Plans A, B, C, D, F, G, K, and L. Plan A is the most basic plan, and it covers the same things as Original Medicare. Plan B adds coverage for Part B deductibles and coinsurance. Plans C, D, F, G, K, and L all add coverage for prescription drugs.

If you enroll in Medigap during your initial enrollment period, you will not have to pay a medical underwriting. This means that your insurance company cannot deny you coverage or charge you more for your premium based on your health history. However, if you enroll in Medigap outside of your IEP, your insurance company may be able to deny you coverage or charge you more for your premium based on your health history.

What is a Medicare Advantage Plan (part C)?

You can choose a Medicare Advantage plan, which is a private health insurance plan that replaces both Part A and Part B. Medicare Advantage plans have different plans and costs, so it is important to review plans before you choose one. Medicare Advantage is a type of Medicare health plan offered by private companies that contract with Medicare. Medicare Advantage plans provide all the same benefits as Original Medicare (Part A and Part B) and may include a prescription drug plan.

Medicare Advantage plans are available in all 50 states, the District of Columbia, and Puerto Rico. Many different Medicare Advantage plans are available, so it is important to review them before you choose one. You can review plans using the Medicare Plan Finder tool on the Medicare website.

If you are eligible for Medicare, you may be wondering whether to enroll in a Medicare Advantage plan or Original Medicare. There are pros and cons to both options, so it is important to weigh your options carefully before you make a decision

Medicare Prescription Drugs (part D)

Medicare Part D is a prescription drug program offered by private insurance companies approved by Medicare. It helps cover the cost of prescription drugs that are not covered by Medicare Part A or Part B.

There are different costs associated with Medicare Part D, including premiums, deductibles, copayments, and coinsurance. Premiums are the amount you pay each month to have Part D coverage. Deductibles are the amount you pay out of pocket before your plan begins to cover your prescriptions. Copayments and coinsurance are the amounts you pay for each prescription or refill.

Part D coverage costs vary depending on the plan you choose and the medications you take. Each plan has a formulary, which is a list of covered medications and their costs. It’s important to review each plan’s formulary to make sure the medications you need are covered and to review costs.

3. Medicare enrollment periods

You can enroll in Medicare during the following times:

- Initial Enrollment Period: Lasts for seven months; your sign-up window is from 3 months before your birth month when you turn 65 to 3 months later. It would be best if you enrolled in Medicare Part A and Part B during this sign-up window to avoid penalties. If you don’t register in time, you may have to pay the penalty for parts B and D.

- Annual Enrollment Period: Anyone can use the Annual Election Period (AEP) to make changes to their Medicare coverage – October 15 to December 7

- Open Enrollment Period: January 1 to March 31

Lock-in Period: April 1 to December 31 - Special Enrollment Period (SEP): Special circumstances within the year, You may qualify for a SEP if you have a qualifying life event, such as moving, losing your job, or getting married.

- Medicare Birthday Rule: The Medicare birthday rule allows consumers to change to an equal or lesser benefit Medigap policy within a 60-day window without medical underwriting (not available in all states).

4. Three Ways to Sign up for Original Medicare:

1. You can apply online at: www.ssa.gov

2. Call Social Security at 1-800-772-1213 (TTY 1-800-325-0788) to apply over the phone or to request an application

3. Apply at your local Social Security office

How To Sign Up for an Additional Medicare Plan

- With our Medicare plan finder tool, you can review the available plans in your zip code. You can do this yourself or with the help of a licensed agent. Determine the type of insurance you need by entering your doctors, prescriptions, etc…

- Check the star rating when selecting a Medicare plan. These ratings are updated every year and will help you review them.

- Complete an online application yourself or schedule a virtual meeting to enroll with a licensed insurance agent from Policy Engineer.

5. Medicare Penalties

Medicare Part B and Part D have late enrollment penalties if you don’t enroll when you’re first eligible.

Medicare Part B

If you don’t enroll in Medicare Part B when you’re first eligible, you may have to pay a late enrollment penalty. The penalty is 10% of the monthly premium for each 12-month period that you could have enrolled but didn’t. For example, if you don’t enroll in Part B until you’re 70, you’ll have to pay a 30% penalty on your monthly premium for the rest of your life.

Medicare Part D

If you don’t enroll in Medicare Part D when you’re first eligible, you may have to pay a late enrollment penalty. The penalty is 1% of the “national base beneficiary premium” for each full, uncovered month you didn’t have Part D or creditable prescription drug coverage. The national base beneficiary premium is $32.74 in 2023. The monthly penalty is rounded to the nearest $0.10 and added to your monthly Part D premium.

How to avoid the penalties

The best way to avoid the late enrollment penalties is to enroll in Medicare Part B and Part D when first eligible. You can enroll in Part B online or by phone, or by visiting your local Social Security office. You can enroll in Part D online, by telephone, or by visiting your local Medicare plan.

If you miss your initial enrollment period, you may still be able to enroll in Part B or Part D during a Special Enrollment Period (SEP). SEPs are available if you have a qualifying life event, such as moving, losing your job, or getting married.

Check out our Medicare 101 Handbook.

Learn more about Medicare, so you can make a confident decision and pick the best plan that fits your needs.

- The handbook Includes Parts A, B, C, and D of Medicare.

- What has changed in Medicare for the upcoming year

- Available plans

- Medicare plan buyer tips

- and much more!