Last Updated on January 11, 2025 by policyengineer

Last Updated: January 11th, 2025

Understanding IRMAA: How Income Affects Your Medicare Premiums

Medicare is a healthcare program that provides coverage to millions of Americans aged 65 and older. While most people become eligible for Medicare when they turn 65, some factors, such as higher income, can influence the amount they pay for their Medicare premiums. This is where the Income-Related Monthly Adjustment Amount (IRMAA) comes into play. IRMAA is an additional premium that some high-income Medicare beneficiaries have to pay based on their income.

What is IRMAA?

IRMAA, or Income-Related Monthly Adjustment Amount, is an extra amount certain Medicare beneficiaries must pay on top of their standard Medicare Part B and Part D premiums. IRMAA aims to help fund the Medicare program by requiring individuals with higher incomes to contribute more. IRMAA operates on a tiered system, with different income thresholds corresponding to various premium brackets. These brackets determine how much extra you’ll pay on top of your regular Medicare premiums.

How IRMAA can affect the cost of Medicare premiums

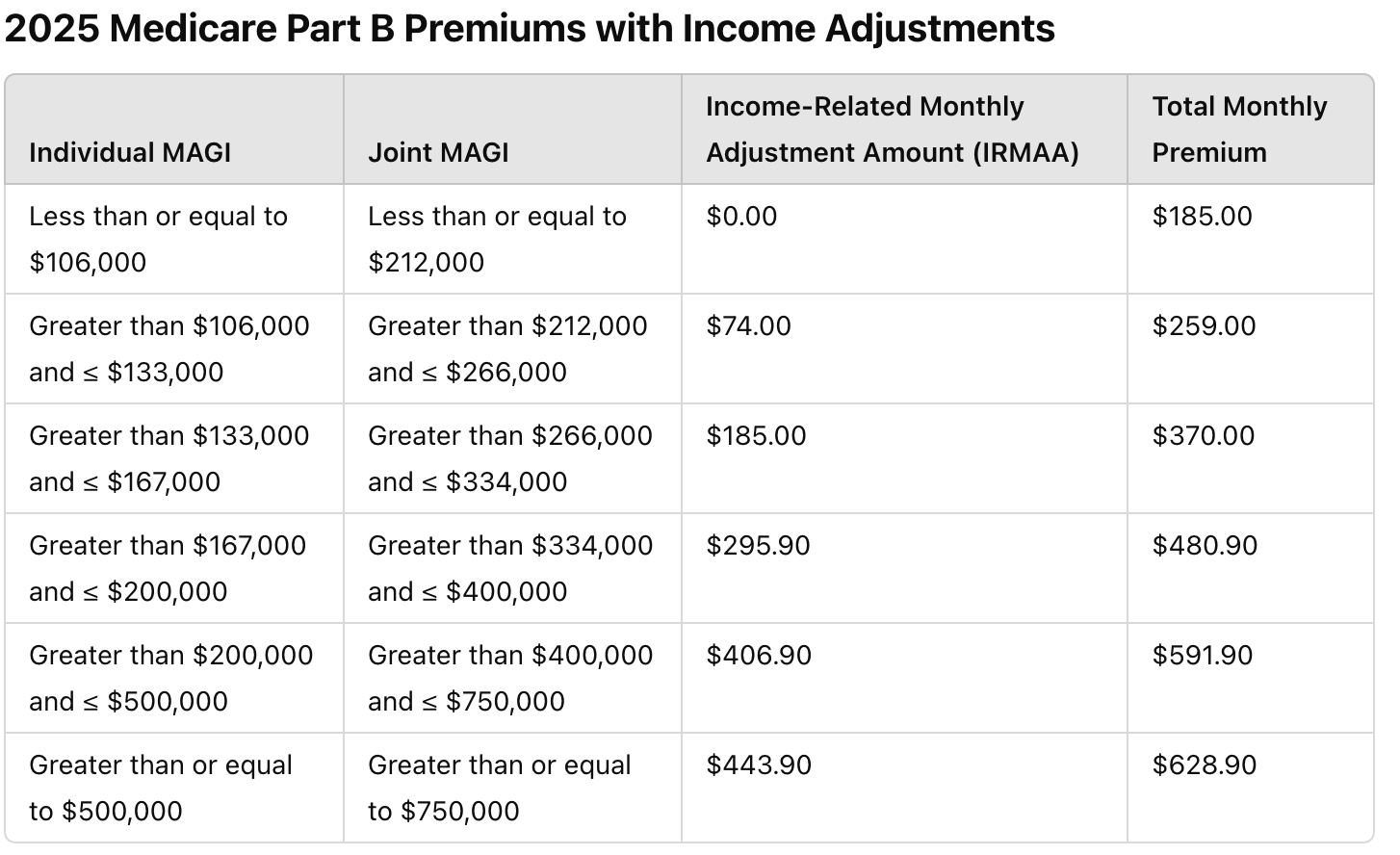

The traditional Medicare Part B and Part D premiums are typically fixed for most beneficiaries, but IRMAA adds an income-related adjustment that varies based on your financial situation. IRMAA can add significantly to the cost of Medicare premiums. Refer to the IRMAA Premium charts below to understand the possible premium rate hikes.

How is IRMAA calculated?

IRMAA is based on your Modified Adjusted Gross Income (MAGI) from two years prior to the current year. For example, if you’re paying IRMAA in 2025, your MAGI from 2023 will be used to determine the additional premium. The Social Security Administration (SSA) and the Internal Revenue Service (IRS) collaborate to obtain this income information.

If your MAGI exceeds certain income thresholds, you’ll be subject to IRMAA. The thresholds for 2025 are as follows:

How to lower your IRMAA

There are a few things you can do to lower your IRMAA, such as:

-

- Reducing your MAGI. This can be done by contributing to a retirement plan, making charitable donations. you can deduct up to $300 of charitable donations from your MAGI each year.

- Take advantage of tax credits and deductions. There are a number of tax credits and deductions that can help you reduce your taxable income, which can lower your MAGI.

- Enrolling in a Medicare Advantage plan with no IRMAA. Some Medicare Advantage plans do not charge an additional premium for people who are subject to IRMAA.

- Appealing your IRMAA determination. You can appeal your IRMAA determination if you believe it is incorrect. You will need to submit the SSA-44 form to the Social Security Administration.

How to lower your IRMAA

There are a few things you can do to lower your IRMAA, such as:

-

- Reducing your MAGI. This can be done by contributing to a retirement plan, making charitable donations. you can deduct up to $300 of charitable donations from your MAGI each year.

- Take advantage of tax credits and deductions. There are a number of tax credits and deductions that can help you reduce your taxable income, which can lower your MAGI.

- Enrolling in a Medicare Advantage plan with no IRMAA. Some Medicare Advantage plans do not charge an additional premium for people who are subject to IRMAA.

- Appealing your IRMAA determination. You can appeal your IRMAA determination if you believe it is incorrect. You will need to submit the SSA-44 form to the Social Security Administration.

Life Events

Life events that may impact your IRMAA

IRMAA Appeals

While IRMAA is typically unavoidable if your income falls within the specified thresholds, certain life events can lead to significant changes in your income. In these cases, you may have the opportunity to appeal the IRMAA determination through the “Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event” (SSA-44) form.

If any of the life events mentioned above apply to you, you have the option to submit the SSA-44 form to the Social Security Administration. Include evidence of the life-changing event and provide an estimate of your reduced income. It’s essential to know that each appeal is evaluated on a case-by-case basis, and there’s no guarantee of a successful outcome.

The appeal process is two-tiered. First, you will file an informal appeal with the Social Security Administration (SSA). If the SSA does not uphold your appeal, you can then file a formal appeal with the Medicare Appeals Council.

The SSA will consider the following factors when evaluating your appeal:

- The accuracy of your MAGI

- Whether there were any errors in the calculation of your IRMAA

- Whether there were any changes in your income or circumstances that would warrant a reduction in your IRMAA

If you are successful in your appeal, the SSA will recalculate your IRMAA and send you a new determination letter.

Here are some tips for appealing an IRMAA determination:

- Be sure to file your appeal within the 60-day deadline.

- Gather all of the documentation that supports your appeal, such as tax returns, income statements, and any other evidence that shows that your MAGI has changed.

- Be clear and concise in your appeal letter. Explain why you believe the SSA’s determination is incorrect and why you deserve a reduction in your IRMAA.

- If you are not comfortable writing your own appeal letter, you can hire an attorney or a representative to help you.

Strategies to Reduce Medicare IRMAA

No one wants to deal with unexpected premium hikes because of IRMAA. Although many people face an IRMAA when they first sign up for Medicare, factors like retirement income can help reduce or even get rid of this extra expense. Some Medicare beneficiaries may initially qualify for benefits below the IRMAA threshold, but their income may increase as they age.

Let’s explore some effective strategies to help you minimize your susceptibility to IRMAA increases and maintain a stable financial outlook in your retirement years.

- Use tax-deferred accounts.

If you have a taxable investment account, consider moving some of your money into a tax-deferred account, such as a 401(k) or IRA. This strategy allows you to postpone reporting capital gains and dividends until you withdraw the funds, which can lower your MAGI (Modified Adjusted Gross Income).

For example, if you have $100,000 in a taxable investment account and make a $10,000 withdrawal, you would need to report the $10,000 of capital gains on your tax return. However, if you move that $10,000 into a tax-deferred account, you won’t have to report the capital gains until you withdraw the money in retirement. This approach could save you hundreds or even thousands of dollars in Medicare IRMAA over the years by reducing your MAGI and potentially lowering your Medicare premiums.

- Maximize your retirement account contributions.

If you are still working, you can contribute up to $23,000 to your 401(k) or $7,000 to your IRA in 2025. These contributions are deducted from your income before it is calculated for Medicare IRMAA, which can significantly reduce your MAGI (Modified Adjusted Gross Income).

For example, if you make the maximum contribution to your 401(k), your MAGI will be $23,000 lower than it would be without the contribution. This reduction could save you hundreds of dollars in Medicare IRMAA surcharges by potentially keeping you in a lower income bracket.

- Consider using Qualified Longevity Annuity Contracts (QLACs).

QLACs are a type of annuity that allows you to delay Required Minimum Distributions (RMDs) until age 85. Since RMDs are calculated based on your account balance at the end of the year, delaying them means you can also delay the income that is included in your MAGI (Modified Adjusted Gross Income).

For example, if you have a $1 million IRA and are required to take an RMD of $50,000 in 2025, that $50,000 would be included in your MAGI for the year. However, by using a QLAC to delay your RMDs until age 85, you won’t need to include that $50,000 in your MAGI until 2045. This strategy could save you thousands of dollars in Medicare IRMAA surcharges over the years by keeping your income in a lower bracket.

- Dual Eligibility and IRMAA: It’s essential to note that individuals who are dually eligible for both Medicare and Medicaid are usually exempt from paying Part B premiums and, by extension, IRMAA. Medicaid coverage typically takes care of these costs, providing much-needed relief for those with limited financial resources.

- IRMAA Notifications: Beneficiaries subject to IRMAA will receive notifications from the Social Security Administration. These notifications outline the extra premium amount due to IRMAA and provide details on how to make the payment. Make sure to read and respond to these notices promptly to avoid any interruptions in coverage.

- IRMAA for Late Enrollees: For those who enroll in Medicare Part B or Part D after turning 65, the initial IRMAA determination might be based on their current year’s income. This adjustment accounts for late enrollees and ensures a fair calculation that aligns with their actual financial situation.

- IRMAA and Part C (Medicare Advantage): While IRMAA affects Part B and Part D premiums, it doesn’t extend to Medicare Advantage (Part C) plans. However, it’s crucial to understand that even if your Medicare Advantage plan covers your Part B premium, you must continue paying it separately to avoid IRMAA implications.

- Annual Income Review: Remember that your income is reviewed annually for IRMAA purposes. Even if you haven’t experienced a life-changing event, changes in your income could lead to adjustments in future IRMAA determinations.

Frequently Asked Questions

-

What is IRMAA? IRMAA stands for Income-Related Monthly Adjustment Amount. It’s an additional premium that some Medicare beneficiaries with higher incomes have to pay on top of their regular Medicare Part B and Part D premiums.

-

How is IRMAA calculated? IRMAA is calculated based on your Modified Adjusted Gross Income (MAGI) from two years prior. The higher your MAGI, the more you may have to pay for IRMAA.

-

What income is considered for IRMAA calculations? The income considered for IRMAA calculations includes your adjusted gross income, tax-exempt interest, and other tax-exempt income.

-

What are the income thresholds for IRMAA? The income thresholds for IRMAA vary depending on whether you’re an individual or a joint filer (married). Different income ranges correspond to different levels of IRMAA.

-

When do I have to pay IRMAA? IRMAA is typically added to your Medicare premium if your income exceeds the specified thresholds. You’ll pay this additional amount alongside your regular Part B and Part D premiums.

-

Can my IRMAA change from year to year? Yes, your IRMAA can change from year to year based on your income. The Social Security Administration reviews your tax return information periodically to determine any changes in your IRMAA status.

-

How do I know if I need to pay IRMAA? You’ll receive a notice from the Social Security Administration if you need to pay IRMAA. This notice will detail the amount you need to pay and how to pay it.

-

Is IRMAA the same for Medicare Part B and Part D? No, IRMAA applies separately to Medicare Part B and Part D. Your income will be evaluated for each of these parts independently.

-

What happens if my income changes during the year? Your IRMAA is based on your income from two years prior. If your current income is significantly lower due to certain life events, you might be able to appeal your IRMAA determination.

-

Can I appeal an IRMAA determination if I experience a life-changing event? Yes, you can appeal an IRMAA determination if you experience certain life events, such as marriage, divorce, or retirement, that result in a significant income change.

-

What are considered “life-changing events” for IRMAA appeals? Life-changing events that might warrant an IRMAA appeal include marriage, divorce, annulment, death of a spouse, retirement, reduced work hours, loss of income-producing property, pension plan changes, and settlements from employers.

-

How do I submit an appeal for IRMAA? To appeal an IRMAA determination, you can submit the “Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event” (SSA-44) form to the Social Security Administration along with evidence of the life-changing event and an estimate of your reduced income.

-

Is there a deadline for appealing an IRMAA determination? You must file your appeal within 60 days of the date of the determination letter. If you miss the deadline, you may still be able to appeal, but your chances of success are lower, it’s recommended to submit your appeal as soon as possible after experiencing a qualifying life-changing event.

-

How long does it take to hear back about an IRMAA appeal? The processing time for IRMAA appeals can vary, but you should receive a response from the Social Security Administration once they review your appeal.

-

Can I reduce my income to avoid paying IRMAA? While it’s not advisable to make financial decisions solely to avoid IRMAA, certain life events like retirement might naturally reduce your income.

-

What documentation do I need to provide for an IRMAA appeal? You’ll need to provide evidence of the life-changing event that caused the income change, along with an estimate of your reduced income. Supporting documents might include marriage or divorce certificates, retirement notices, or other relevant paperwork.

-

Can I avoid IRMAA by changing my investment strategies? Changing investment strategies solely to reduce your income for IRMAA purposes may not be practical or advisable. It’s essential to consider your overall financial goals.

-

Are there any programs to help with paying IRMAA for individuals with financial difficulties? There are assistance programs available for individuals with limited income and resources. You can explore programs like Medicare Savings Programs (MSPs) that might help cover IRMAA costs.

-

Does IRMAA apply to all Medicare beneficiaries? No, IRMAA only applies to Medicare beneficiaries whose income exceeds specific thresholds.

-

What happens if I don’t pay my IRMAA premium? If you’re required to pay IRMAA and you don’t, your Medicare coverage might be affected. It’s crucial to fulfill your premium obligations to maintain uninterrupted coverage.