Maximizing Your Medicare

Coverage During

the Annual Election Period (AEP)

Welcome to the Annual Election Period (AEP), a time when you have the opportunity to take a closer look at your Medicare coverage and make changes to ensure it suits your needs perfectly. This annual checkup is crucial to ensure you’re getting the best possible policy for your medical requirements. Surprisingly, seven out of ten Medicare enrollees forget to review their policy every year, missing out on potential cost savings. Don’t be one of them! By reviewing your coverage, Let’s ensure you kick off 2024 with the right Medicare or Prescription insurance plan. You’ve got seven weeks to make those changes, so let’s dive in!

Are you looking for extra benefits like vision, dental, and hearing coverage or lower out-of-pocket costs? A Medicare Advantage plan might be the right choice for you. These plans often provide more comprehensive coverage than Original Medicare.

The AEP Basics

The Annual Election Period runs from October 15th to December 7th. Any Medicare plan enrollee can take advantage of this period to assess their coverage. It’s essential not to let your existing plan auto-renew without thoroughly reviewing it. Your policy can become significantly more expensive if you forget to do this. Medicare insurers can update their plans each year, affecting prices, networks, and formularies.

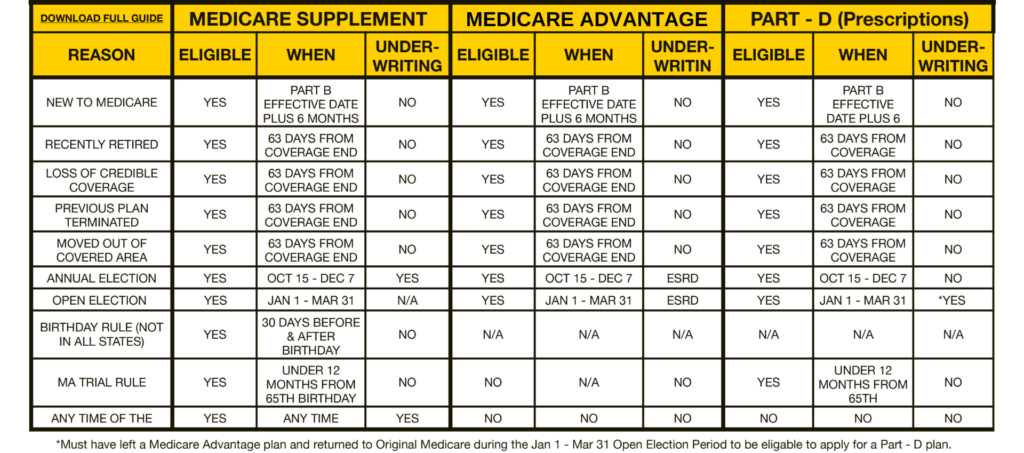

Here’s a quick overview of the switches you can make during the Annual Enrollment Period:

What switches can you make during the Medicare Annual Enrollment period?

This year’s annual election period starts on October 15th and ends on December 7th. Don’t skip out on the chance to put yourself into the best plan for next year. Anyone can use the Annual Election Period (AEP) to change their Medicare coverage. You can use our Medicare plan finder tool for free to review the available plans every year.

*Avoid letting your existing plan auto-renew without reviewing it. Your policy can become much more expensive if you forget to do this. This is because each year, your medicare insurer can update their plans. They can update their policies: the prices of your existing policy, your policy’s network can change, or your plan’s formulary can change.

Here’s an overview of the switches you could make:

1. Change to a Medicare Advantage plan from Original Medicare.

The Medicare Advantage Plan is for people who want extra benefits such as vision, dental, and hearing or lower out-of-pocket costs. Sometimes, you can get more coverage for less with an Advantage Plan than your Original Medicare plan. Go to the number three list to view the available plans and Medicare Advantage tips.

2. Change from a Medicare Advantage plan to Original Medicare, Part A, and Part B.

If you prefer a simpler plan without extra benefits or need a broader provider network, you can switch back to Original Medicare. Just be sure to check if you need to add a Part D prescription plan to avoid late penalties.

3. Change from one Medicare Advantage plan to another.

You can switch your Medicare Advantage plan if your medical needs have changed. Or if other plans have expanded their benefits.

There are different types of Medicare Advantage plans.

- HMO (Health Maintenance Organization):

- PPO (Preferred Provider Organization)

- PFFS (Private Fee-for-Service)

- SNP (Special Needs Plan)

- HMO-POS (Health Maintenance Organization Point-of-Service)

- MSA (Medical Savings Account).

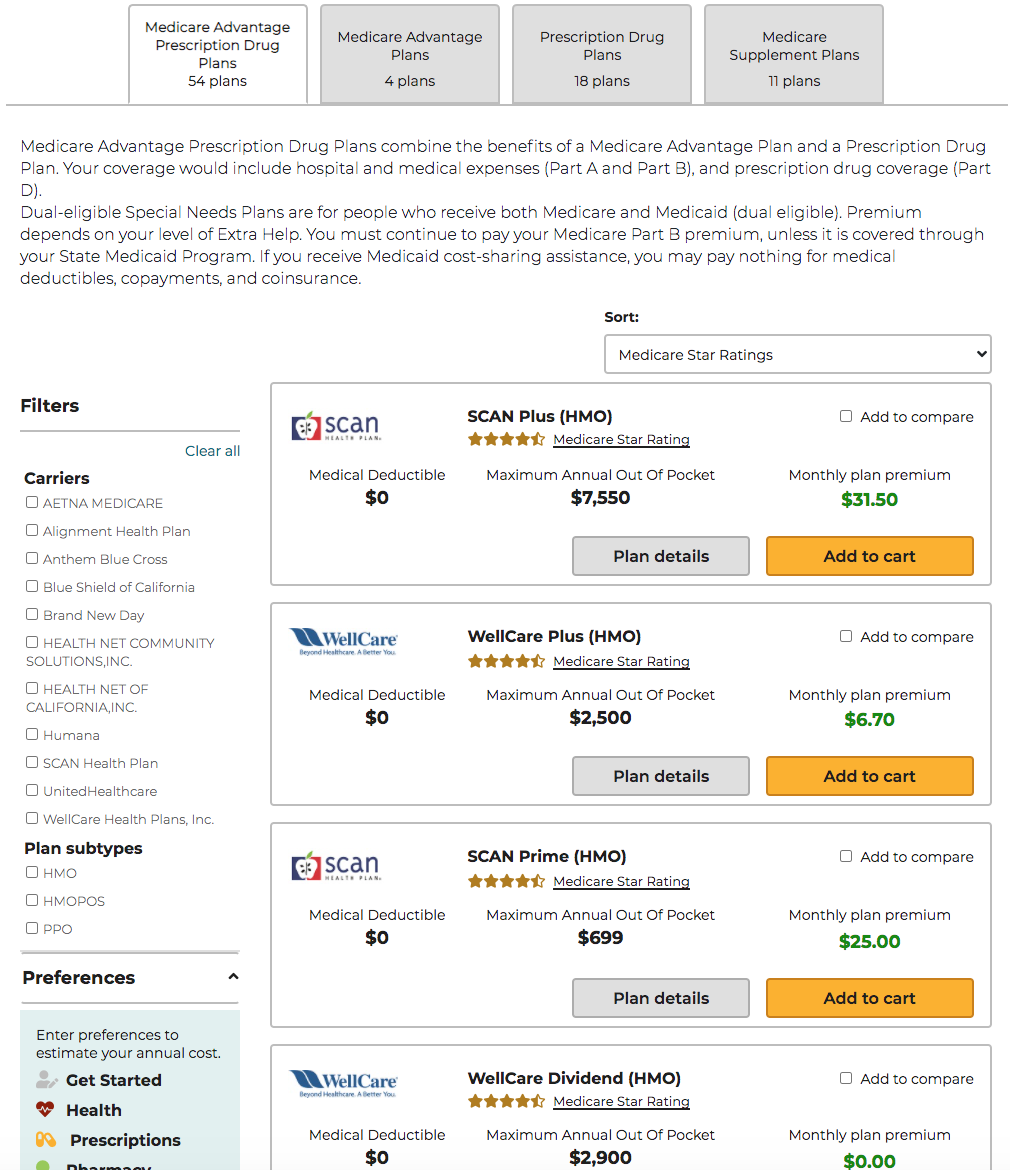

Check with a licensed insurance agent at Policy Engineer which plan best fits your needs during AEP. Since advantage plans are not standardized, you may prefer a different insurer that may provide additional benefits. With our Medicare plan finder, you can review Medicare plans and enroll in the one that fits your needs and budget.

4. Enroll in a Part D prescription drug plan.

When your creditable coverage stops because you stopped working or changed jobs, you must enroll in a Part D prescription plan to avoid late enrollment penalties.

Late Enrollment Penalty Part D: For each month you delay enrollment in Medicare Part D, you will have to pay a 1% Part D late enrollment penalty (LEP)

*If you have creditable coverage, keep the Certificate of Creditable Coverage in your records as proof. You might need to show this later on.

5. Switch from one Part D plan to another.

6. Change from one Medicare Supplement (Medigap) plan to another.

You don’t have to wait until AEP to change your Medigap plan. However, if you want to change your Medigap plan, you might have to undergo medical underwriting. Unless you still have the guaranteed issue rights due to your situation. If you don’t have the guaranteed issue rights, the insurer can refuse to sell you a plan, offer you a plan with less coverage, or charge you more because of your health. Choosing the right Medigap plan during your open enrollment period is very important because changing your policy after that isn’t as easy for Medigap as for the other Medicare parts. Even though it is harder to change your policy, there are still many people who would want to change their Medigap plan. Review your Medicare policy if your medical needs have changed. You might need to switch to another plan to be fully covered.

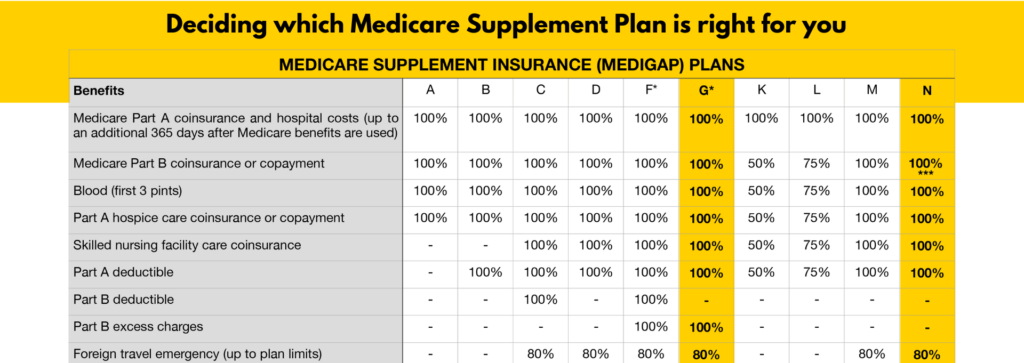

You can choose between ten Medigap plans. These ten plans have the same coverage regardless of company, so checking whether you are overpaying for your policy is important. Sometimes, switching to a different insurer is better to avoid overpaying for the same policy.

7. Change from one Medicare Prescription Drug Plan to Another

Your prescriptions may have changed, or you may need better coverage. It’s important to find a Part D plan that aligns with your needs throughout the year, considering Medicare’s four-stage structure for prescription coverage.

How do I compare Medigap policies?

The chart below shows basic information about the different benefits that Medigap policies cover. If a percentage appears, the Medigap plan covers that percentage of the benefit, and you are responsible for the rest. For example, if the chart shows 100%, you would be responsible for zero.

6. Change from one Medicare prescription drug plan to another.

Did the number of prescriptions change, or do you need better coverage? Not all Part – D prescription insurance plans are created equal; different plans can cater to having more coverage during one or more of the four stages of your Part – D coverage. Medicare has a 4 stage structure for how you pay for prescriptions throughout the year. Get the plan that fits your needs best.

7. You can opt out of Medicare prescription drug coverage altogether.

If you enrolled in a plan with creditable coverage, you no longer need to have Medicare Part D, so don’t forget to opt out of your Medicare Prescription Drug Coverage. You could have creditable coverage through your spouse’s work or because you enrolled in a Medicare Advantage plan with prescription coverage.

Enrolling in a Medicare Plan with Policy Engineer is simple!

Our Medicare plan finder tool empowers you to assess available plans in your zip code. By considering the star ratings, which evaluate plan quality, member satisfaction, and other key factors, you can confidently select a plan that aligns with your healthcare needs.

- Determine the type of insurance you need.

- Answer a few quick questions to get a quote.

- Pick the company and options that you prefer.

- Complete an online application yourself or schedule a virtual meeting to enroll with a licensed insurance agent at Policy Engineer.

How do you use our Medicare plan finder?

With our Medicare plan finder tool, you can review the available plans in your zip code. After you pick the plan that fits your medical needs best, you can self-enroll.

Check the star rating when Selecting a Medicare plan. These ratings are updated every year and will help you compare. The stars are based on the following:

- Quality of the plans

- Member satisfaction surveys, plans, and providers

- Performance on more than 50 key factors.

When is your Medicare sign-up window?

When to Sign Up for Medicare

Your Medicare sign-up window spans three months before your birth month when you turn 65 to three months later. Enrolling in Medicare Part A and Part B during this window is crucial to avoid penalties. Failing to register on time could lead to higher premiums for parts B and D. Remember, the Medicare Annual Election Period also offers another opportunity for enrollment.

* Late Enrollment Penalty Part B: Your monthly Part B premium could be 10% higher for every 12-month period you were eligible for Part B.

*Late Enrollment Penalty Part D: For each month you delay enrollment in Medicare Part D, you will have to pay a 1% Part D late enrollment penalty (LEP)

Do you want to learn more about Medicare?

- Go to our Medicare page to review your Medicare coverage.

- Go to our other blogs to learn more about the different parts of Medicare.

- Schedule a consultation with a Licensed Insurance Agent

Click the button below to visit our Medicare plan finder to make any changes. You can even self-enroll or schedule a meeting with a Licensed Insurance Agent to review your policy to ensure you have the coverage you need and that you are not overpaying for your Health insurance.