Last Updated on January 11, 2025 by policyengineer

Last Updated: January 11th, 2025

Is a Medicare Advantage PPO plan or Medigap better for your healthcare needs

Are you new to Medicare? Or are your out-of-pocket expenses too high? Have you noticed that Original Medicare isn’t enough to cover your medical needs but don’t know which policy is best for you? There are many options, and it all depends on your personal preferences. Would a Medigap plan be the right fit, or would a Medicare Advantage plan like a PPO be better for you? We have reviewed the two to help you make your decision.

What is the difference?

Medicare Advantage PPO plans: are private health insurance plans that offer all of the benefits of Original Medicare (Part A and Part B) and may include prescription drug coverage. Medicare Advantage PPO plans typically have lower out-of-pocket costs than Original Medicare but may have a narrower network of doctors and hospitals. Medigap: is a type of private health insurance plan that helps to pay for the out-of-pocket costs of Original Medicare, such as deductibles, copayments, and coinsurance. Medigap plans are standardized, so they all offer the same benefits. However, Medigap plans can have different monthly premiums, so it is important to compare plans before you choose one.

What should you consider when reviewing Medigap with a Medicare Advantage PPO plan?

We will list some essential things to consider when reviewing the different insurance policies.

1. Your Initial Enrollment Status

First, you should check if you missed your Medigap initial enrollment

If you missed it, you might have to go through medical underwriting. The medical underwriting process for Medigap insurance usually consists of a series of medical questions inside the application. The insurance company could deny your application if you answer “yes” to specific health-related questions. If a Medigap plan fits your needs better, it can still be worth applying. Worst-case scenario, you can keep your current insurance plan if denied.

During your initial enrollment, you have guaranteed issue rights. These rights prohibit insurance companies from denying or overcharging you for a Medigap policy. It is important to note that there might be a different rule in your state, so check the guaranteed issue rights in your state. f you are in your initial enrollment period, a Medigap insurer can’t deny you if you have a medical condition, and you won’t have to do any medical exams.

2. Your out-of-pocket costs

It is also essential to think about your out-of-pocket costs. Medigap plans may have a higher out-of-pocket cost than a PPO Medicare Advantage plan.

Remember that most Medicare Advantage PPO plans and Medigap plans have a monthly cost, which would be on top of what you pay for Medicare Part B. If you have a Medigap plan, you would have to pay for Part B and a Part D Prescription plan if you don’t have sufficient prescription coverage through your employer. This can make a Medigap plan look more expensive, but it is important to consider the out-of-pocket costs such as coinsurance, deductibles, and copayments. These costs are generally lower with a Medigap plan. For 2023, the out-of-pocket maximum for a Medicare Advantage plan is $8,300 (only for Part A and B, prescriptions not included). If you have a PPO plan, there will be two annual limits on out-of-pocket costs. One limitation is for in-network costs; the other is for combined in-network and out-of-network costs. Keep this in mind when you are reviewing the insurance plans. The cost-efficient option might not be the cheapest or best policy for your needs, so it’s important to carefully consider each plan’s costs and offerings before making a decision.

3. The plan you want or need

Do you want to maximize your needs? Do you travel outside the U.S.? A Medigap plan most likely won’t provide all of these benefits. There are some Medigap plans that have added benefits such as vision, hearing, and over-the-counter pharmacy allowance. Some Medigap policies offer emergency health care services when you are outside the U.S. Do you need an extensive network of providers, or will you go to the same provider each time? This can influence the price of your visits significantly.

Should you choose Medicare Advantage PPO or Medigap?

Medigap (also called Medicare Supplements) pays to fill the gaps after Medicare. This will leave you with low out-of-pocket costs. Often, you will not even have a doctor co-pay. However, these plans often have a higher monthly premium. If you only consider the monthly premiums and not the out-of-pocket costs. The total price that you would spend yearly could be lower. Medicare Advantage PPO plans may maximize your needs and budget if you use the network of preferred doctors. It can be more expensive if you often choose out-of-the-network providers for your medical needs. With these plans, you pay as you go; you will have to pay your co-pay at the time of each service. These services go from doctor visits to lab work, hospital stays, surgeries, and more. Some people don’t mind the out-of-pocket costs, while others would rather have lower out-of-pocket costs.

Overview of the two types

1. Medicare Advantage PPO plan

Medicare Advantage (part c) has six different plans. All Medicare Advantage plans include Medicare parts A and B.

– Medicare Part A: includes hospital services, limited skilled nursing facility care, limited home healthcare, and hospice care

– Medicare Part B: includes medical insurance for the diagnosis, prevention, and treatment of health conditions

The Preferred Provider Organization plan (PPO) is offered by a private insurance company and lets you choose any provider who accepts Medicare. With this plan, you can go to network doctors, health care providers, and hospitals or use out-of-network providers. If you choose to get your healthcare from out-of-network providers, it will likely be more expensive than within the network.

Often Prescription plans are covered within this plan; however, if it is not covered, you won’t enroll in a Medicare Drug Plan (part D). It is essential to pick your plan carefully.

Pros

- You can keep flexibility in the providers you visit

- You won’t need to choose a primary doctor

- A referral is not required (in most cases)

- Save money by using in-network specialists

- Most likely, prescription drug coverage

- Easy to match your budget since you can choose your providers

Cons

- Out-of-network providers are more expensive.

- You must continue to pay your Medicare Part B premium.

- Can charge a deductible amount for both the plan and the prescription drug portion of the plan.

- Typical co-payment amounts may vary.

- With a Medicare PPO plan, you will have both an in-network and out-of-network max.

- Medicare PPOs aren’t as widely available as HMOs.

- Annual Changes to the plan formulary, pharmacy network, and provider network.

- You can’t enroll in Part D drug prescription coverage

2. Medigap

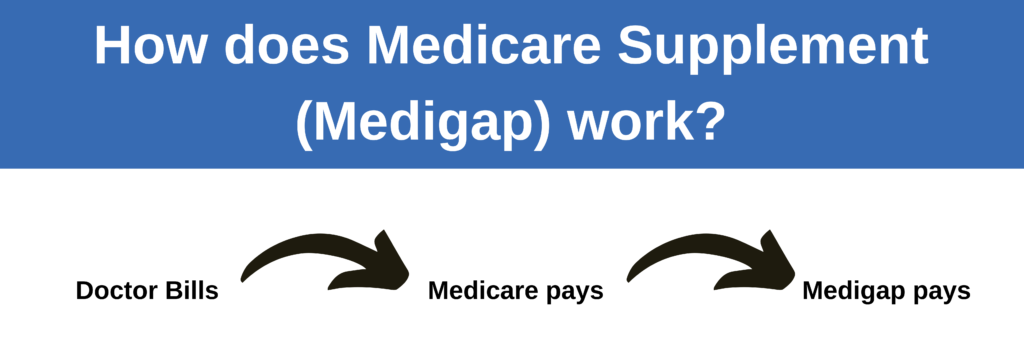

Medigap (also known as Medicare Supplement Insurance) exists to cover out-of-pocket costs, such as co-payments or deductibles. You will still have Original Medicare parts A and B. Medigap functions as an add-on policy to Original Medicare. These policies are standardized and go by letters: A, B, C, D, F, G, K, L, M, and N in most states. Each lettered plan’s benefits are the same, regardless of which insurance company sells them. You will have access to any Medicare-appointed doctor in the U.S.

Pros

- Medigap will help fill some gaps that Original Medicare doesn’t cover.

- You will have access to providers nationwide who accept Medicare.

- Most Medigap plans will help pay the Part A deductible.

- You can get a supplemental plan covering Part A and Part B coinsurance.

- With Plan F, you don’t have to worry about out-of-pocket expenses.

- Standardized – 10 plans that have precisely the same coverage no matter which company.

- A Medicare Supplement company cannot cancel your policy for using the policy too much. Your policy will renew automatically every year.

- You can change your Medigap plan or company at any time you want.

- You have 30 days to drop the coverage and receive your premium back when your policy is approved.

- Pays for deductibles, co-pays coinsurance

Cons

- Medigap plans do not cover prescription drugs.

- If it is more expensive, your rate most likely increases

- You have to have Part A and Part B.

- Do not cover routine dental, vision, or hearing care.

- After your Guarantee issue ends, getting approved might be tricky if you have certain health conditions.

- Medigap Has fewer benefits than Medicare Advantage plans.