Last Updated on May 10, 2025 by policyengineer

Last Updated: May 10th, 2025

Fixed Index Annuities & Compound Interest

When it comes to planning for retirement, finding investment vehicles that offer growth, stability, and long-term financial security is essential. Fixed Index Annuities (FIAs) have gained popularity as an option that combines these features. What sets FIAs apart is the power of compound interest, which can significantly impact your financial future. In this blog, we will explore how compound interest works within FIAs, and why they are an attractive choice for individuals seeking steady growth and a reliable income stream during retirement.

What is a Fixed Index Annuity?

How do Fixed Index Annuities work?

Understanding Compound Interest:

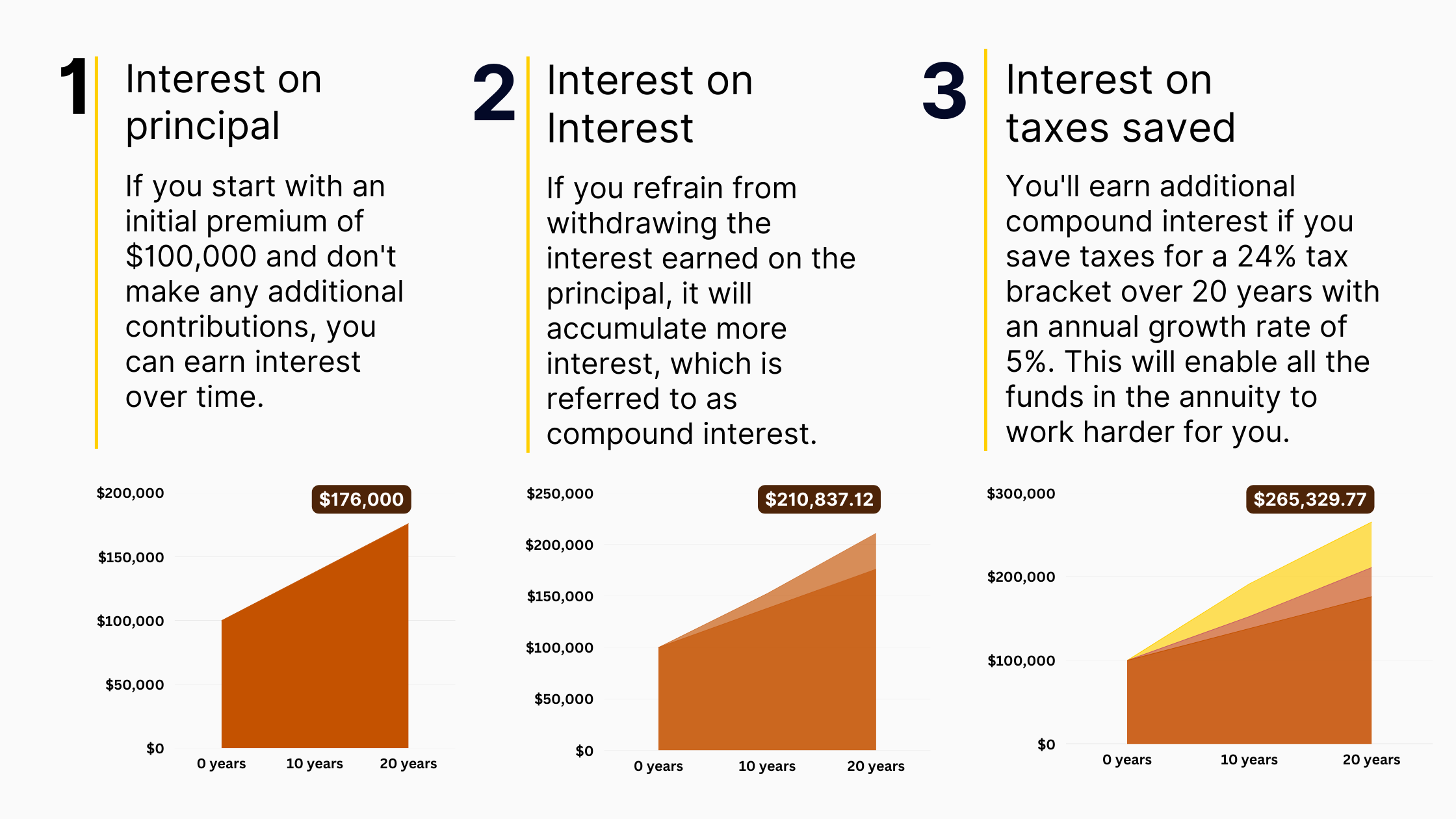

Compound interest is the concept of earning interest not only on your initial investment but also on the accumulated interest over time. This compounding effect can be a game-changer for your retirement savings. With FIAs, you have not just one but three opportunities for compound interest, allowing your money to work harder and potentially grow faster.

The Power of Compound 3x Interest: The Potential of Fixed Index Annuities

-

By deferring taxes on your investment gains, you can capitalize on the full force of compounding interest. Unlike many other investment vehicles, FIAs offer tax-deferred growth, allowing your earnings to compound without the burden of immediate tax payments. The amount that would have otherwise been paid in taxes can now be reinvested, allowing your funds to grow even more rapidly. It’s like turbocharging your savings! By deferring taxes, you effectively have more money working for you, which can have a significant impact on your long-term financial success.

*Charts are for demonstrative purposes and assume a hypothetical 5% annual growth rate for an individually owned contract. All withdrawals will be subject to ordinary income taxes and a 10% tax penalty if taken before age 59-1/2. This material is for informational purposes only and is not a recommendation to buy, sell, hold, or rollover any asset. It does not consider the specific financial circumstances, investment objectives, risk tolerance, or need of any person. This is a partial overview of a fixed index annuity’s relevant features and benefits. This chart presents specific examples of how tax deferral works.

The Benefits of Fixed Index Annuities:

FIAs offer a unique combination of growth potential and protection, making them an attractive choice for retirement planning. Here are some key benefits to consider:

-

Principal Protection: FIAs provide a level of security by guaranteeing the return of your principal investment. Regardless of market fluctuations, your initial investment is protected. This feature offers peace of mind and ensures that your retirement savings are safeguarded.

-

Market Participation: FIAs are linked to the performance of a specific market index, such as the S&P 500. This allows you to participate in market gains, potentially earning higher returns compared to traditional fixed annuities. However, it’s important to note that FIAs also have a cap or participation rate that limits the amount of growth you can receive from the index.

- Steady Income Stream: One of the primary goals of retirement planning is securing a reliable income stream. FIAs can provide this by offering a guaranteed lifetime income option. You can choose to receive regular payments for the rest of your life, ensuring a stable source of income during your retirement years.

Fixed Index Annuities offer a powerful tool for retirement planning, thanks to the potential of compound interest. The ability to earn interest on your principal, interest on interest, and the advantage of tax-deferred growth can significantly enhance your savings and help you achieve your financial goals. By harnessing the power

3 Hypothetical Examples;

Fixed Index Annuities

Sarah’s Retirement Income

Sarah invests $500,000 from her after-tax savings into a Fixed Index Annuity that guarantees a 5% annual payout for the rest of her life. This means she will receive $25,000 per year as her retirement income. As the tax has already been paid on the initial investment, Sarah will receive the full $25,000 without any further tax obligations

John’s Wealth

Transfer

John invests $1,000,000 from his after-tax savings into a Fixed Index Annuity that provides a death benefit equal to the initial investment plus accumulated gains. Let’s assume the annuity grows at an average rate of 4% annually over 20 years. Upon his passing, the annuity is worth $2,191,473. This entire amount will be paid out to his beneficiaries tax-free, as the tax liability was already settled when John initially purchased the annuity.

Emily’s Educational Funding

Emily invests $100,000 from her after-tax income into a Fixed Index Annuity with a guaranteed minimum growth rate of 3% annually. She plans to withdraw the accumulated gains after 15 years to pay for her child’s education. Assuming the annuity grows at an average rate of 5% annually, the accumulated value after 15 years will be approximately $186,913. When Emily withdraws this amount, the $86,913 in accumulated gains will be tax-free, as tax has already been paid on the original investment.

These examples demonstrate the potential growth, tax advantages, and income stability that Fixed Index Annuities can offer through the power of compound interest. It’s important to note that the numbers provided are hypothetical and for illustrative purposes only. The actual performance and results may vary based on market conditions, annuity terms

Frequently Asked Questions About Fixed Index Annuities

What are the benefits of Fixed Index Annuities?

Fixed Index Annuities offer several benefits, including potential market-linked growth, principal protection against market downturns, tax-deferred growth, and the option for guaranteed lifetime income. They provide an opportunity to participate in market gains while offering downside protection during market downturns.

How are Fixed Index Annuities different from other types of annuities?

Fixed Index Annuities are distinct from fixed annuities and variable annuities. Unlike fixed annuities, FIAs offer the potential for interest earnings tied to market performance. Unlike variable annuities, FIAs provide downside protection and a guaranteed minimum interest rate, making them less susceptible to market volatility.

Are Fixed Index Annuities safe investments?

Fixed Index Annuities are generally considered safe investments due to their principal protection feature. The initial premium and any credited interest are typically guaranteed by the issuing insurance company. However, it’s important to review the financial strength and reputation of the insurance company before investing.

Are there any risks associated with Fixed Index Annuities?

While Fixed Index Annuities offer downside protection, they also have certain limitations. These may include caps or limits on the amount of interest that can be earned, participation rates that determine the percentage of index gains credited, and surrender charges for early withdrawals. It’s important to understand the terms and features of the annuity before investing.

Can I access my money in a Fixed Index Annuity before the end of the contract term?

Fixed Index Annuities typically have surrender periods, during which early withdrawals may be subject to surrender charges. However, many FIAs offer provisions that allow for partial withdrawals or penalty-free access to a certain percentage of the account value each year.

Are Fixed Index Annuities taxable?

The tax treatment of Fixed Index Annuities depends on how and when you access the funds. Earnings within the annuity grow on a tax-deferred basis until withdrawn. When you start receiving payments, taxes are generally due on the earnings portion, while the return of your principal is typically tax-free. Consult a tax advisor for specific information based on your situation.

Should I consult a financial advisor before purchasing a Fixed Index Annuity?

It’s advisable to consult with a qualified financial advisor before purchasing a Fixed Index Annuity. They can evaluate your financial goals, risk tolerance, and overall retirement plan to determine if an FIA aligns with your needs. A financial advisor can also help you understand the terms, features, and potential risks associated with FIAs.

Are There Any Potential Drawbacks and Considerations?

While annuities offer numerous benefits, it’s important to understand their potential drawbacks. These may include limited access to funds, fees associated with the annuity contract, and the impact of inflation on fixed payouts. Evaluating the terms and conditions, comparing multiple offerings, and seeking professional guidance will help you make well-informed decisions.

Remember to conduct thorough research, seek professional advice, and take into account your unique circumstances when considering annuities as part of your retirement plan. With careful planning and informed choices, you can embrace your retirement years with confidence and peace of mind.

Please note that the information provided is for educational purposes only and should not be considered as financial or investment advice. Consult with a financial advisor or professional for personalized guidance regarding your specific situation.