Can Life Insurance Through Your Employer Protect Your Family Financially?

Life insurance is an important financial tool that provides financial protection to your loved ones in the event of your death. Many employers offer life insurance coverage as part of their employee benefits package. This type of life insurance, commonly known as group life insurance or employer-sponsored life insurance, can play a crucial role in safeguarding your family’s financial well-being. In this blog post, we will explore the benefits and considerations of life insurance through your employer and its potential impact on your family’s financial security.

Employer-Sponsored Life Insurance Explained: Your employer may offer you a life insurance policy that can benefit your designated beneficiaries in case of your death while you are employed. This type of coverage is usually provided at no cost or at a lower rate, making it an appealing choice for many employees.

-

Financial Protection for Your Family: One of the significant advantages of life insurance through your employer is that it can provide a financial safety net for your family. In the event of your death, the policy’s death benefit can help replace lost income, cover funeral expenses, pay off outstanding debts, and ensure that your loved ones are not burdened with financial hardships during an already challenging time.

-

Convenience and Ease of Enrollment: Obtaining life insurance through your employer is generally convenient and straightforward. The enrollment process is typically streamlined, and you may not be required to undergo a medical examination or provide extensive health information. This ease of enrollment can be beneficial, especially if you have pre-existing health conditions that might make obtaining an individual life insurance policy difficult.

-

Limitations and Considerations: While employer-sponsored life insurance can be valuable, there are some limitations and considerations to keep in mind:

- a) Coverage Amount: The coverage amount provided by employer-sponsored life insurance policies is often limited. It may be a multiple of your annual salary or a fixed amount, which may not adequately protect your family’s long-term financial needs. Life insurance through your work is a nice benefit, but it might cover less than you and your family need.

- b) Job Dependency: Since this type of life insurance is tied to your employment, you may lose your coverage if you change jobs or lose your job. It’s crucial to assess whether the policy is portable or if you have the option to convert it to an individual policy upon leaving your job.

- c) Inadequate Customization: Group life insurance policies offered by employers are generally designed to meet the needs of the majority of employees. They may not provide individual life insurance policies’ flexibility and customization options. Tailoring coverage to your specific circumstances, such as additional riders or specific beneficiaries, may be limited.

- Supplementing Employer-Sponsored Coverage: To ensure comprehensive financial protection for your family, it’s often advisable to consider supplementing your employer-sponsored life insurance coverage with an individual life insurance policy. Individual policies typically offer greater flexibility, higher coverage amounts, and the ability to customize your coverage based on your unique needs. This will leave your family with enough money to cover debts, tuition, retirement, medical costs, income replacement, etc…

If you have life insurance through your employer

You need to look at these two main things:

Question 1: Is your death benefit high enough?

It’s important to note that the life insurance coverage provided by your employer may not offer adequate death benefits. The death benefit is the amount the insurance company would pay your family in case of your passing.

Question 2: Is it possible to keep your life insurance when you change jobs?

Usually, your life insurance coverage ends when you leave your job. However, you can choose to obtain life insurance independently from your employer to ensure that it stays with you regardless of your job. Obtaining life insurance at a young and healthy age is recommended as the rates increase with age. This way, you will have complete control over your coverage.

It is important to note that obtaining a policy at a younger age and in good health can result in lower rates. It is recommended to secure these cheaper rates for future benefit.

How should you ensure that life insurance through your work is enough?

Follow these simple three steps to determine which insurance policy you should get.

- Determine how much life insurance you need:

You need to replace your income and make sure you cover your debts. Everyone needs a different amount. People with multiple kids might need more than people with no kids. Homeowners: If you own a home, ensure you get enough to cover your mortgage. If you get enough life insurance, your family can invest the benefit into an interest-bearing account, live off the interest alone, and maintain their current lifestyle financially.

- Determine the length of the insurance:

Make sure the term of your policy is correct. Life insurance companies give the option to have anywhere from a 5-year term policy up to a permanent life insurance policy. An example of this would be a homeowner who still has 20 years to pay off their home; a 20-year term life insurance policy will cover that mortgage during the 20 years while the house is still being paid off.

- Shop & compare

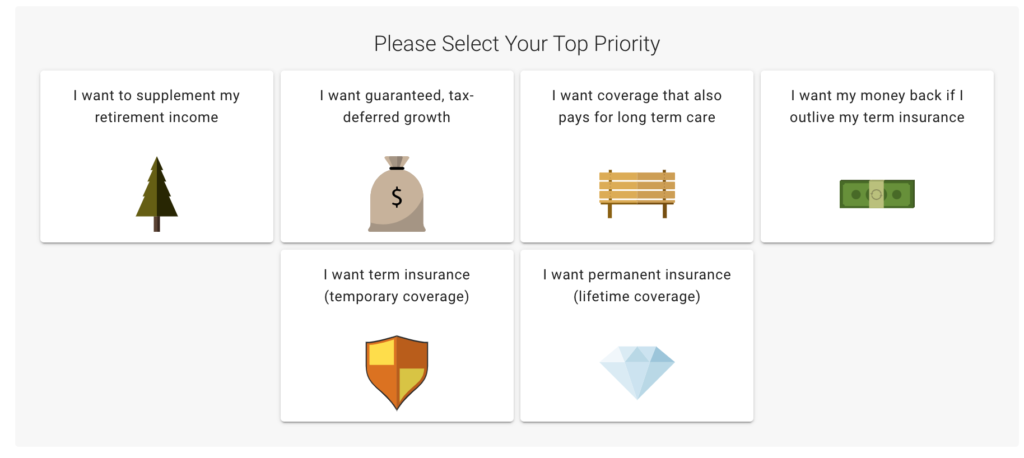

If you have life insurance through your employer, you might be limited to the amount of life insurance companies to pick from. In reality, you can choose from hundreds of companies and combinations of life insurance policies. We have a tool that you can use to compare and even self-enroll If you want to. Click here to shop and compare.

Overview of the advantages and disadvantages of Life insurance through your employer.

Advantages

- It is convenient: Easy, they won’t give you too many options to choose from. HR might do the paperwork, and you can go there if you have any questions.

- Price: Most likely, your employer will cover the costs of your life insurance or offer it at a low price

- Guarantee: Most policies through your employer will accept you even if you have serious medical conditions.

Disadvantages

- Coverage stays with your job: if you move or switch jobs, you may not be able to take the policy with you. Some employers offer to convert your policy from employer-based to individual one. However, you will most likely end up with a higher price. The older you get, the higher your policy will be, so it is better to lock in a reasonable rate for a policy earlier on.

- Your choices will be limited: coverage through your employer might be through one insurance company, and only a couple of plans will be available. Most of them are term life policies with a limited death benefit.

- Amount: Your policy’s death benefit will likely be lower. Most people need more than what their work offer to be able to leave their family financially protected. If you get better coverage, it can cover your family’s debts, mortgage, and retirement and even help cover tuition for your children.

If you don’t want to be limited by the policy through your work, you can add a policy that fits your needs better.

You can use Policy Engineer’s life insurance tool to calculate how much life insurance you need, compare different companies, and self-enroll. We are happy to assist you; if you need help, schedule a meeting with one of our policy engineers.

Life insurance through your employer can be a valuable benefit that helps protect your family financially in the event of your untimely passing. While it offers convenience and ease of enrollment, it’s essential to review the coverage amount, consider potential limitations, and assess whether supplementing with an individual life insurance policy is necessary. A comprehensive approach to life insurance will ensure that your loved ones are adequately safeguarded, providing them with the financial stability they need during a difficult time.

FAQ

Q: What is life insurance through an employer?

A: Life insurance through an employer, also known as employer-sponsored or group life insurance, is a type of insurance coverage provided by an employer as part of their employee benefits package. It offers life insurance protection to employees, typically at a group rate.

Q: How does life insurance through an employer work?

A: When you enroll in life insurance through your employer, the employer pays the premiums or a portion of the premiums on your behalf. The coverage is usually term life insurance and remains in effect as long as you are employed by the company. If you pass away while covered by the policy, a death benefit is paid out to your designated beneficiaries.

Q: Is life insurance through an employer free?

A: Some employers offer employees basic life insurance coverage at no cost. However, the coverage amount is often limited. If you opt for additional coverage beyond the basic amount, you may have to contribute towards the premiums.

Q: How much life insurance coverage can I get through my employer?

A: The amount of life insurance coverage provided through an employer varies. It may be based on a multiple of your salary (e.g., one or two times your annual salary) or a fixed amount. The coverage limit is determined by your employer’s policy.

Q: What are the advantages of life insurance through an employer?

A: Life insurance through an employer has several advantages:

- Convenience: The enrollment process is usually simple, and you may not need to undergo a medical examination.

- Cost: Basic coverage is often provided at no cost or at a reduced group rate.

- Accessibility: Employer-sponsored coverage is typically available to all employees, including those with pre-existing health conditions.

- Portability: Some policies may allow you to convert the coverage to an individual policy or carry it with you if you change jobs.

Q: Are there any disadvantages or limitations to employer-sponsored life insurance?

A: Yes, there are some limitations to consider:

- Coverage Limitations: The coverage amount may not be sufficient to meet all of your family’s financial needs.

- Job Dependency: If you leave your job or are terminated, you may lose your coverage, unless it is portable or convertible.

- Lack of Customization: Group policies may not offer the same level of customization options as individual life insurance policies.

- Tax Implications: If the employer pays for a portion of the premium, the portion paid by the employer may be considered taxable income.

Q: Should I rely solely on life insurance through my employer?

A: It is generally recommended not to rely solely on employer-sponsored life insurance coverage. Consider supplementing it with an individual life insurance policy to ensure you have adequate coverage that meets your specific needs. Individual policies offer more flexibility, higher coverage amounts, and the ability to customize your coverage.