The Best Time to Start Receiving Social Security Benefits:

A Comprehensive Guide for Retirees

Social Security is a crucial supplemental income source during retirement, and the timing of when to start receiving benefits can significantly impact your financial well-being. This blog aims to help retirees make informed decisions by exploring the three common scenarios: stopping work before retirement age, continuing to work while receiving benefits, and working without receiving retirement benefits. We will delve into each situation’s key points, benefits, and considerations, ensuring you can choose the best time to receive Social Security benefits.

Social Security is one of the few supplemental income sources during retirement that changes yearly for inflation. Deciding whether you should wait to receive Social Security benefits is essential. If you choose to start your benefits before your full retirement age, your benefits will likely be reduced at a fraction of a percent for every month before you reach the full retirement age. It might be better to wait until you reach full retirement age or delay it more to receive an increase in Social Security benefits.

According to Social Security Administration, based on data from 2022, your full retirement age =

* 66 years and four months (if born in 1956)

* 67 years for those born in 1955 and beyond.

Situation A

Stopping Work Before Retirement Age & Starting Social Security Benefits

If you are considering retiring early and starting to receive Social Security benefits, there are essential factors to consider. You can apply for Social Security benefits as early as age 62, but doing so will result in reduced benefits. The reduction amounts to 6% per year or 0.5% per month (as of 2022) for each month you receive benefits before reaching your full retirement age. On the other hand, if you delay receiving benefits, you may qualify for an increase of 8% per year or 0.67% per month until you reach the age of 70.

Key Points:

- You can apply for Social Security Benefits as early as age 62

- If you apply before reaching your full retirement age, your benefits will be reduced by 6% per year or 0.5% per month (2022), and if you delay, it’s an 8% per year deferral credit or 0.67% per month.

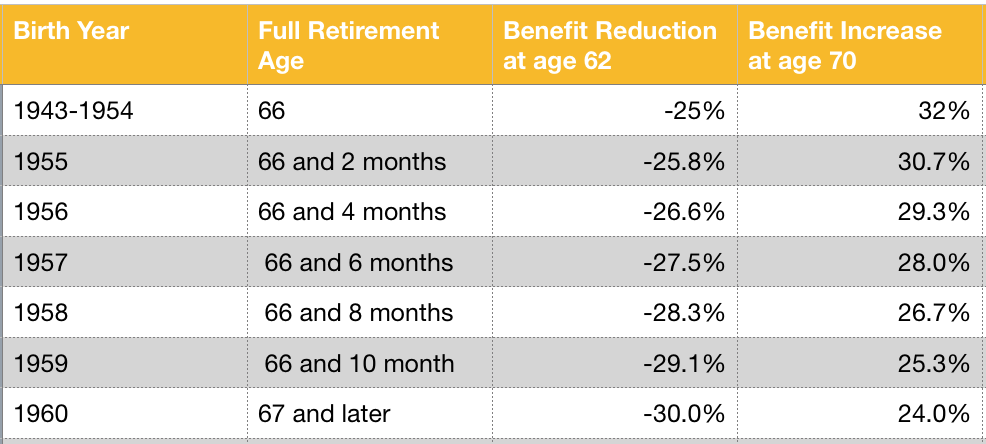

It’s crucial to weigh the trade-offs carefully. While starting benefits early can provide additional income, waiting until your full retirement age or beyond can result in higher benefit amounts for the rest of your life. For instance, delaying benefits until age 70 can yield up to 33% higher benefits compared to taking them at full retirement age, as shown in Table 1.

You will automatically enroll in Original Medicare (Part A and Part B) when you turn 65.

Table 1, 2020 What your Social Security reduction would be if you applied at age 62 compared to an increase at age 70

If you decide to work after receiving Social Security benefits, your benefit payments will be recalculated based on that year’s income limits. Additionally, at age 65, you will automatically enroll in Original Medicare (Part A and Part B).

Situation B

Continuing Work and Receiving Social Security Benefits

Retirees who wish to keep working while receiving Social Security benefits can do so, but certain income limits may affect the benefits they receive. If you are younger than your full retirement age during the tax year, the income limit is $22,320 in 2024. For every $2 you earn above this limit, $1 will be deducted from your Social Security benefits. Once you reach your full retirement age, the income limit increases to $59,520, and the reduction changes to $1 in benefits for every $3 you earn above the limit.

However, it’s essential to understand that the income limits only apply to income earned through work and not other sources such as investments, annuities, pensions, or capital gains. Moreover, there are no reductions in benefits if you work after reaching your full retirement age.

Key Points:

- You can work and receive Social Security benefits.

- Your Social Security benefits will be reduced until you reach full retirement age.

- The maximum income you can earn to avoid an extra benefit reduction depends on how close you are to the full retirement age. If your income is above this limit, they will reduce your benefits until you reach full retirement age.

- Double penalty – if you earn more than the income limit, apply before full retirement age.

- There are no reductions if you work after you reach your full retirement age.

Can you work and receive Social Security benefits?

Yes, you can work and get Social Security benefits simultaneously. Social Security can give you the extra boost of income you need if your job doesn’t give you enough. However, there are income limits. They will deduct a certain amount from your benefits if you earn more than these limits. The income limits only apply to income from work, and it does not count for investments, annuities, pensions, or capital gains.

What are the Income Limits for 2024?

The Social Security Administration sets its income limits for people receiving Social Security benefits yearly. This is the amount you are allowed to earn without getting a reduction on your Social Security payments. If you make more than the limit ($22,320 in 2024), your benefits will be reduced (if you are younger than the retirement age). Luckily, these reductions will be returned to you when you reach full retirement. The social security benefits are only withheld temporarily.

If you’re younger than full retirement age during all of 2024, they will deduct $1 from your benefits for each $2 you earn above $22,320. If you reach full retirement that year, the limit changes to $59,520 (2024). They will deduct $1 in benefits for every $3 you earn above the limit.

If you are older than full retirement and decide to work, you will receive your full benefits; there are no income limits.

For more examples, visit ssa.gov.

*note: there are different rules if you work outside the country or are on disability.

You will automatically enroll in Original Medicare (Part A and Part B) when you turn 65. Check before signing up for Medicare Part B if you or your spouse are still covered under an employer-provided group health plan.

Situation C

Continuing Work and Delaying Social Security Benefits

There can be significant advantages for retirees who choose to keep working and delay receiving Social Security benefits. For each month you delay your benefits beyond your full retirement age, your benefits increase. Delaying until age 70 can lead to the maximum possible increase in benefits, up to 33% more than what you would receive at your full retirement age (see Table 1). Furthermore, delaying Social Security benefits can be beneficial since your current earnings may replace earlier years of lower or no wages, leading to a higher benefit amount. However, keep in mind that enrolling in Original Medicare (Part A and Part B) three months before turning 65 is crucial to avoid penalties if you do not receive your Social Security benefits at that time.

Key Points:

- If you decide to keep working and not start your benefits until after your full retirement age, your benefits will increase for every month you do not receive them until you reach the age of 70.

- Delaying can also increase your benefits because your current earnings could replace an earlier year of lower or no wages.

How much will you get?→Social Security Quick Calculator

Want to learn more?

Deciding when to start receiving Social Security benefits is a critical financial decision that can significantly impact your retirement income. Each situation has its merits and drawbacks, and understanding the implications of starting early, continuing to work, or delaying benefits is crucial. By carefully assessing your financial needs, health status, and long-term goals, you can make an informed choice that aligns with your unique circumstances.

Feel free to schedule a meeting with one of our licensed financial planners if you need help deciding when to apply for social security benefits or retirement planning in general; identifying goals and objectives is key to a successful retirement.