Last Updated: May 30th, 2024

Social Security & Taxes

A Roadmap to Retirement Security

Social Security is a vital source of income for many retirees, but tax implications can sometimes be confusing. In 2024, whether your benefits are taxed depends on your combined income, which includes your adjusted gross income (AGI), non-taxable interest, and half of your Social Security benefits.

In 2024, whether your benefits are taxed depends on your combined income (calculate here), which includes your adjusted gross income (AGI), non-taxable interest, and half of your Social Security benefits.

Taxation Thresholds:

- Single Filers:

- Income below $25,000: Good news! No Social Security benefits are taxed.

- Income between $25,000 and $34,000: Up to 50% of your benefits may be taxable.

- Income above $34,000: Up to 85% of your benefits may be subject to taxes.

- Married Filing Jointly:

- Income below $32,000: You get a tax break! No Social Security benefits are taxed.

- Income between $32,000 and $44,000: Up to 50% of your benefits may be taxable.

- Income above $44,000: Up to 85% of your benefits may be subject to taxes.

Taxable Benefits:

The portion of your benefits that gets taxed depends on where your combined income falls within the thresholds mentioned above. The maximum percentage that can be taxed is 85%. This taxable amount is then added to your regular taxable income and taxed at your ordinary income tax rate.

Examples:

Let’s say you’re single and your AGI is $20,000. You also receive $10,000 in Social Security benefits for the year. Here’s how to calculate your combined income and potential tax impact:

- Half of your Social Security benefits: $10,000 / 2 = $5,000

- Combined income: $20,000 (AGI) + $0 (non-taxable interest) + $5,000 (half benefits) = $25,000

Since your combined income falls below $25,000, none of your Social Security benefits would be taxed in this scenario.

How They Calculate Your Combined Income:

This might seem complex, but it’s actually quite straightforward. Here’s the formula:

Combined Income = Adjusted Gross Income (AGI) + Nontaxable Interest + ½ Social Security Benefits

Combined Income Calculator

Combined Income:

Components

-

Adjusted Gross Income (AGI)

- Definition: AGI is your total gross income minus specific deductions. Gross income includes wages, dividends, capital gains, business income, and other income.

- Nontaxable Interest

-

- Definition: This is interest income that is not subject to federal income tax. Examples include interest from municipal bonds.

- Calculation: Nontaxable Interest=Total interest earned from nontaxable sources

- Typically, this is reported to you on Form 1099-INT or similar tax documents.

- ½ Social Security Benefits

-

- Definition: This is half of the Social Security benefits you receive. Social Security benefits include retirement, disability, and survivor benefits.

- Calculation:

- The total amount of Social Security benefits is reported to you on Form SSA-1099.

Consulting a licensed financial planner can provide personalized advice tailored to your unique situation. Remember, planning for a secure and fulfilling retirement starts with identifying your goals and making informed decisions.

Important Additional Points:

- Tax Resources: For more information on Social Security taxation, you can visit the IRS website (https://www.irs.gov/faqs/social-security-income) or reputable tax information sites.

- Impact of Deductions: Remember, deductions you qualify for can lower your AGI, potentially affecting your combined income and reducing the taxable portion of your Social Security benefits.

- State Taxes: It’s important to remember that these are federal tax guidelines. Some states may have additional taxes on Social Security benefits, while others may not tax them at all. Be sure to check with your state’s tax office for details.

- Consult a Tax Professional: While this blog provides a general overview, consider consulting a tax professional if you have a complex tax situation, significant non-taxable income, or run your own business. They can offer personalized guidance on your specific circumstances.

By understanding these basics, you can be better prepared to navigate the tax implications of your Social Security benefits in 2024. Remember, a little planning can go a long way in ensuring a smooth tax season!

Estimate How Much You Will Need In The Future

-

Current Annual Expenses:

- Enter your current annual expenses. This should represent your present yearly spending.

-

Average Inflation Rate:

- Input the average inflation rate (in percentage) in the “Average Inflation Rate (%)” field. This reflects the expected annual increase in prices. The average inflation rate for the past 10 years is 2.65%.

- Input the average inflation rate (in percentage) in the “Average Inflation Rate (%)” field. This reflects the expected annual increase in prices. The average inflation rate for the past 10 years is 2.65%.

-

Years Into the Future:

- Specify the number of years into the future you want to plan for in the “Years Into the Future” field. This could be the duration until your retirement or any future financial goal.

-

Click “Calculate”:

- Hit the “Calculate” button to see the estimated future expenses and the corresponding savings needed.

-

Review Results:

- The calculator will display the estimated future expenses and the required savings to cover those expenses.

Result:

Your estimated future expenses will be $X.

Frequently Asked Questions

Claiming:

-

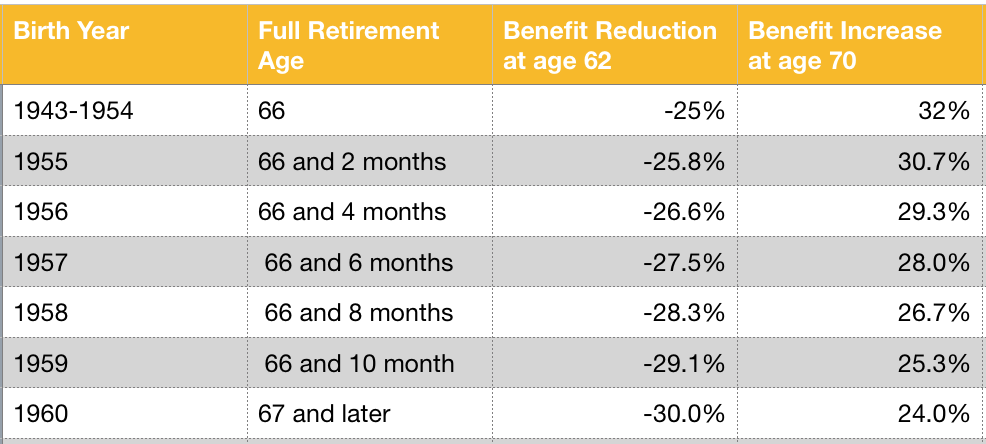

Q: I’m thinking of retiring early. What are the downsides of claiming benefits before my full retirement age?

-

A: You’ll receive a permanently reduced monthly benefit for each month you claim before reaching your full retirement age. The reduction can be significant, up to 30%!

-

Q: Should I wait until 70 to claim benefits even if I need the money now?

-

A: While delaying benefits until 70 gets you the highest monthly payout, it’s not always the best option. Consider your financial needs, health, and future income sources. Talk to a financial advisor for personalized advice.

-

Q: I’m still working. How do income limits affect my Social Security benefits?

-

A: If you’re below your full retirement age and earn over a certain amount from work, you might receive reduced benefits. The limit and reduction rate increase once you reach full retirement age.

Benefits:

-

Q: How much will I receive in Social Security benefits?

-

A: The amount depends on your work history and earnings. You can estimate your benefit online at the Social Security Administration website: https://www.ssa.gov/

-

Q: Will my Social Security benefits be taxed?

-

A: Depending on your total income, up to 50% of your benefits may be subject to federal income tax. Some states also tax Social Security benefits.

-

Q: I’m married. Can my spouse claim benefits based on my work history?

-

A: Yes, your spouse may be eligible for spousal benefits, even if they haven’t worked themselves. The amount depends on your earnings record and their age.

Other:

-

Q: My Social Security number was stolen. What should I do?

-

A: Report the theft immediately to the Social Security Administration and the Federal Trade Commission. Take steps to protect your identity and monitor your credit report.

-

Q: Where can I learn more about Social Security?

-

A: The Social Security Administration website offers a wealth of information: https://www.ssa.gov/. You can also contact your local Social Security office for assistance.