Term Life Insurance vs. Permanent Life Insurance: Choosing the Right Coverage for Your Needs

Life insurance is a vital tool for protecting your loved ones’ financial future. When selecting a life insurance policy, one of the fundamental decisions to make is whether to choose term life insurance or permanent life insurance. Understanding the differences, benefits, and drawbacks of each can help you make an informed choice that aligns with your unique circumstances and goals. In this blog, we’ll compare term life insurance and permanent life insurance, explore who each type fits best, and delve into their advantages and disadvantages.

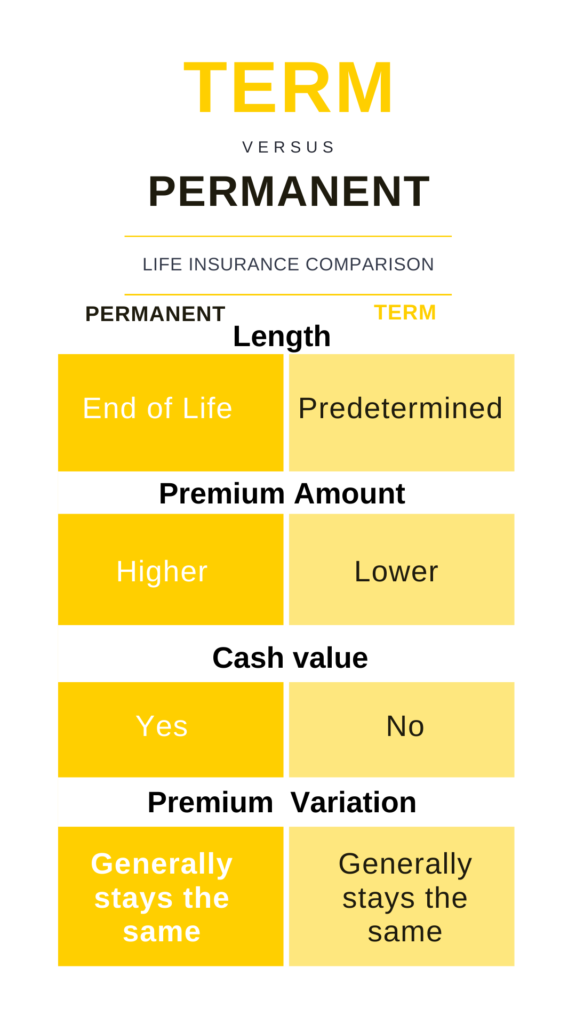

Permanent Life Insurance versus Term Life Insurance. Term life insurance offers a death benefit for a fixed amount of time (mostly between 5 and 30 years). Permanent life insurance covers you for your whole life and accumulates cash value that can be accessed as a living benefit at any time while you are still alive.

Make sure your family can continue to live their lifestyle financially.

Who needs life insurance?

If there are people who rely on your income or are dependent on you, it is important to consider getting life insurance to protect their financial future. In the unfortunate event of your passing, life insurance provides monetary support to your loved ones.

The most common reasons people buy life insurance are:

- Income replacement

- Leave a financial legacy to Children

- Leave a financial legacy to their spouse

- Mortgage protection

- Own/Start a business

Ask yourself: Will, my loved ones, struggle financially if I weren’t here?

A life insurance death benefit can be used for anything: funeral costs, bills, mortgage, student loans, college, retirement & more.

1. Permanent Life Insurance:

Permanent life insurance covers you for your whole life and accumulates cash value that can be accessed as a living benefit at any time while you are still alive. Permanent policies are typically the best option if you look for life-long protection, accumulation of tax-deferred cash value, or adding long-term care coverage to your policy. A portion of the premium of a permanent policy is used to build up a cash value. The cash value can be used in several ways, including allowing you to take out a loan against the cash value or paying your premium after your policy is fully paid.

Permanent life insurance is designed to last permanently. It should last well into your hundreds.

Most common permanent life insurance policies

- Index universal life insurance is a type of permanent life insurance with a cash value component and a death benefit. The money in your cash-value account can earn interest based on your chosen stock market index, such as the S&P 500, Nasdaq, etc… the performance of your selected index will dictate your cash value’s rate of return.

- Variable life insurance: this is a life insurance policy in which the payout amounts are determined by the performance of the underlying sub-accounts available in the policy.

- Whole life insurance: guarantees payment of a death benefit to beneficiaries in exchange for premium payments. It has a cash savings component, which the policy owner can draw or borrow from.

Permanent life insurance is suitable for individuals who:

A. Seek lifelong coverage: If you want the peace of mind that your loved ones will be protected regardless of when you pass away, permanent life insurance offers coverage for your entire lifetime.

B. Want cash value accumulation: Permanent life insurance policies build cash value over time, which can be accessed during your lifetime for various financial needs.

Most common reasons why many people purchase permanent life insurance

- Funding a tax-free retirement income

- Attaching a long-term-care rider on the policy to offset the cost of care

- Final expenses: burial costs, funeral costs

Choose Permanent life insurance if you want:

- To build cash value that grows tax-deferred.

- Lifelong coverage.

- Use it while you are still alive (living benefits).

Advantages of Permanent Life Insurance:

- Lifelong Coverage: Permanent life insurance guarantees a death benefit as long as premiums are paid, providing permanent protection for your loved ones.

- Cash Value Accumulation: Permanent policies build cash value over time, which can be accessed through withdrawals or policy loans. This accumulated cash value can be used for retirement income, college expenses, emergencies, or even as a source of collateral for loans.

- Potential Dividends: Some permanent life insurance policies, such as participating whole life, may earn dividends based on the insurance company’s performance. These dividends can be used to increase the cash value or enhance the death benefit.

Disadvantages of Permanent Life Insurance:

- Higher Premiums: Permanent life insurance generally has higher premiums than term life insurance due to the lifelong coverage and cash value component.

- Complexity: Permanent life insurance policies often include investment and savings components, making them more complex to understand compared to term life insurance.

- Cost of Cash Value: The cash value accumulation in permanent life insurance policies comes with associated costs, such as administrative fees and surrender charges if the policy is terminated.

Click here to learn more about living benefits

2. Term Life Insurance

Term life insurance offers a death benefit for a fixed amount of time (mostly between 5 and 30 years). When you purchase term life insurance, an insurance company promises to pay your beneficiaries a set amount if you die during the term. In exchange, you pay a monthly premium to the company for that term. Term life insurance is purchased to fill a temporary need. So that might replace your income for a certain amount of time, like ten years, 20 years, or 30 years.

Term life insurance is suitable for individuals who:

A. Have temporary financial obligations: If you have a mortgage, outstanding debts, or dependents relying on your income, term life insurance can ensure that your loved ones are financially protected if something happens to you during the term. The most common reasons people purchase term life insurance are mortgage protection and income replacement.

B. Need affordable coverage: Term life insurance generally offers the most affordable premiums compared to permanent life insurance, making it an attractive option for those on a budget.

For example, you just bought a home and have a 30-year loan. Suppose you do pass away before the home is paid off. A benefit will be paid to your family, and they can pay off the house. Without life insurance, your family might struggle to be able to pay a mortgage because of a loss of an income stream.

Choose Term life insurance if you: need a policy that will give you financial protection for a certain period (e.g., while your children are young). After this period, you will need to extend your policy or covert it. If you don’t do anything, you won’t be covered anymore.

Advantages term life insurance:

- Affordability: Term life insurance premiums are typically lower than those of permanent life insurance, allowing you to secure significant coverage at an affordable cost.

- Simplicity: Term life insurance is straightforward, providing coverage for a specific term without complex investment or savings components.

- Flexibility: Depending on the policy, some term life insurance plans offer convertible options, allowing you to convert the policy into a permanent one without undergoing a medical exam.

Disadvantages of Term Life Insurance:

- Temporary Coverage: Term life insurance only provides coverage for the specified term. If you outlive the policy, you will not receive any benefits unless you choose to renew or convert the policy.

- No Cash Value: Unlike permanent life insurance, term life insurance does not accumulate cash value over time. It solely focuses on providing a death benefit to beneficiaries.

- Increasing Premiums: Term life insurance premiums may increase when renewing the policy after the initial term, especially if your age or health has changed.

How Much Insurance to Purchase?

This depends on your lifestyle or your future goals. Every family is different. Life is not a one-size-fits-all proposition, and neither is your insurance policy.

The amount you need can be:

- Needs-based: How much would my loved ones need to survive financially?

- Goals-based: How much would my family need to reach their financial (tuition, retirement) goals?

- Legacy-based: What are you hoping to leave behind for your family?

You need the following to calculate the coverage amount you need:

1. The financial obligations you would want to meet if you died: funeral expenses, cover the mortgage or tuition for your children, etc.

2. The financial resources you already have

As a rule of thumb for income replacement, you can use the following:

- 9x income replaces for ten years

- 13x income replaces for 15 years

- 17x income replaces for 20 years

- 23x income replaces for 25 years

- 26x income replaces for 30 years

- 28x income replaces for 40 years

Remember that life insurance policy premiums are significantly lower when you are young and healthy. Most insurance companies increase policies based on people’s age. They do this because people are more likely to develop medical conditions as they age. If you decide to wait with life insurance, you might end up paying more for your policy, and waiting might also result in an additional health exam, which could increase the premium. You can lock in the lower rate if you get it when you are young and healthy.

Choosing between term life insurance and permanent life insurance requires careful consideration of your financial goals, budget, and individual circumstances. Term life insurance is well-suited for those seeking temporary coverage during significant financial obligations, while permanent life insurance provides lifelong protection and cash value accumulation. Understanding the advantages and disadvantages of each type will help you make an informed decision that aligns with your needs and priorities. To ensure you make the right choice, consider consulting with a licensed policy engineer who can provide personalized guidance tailored to your specific situation.

Review your insurance over time.

Life changes, and so should your life insurance policy. You should review your policy when you get; a new job, a mortgage, are married, divorced, or have children. Otherwise, the wrong person will receive your death benefits.

Click here if you want to review your current life insurance policy.

Our online quoting tool will help you determine the right amount of coverage and which policy to select, all from the comfort of your mobile device. And if you are not confident in making your own decision. One of our licensed agents is ready to support you! You can rest assured that our Policy Engineers will work tirelessly to craft policies tailored to you.