Last Updated: January 11th, 2025

Protect Your Paycheck: The Importance of Disability Planning

Imagine a scenario where you suddenly find yourself unable to work for several months due to illness or injury. How would you cope with the essential costs of living, such as rent, mortgage, car loans, and groceries? Unfortunately, this situation is more common than you might think. According to the Social Security Administration, one out of four 20-year-olds will become disabled and unable to work before reaching the age of 67. This sobering statistic highlights the critical need for disability planning to safeguard your financial stability and that of your family. In this blog, we will explore the significance of disability insurance and the various ways to protect your paycheck during challenging times.

Imagine not being able to work for a couple of months. How will you pay for essential costs such as; rent, mortgage, car loans, or groceries? Do you have an emergency fund or insurance in place?

This scenario is more common than you would think. According to Social Security Administration, one out of four of all 20-year-olds will become disabled and unable to work sometime before reaching 67. This makes it essential to consider what income loss means for you and your family. You can avoid the financial stress you would endure with disability insurance. It will give you peace of mind knowing that you and your family would be okay financially if you couldn’t work for a while. Protect Paycheck with Disability Planning.

There are three ways to get disability benefits.

- State Disability: Some states offer disability benefits to replace a portion of your income if you can’t work for some time. Click to see what’s offered where you reside.

- Disability Insurance: Set up an insurance policy to control how much and how long your income will be replaced. Click here for a quote.

- Social Security: Supplemental Security Income (SSI) is a Federal income supplement program for individuals that have been disabled for over 12 months and considered a permanent disability: Click to learn how much you may qualify for.

What is Disability insurance?

The Power of Disability Insurance: Disability insurance is your safety net during times of uncertainty. It covers a percentage of your income if you suffer from an illness or injury that prevents you from working. Not only does it protect you in case of disabilities, but it can also cover other situations such as mental health issues, severe migraines, pregnancy complications, cancer, or surgery. With disability insurance, you can focus on your recovery without worrying about how to pay your bills. Most policies provide around 70% of your income for a specified duration, giving you the financial breathing space you need to get back on your feet.

Is Disability Coverage through work enough?

While some individuals may believe they are already covered through disability insurance provided by their employer, it’s essential to assess the adequacy of such coverage. Workplace disability insurance might fall short and not cover injuries or illnesses that occurred outside of work. Additionally, your coverage might end if you switch jobs or fields. To ensure comprehensive protection, consider obtaining your disability insurance independently.

Let’s review these possible scenarios

Scenario 1: The Unforeseen Accident

Meet Sarah, a 32-year-old marketing executive with a promising career ahead of her. She’s always been health-conscious and never thought she’d need disability insurance. One fateful day, while driving back home from work, she gets into a serious car accident, leaving her with multiple fractures and a severe back injury. The doctors advise her to take at least six months off work to recover fully.

Without disability insurance, Sarah is now faced with a financial nightmare. Her employer’s short-term disability coverage only covers a portion of her salary for the first few weeks, and after that, she’s left with no income. With mounting medical bills and her regular expenses, such as rent and utilities, piling up, Sarah quickly realizes that her emergency savings won’t last long.

In contrast, had Sarah invested in long-term disability insurance, her worries would have been significantly reduced. She would have received a percentage of her income regularly, allowing her to focus on her recovery without stressing about her financial obligations. This situation serves as a wake-up call for Sarah and many others, highlighting the importance of having a comprehensive disability insurance plan in place, even for young and healthy individuals.

Scenario 2: A New Chapter, A New Challenge

Meet John and Lisa, a young couple in their late 20s, eagerly expecting their first child. Lisa works as a freelance graphic designer, while John is a software engineer employed at a tech startup. Since both are relatively young and healthy, they’ve never considered disability insurance before.

As Lisa’s due date approaches, she develops severe complications that lead to an emergency C-section. The doctor advises her to take an extended leave from work for a smooth recovery. Given Lisa’s freelance status, she doesn’t have access to any workplace disability benefits.

John, on the other hand, had limited disability coverage through his employer. However, it barely covers a fraction of their monthly expenses, leaving them in a vulnerable financial position. Lisa’s recovery takes longer than expected, and without a steady income from her freelance work, they struggle to keep up with their bills and medical expenses.

John and Lisa now understand that buying disability insurance would have been smart. By having long-term disability insurance, they could have secured a more stable financial future during this crucial stage of their lives. They would have been able to concentrate on taking care of their newborn and helping Lisa recover without being concerned about their finances.

What types of disability insurance exist?

There are two primary types of disability insurance – long-term and short-term disability insurance.

Long-term disability

Long-term disability benefits are paid out for the number of years indicated in the plan. There are long-term disability plans that pay out partial wage replacement benefits until a certain age, such as 65 years old.

- Covers around 40-70% of your salary.

- Typically lasts for five years or longer, sometimes until you reach 65 years old.

- Costs approximately 1-3% of your annual income.

- Usually has a 3-6 month waiting period before benefits kick in.

Short term disability

Short-term disability typically pays out a portion of an employee’s income from 9 to 52 weeks, depending on the plan. “elimination” period is usually set from seven to 14 days. Only get this type of disability insurance if your employer offers you free.

- Covers around 60-70% of your salary.

- Lasts for a few months (9 to 52 weeks, depending on the policy).

- Costs approximately 1-3% of your annual income.

- Has a shorter elimination period, usually around 14 days.

How much disability insurance do you need?

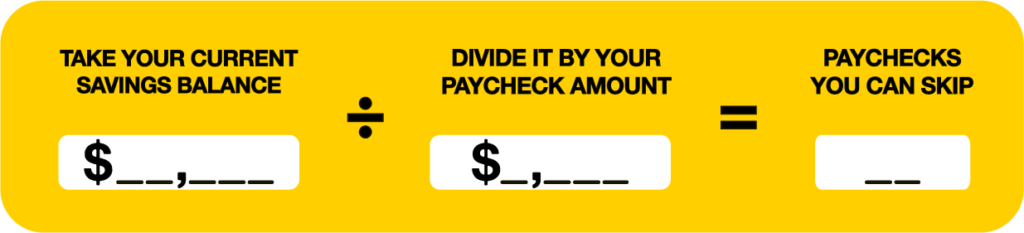

Determining the right amount of disability insurance coverage depends on various factors, such as your income, expenses, and lifestyle. To get an estimate, you can use the following formula:

Remember that the younger you are, the cheaper your premiums will be.

How much does disability insurance cost?

Disability insurance costs for short-term and long-term coverage are most likely between 1% to 3% of your annual income. For example, if you make $50,000 a year, that’s $60 – $125 monthly. You’ll pay less if you get a long-term policy with a more extended elimination period.

Who Needs Disability Insurance?

It is wise to have long-term disability insurance regardless of your type of job. Not everyone needs disability insurance, but disability planning is crucial to ensuring a stable lifestyle for you and your loved ones while working. Your planning should give you peace of mind. Knowing that your financial stability would stay intact if your income were to stop due to an injury or illness.

What Disability Insurance doesn’t cover:

Disability insurance is designed to replace a portion of your income. It doesn’t cover extra expenses such as; medical bills and extended or term care costs.

Long-term policies don’t usually cover pregnancy. However, the complications that extend beyond pregnancy (if a doctor orders you to stay at home after a C-section) could qualify you for benefits, but only if you had a long-term policy in place before you got pregnant.

Short-term policies cover birth as a disability, but you might be waiting long, six-to-eight weeks for each check.

How do I get disability insurance?

- On your own through with the help of an Insurance Agency. One of the best ways to get disability insurance. It lets you get the exact amount of coverage you need and compare coverage and prices from various insurance companies. You don’t need to worry about losing coverage if you change jobs or leave a particular professional organization. You can work with a licensed policy engineer to get the best coverage and price for your needs.

- Through a specific industry professional organization

Pros

– Many professional organizations for people in a specific industry offer the option to buy insurance through a group plan.

– It’s easier to qualify for coverage and less expensive than buying disability insurance on your own.Cons

-The professional organization may choose to stop offering the coverage at any time.

– You would lose coverage if you change professions or leave the professional organization industry. - Through your employer:

Pros

-Typically, the coverage is automatic.

-There’s often no premium for you to pay.

Cons

-You lose coverage if you leave or are terminated from your job.

– Coverage limitation. Most likely not enough to be okay financially. - Through the government

Workers’ Compensation Every state has its own Workers’ Compensation laws. It only covers work-related injuries and illnesses and may not be enough to cover your lost income.

Social Security Disability Insurance Qualifying isn’t easy. Around 65% of the applications were initially denied. The average payment (in 2020) was only $1,258.

State disability insurance programs are Only in 5 states. It covers only a portion of your income for about 4 to 6 months.

Ready to protect your Paycheck?

Disability planning needs depend on each individual’s income and job duties. That’s why our licensed Policy Engineers take an in-depth look at your situation to determine your actual disability income needs. You can do all this online from the comfort of your home. Protect Paycheck with Disability Insurance. Get a free disability income evaluation today!

What’s the average length of a disability?

More than one in four of today’s 20-year-olds can expect to be out of work for at least a year because of a disabling condition before they reach the full retirement age of 67.

Don’t get caught with empty pockets.

Almost half of the American adults indicate they can’t pay an unexpected $400 bill without taking out a loan or selling something to do so.

Don’t follow the herd.

At least 51 million working adults in the United States are without disability insurance other than the basic coverage available through Social Security.

Three months go by in the blink of an eye.

Only 48 percent of American adults indicate they have enough savings to cover three months of living expenses if they’re not earning any income.