Click the get started button to get a quote for a long-term care insurance policy engineered for someone just like you.

We believe that long-term care expenses are the number 1 reason American seniors are outliving their savings.

There are four major categories of benefits you may be able to incorporate into your long-term care planning.

Self Insure

Insurance Policy

VA Benefits

Government Aid

What is the average cost of care without insurance?

Nursing Home w/ Private Room

Assisted Living Facility

Home Health Care

Source: Mutual of Omaha national cost of care calculator, the cost of care may vary based on the cost of living in your area.

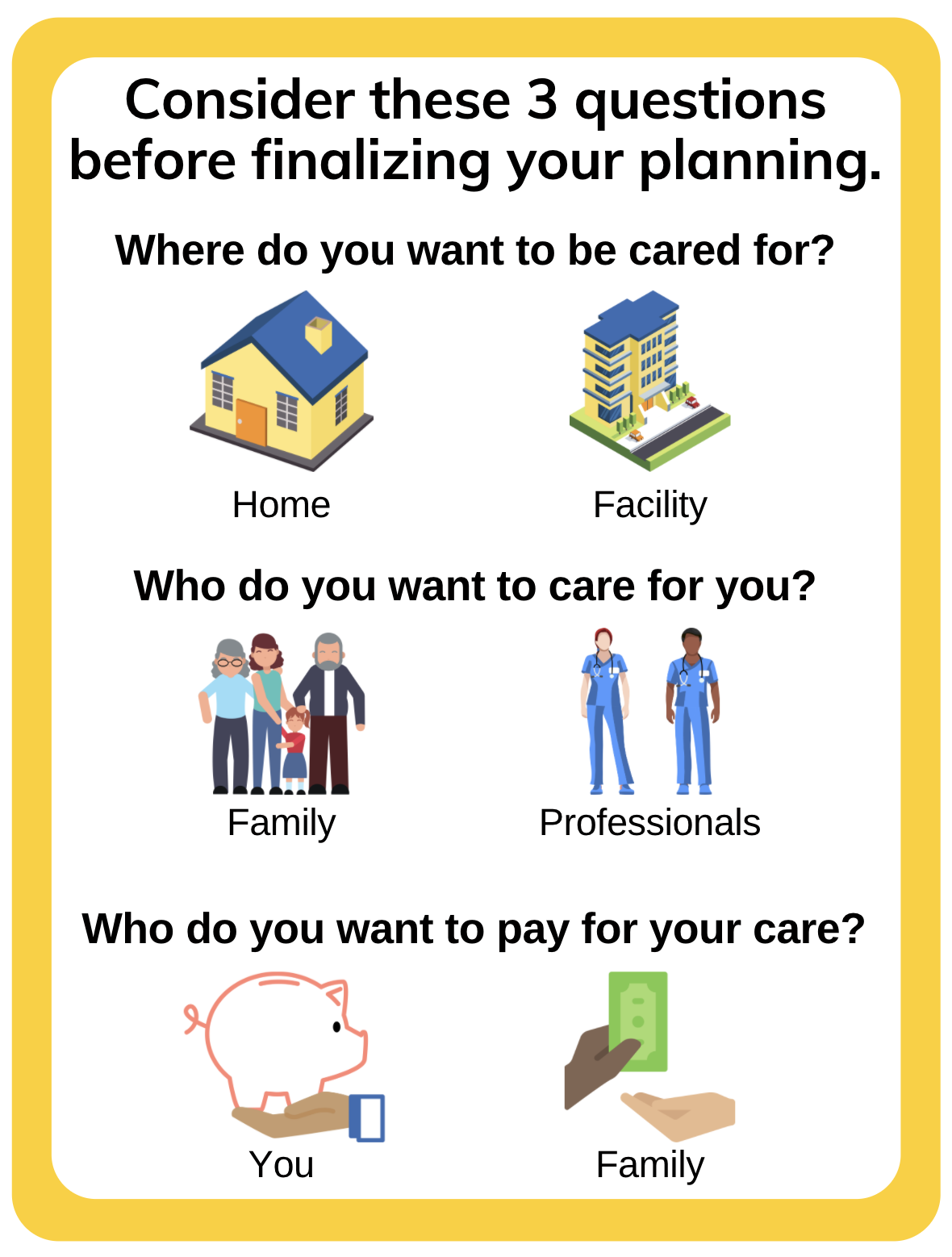

Not everyone needs insurance, but no one should go without a plan.

Long Term Care planning is crucial to ensuring a stable lifestyle for you and your loved ones as you age. Your planning should give you peace of mind, along with the freedoms of being cared for where you feel most comfortable, by the caregivers of your choice, and without compromising your loved ones’ lifestyle.

Get A Long-Term Care Needs Analysis Today!

Long-term care needs are different for each individual; that’s why our Licensed Policy Engineers take an in-depth look at your future care needs. You can do all this online from the comfort of your home. Get a free long-term care evaluation today!

What Is Long-Term Care Insurance?

- Long-term care insurance is a contract between you and an insurance company designed to pay for long-term services and supports, including personal and custodial care in various settings such as your home, a community organization, or other facilities.

- Long-term care insurance policies reimburse policyholders up to a maximum dollar amount set by the policy owner at the time of purchase.

- Long-term care is defined as needing hands-on assistance with any 2 of the following six activities of daily living: Bathing, Toileting, Continence, Dressing, Transferring, and Eating.

- There are many long-term care insurance styles, ranging from single payment to lifetime payment, a limited benefit to unlimited benefits, life insurance & long-term care hybrid policies, and the list goes on. So be sure to make a comparison before deciding on a policy.

Try Not To Make This Retirement Planning Mistake

Long-term care is often overlooked and the costs are underestimated in retirement planning. On top of that long-term care, expenses are growing every year. The possibility of needing help taking care of yourself later in life is probably hard to imagine and most likely not on your priority list. If you forget to add this to your planning you might run out of your retirement savings before you know it.